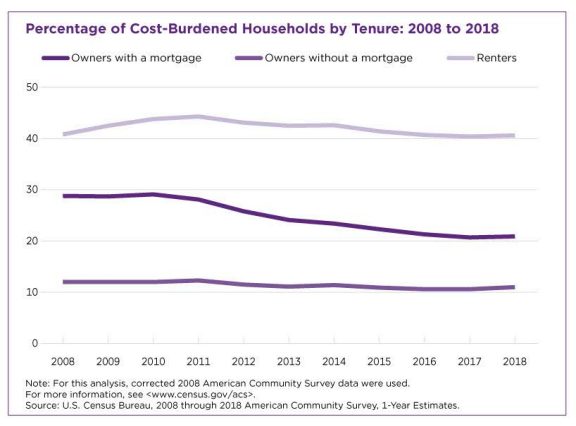

Last year, fewer American homeowners were burdened by the costs of homeownership. In a blog post published earlier this week, the Census noted that according to data from their 2018 American Communities Survey, 20.9 percent of homeowners with a mortgage were paying 35 percent or more of their monthly household income on mortgage payments, utility bills, real estate taxes, property insurance, and other home-related fees. This was down some eight percentage points from the start of the recession in 2008, when 28.8 percent of homeowners with a mortgage were similarly burdened.

The extreme proportion of housing-cost burden that plagued the country appears to be lifting as well. The Census noted that in 2008, the country counted 43 metro areas where at least 40 percent of homeowners with a mortgage were burdened, and there were no such areas last year.

For renters, a different story emerged from the data. Not only are more of them rent burdened, but they’re not seeing much change from the dark days of the recession. The Census post noted that last year, some 40.6 percent of rental unit residents spent 35 percent or more of their monthly household income on rent and utility bills. Not only is that significantly higher than the 20.9 percent number for homeowners, it’s also only 0.2 percentage points lower than it was in 2008, when 40.8 percent of renters were similarly burdened.

The national numbers were pretty close to what we’re seeing in Houston. In Harris County, 21.1 percent of homeowners were in that bracket of burdened, according to the most recent data, which is from the 2017 American Community survey. Still, this number is down from 22 percent in the year prior, and 26.5 in 2010.

Mirroring the national picture, renters in Harris County are paying significantly more on housing than homeowners are. In the most recent data, 39.9 percent were considered rent burdened.

In 2018, approximately 62 percent of homeowners in the U.S. had a mortgage, down 6.5 percentage points from 2008. Mortgages are often the biggest source of monthly bill-payment stress for homeowners. But even for those who own their homes free and clear, housing costs can still be an overwhelming burden.

According to the Census data from 2018, 11 percent of homeowners without a mortgage payment found themselves to be paying 35 percent or more of their monthly household income on housing costs such as utility bills, real estate taxes, property insurance, and other home fees. Still, this has eased too since the recession; in 2008 this number was slightly higher, at 12 percent.