Clear Capital (www.ClearCapital.com) has released its monthly Home Data Index (HDI) Market Report, providing a granular analysis of how local markets performed through November of this year, compared to the national downward trend in home prices.

Image courtesy of Bernd Vogel/Corbis

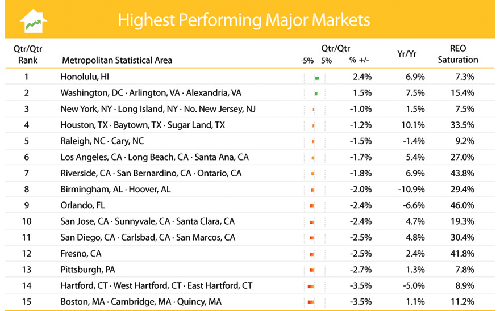

The Houston-Baytown-Sugarland market came in at No. 4 in Clear Capital’s list of top-performers. Despite a 1.2 percent decrease in home prices from last quarter, the Houston metro is enjoying a 10.1 percent increase in home prices compared to the same time a year ago.

Nationally, home prices continue to decline but show no clear signs of bottoming-out any time soon. Clear Capital says that 13 of the 50 top markets analyzed have double-dipped, indicating their lowest price level yet since the start of the housing-slump. Areas experiencing a double-dip in November 2010 include: Charlotte, NC; Jacksonville, FL; Las Vegas, NV; Miami, FL; Nashville, TN.; Orlando, FL; Philadelphia, PA.; Portland, OR; Richmond, VA; Seattle, WA; Tampa, FL; Tucson, AZ; and Virginia Beach, VA.

“It’s encouraging that the immediate and dramatic decline in prices that we observed since mid August appears to be softening,” says Dr. Alex Villacorta, Senior Statistician, Clear Capital. “But any optimism should be tempered by the fact that November’s numbers show continued significant downward pressure for home prices. Nationally, prices are six percent above double dip territory, but are down eight percent since the momentum from the tax credit ended.”

Download the entire analysis from Clear Capital.