Current Market Data

Realtors entered 3,632 properties into the MLS during the week, a 25.6% increase over the same week in 2023.

Home sales declined 8.3% in Houston last month, with 7,163 closings — however, that was the third-highest sales volume in the country.

“The Texas spring homebuying season is underperforming as the new home sales recovery has been unimpressive,” said HomesUSA CEO Ben Caballero.

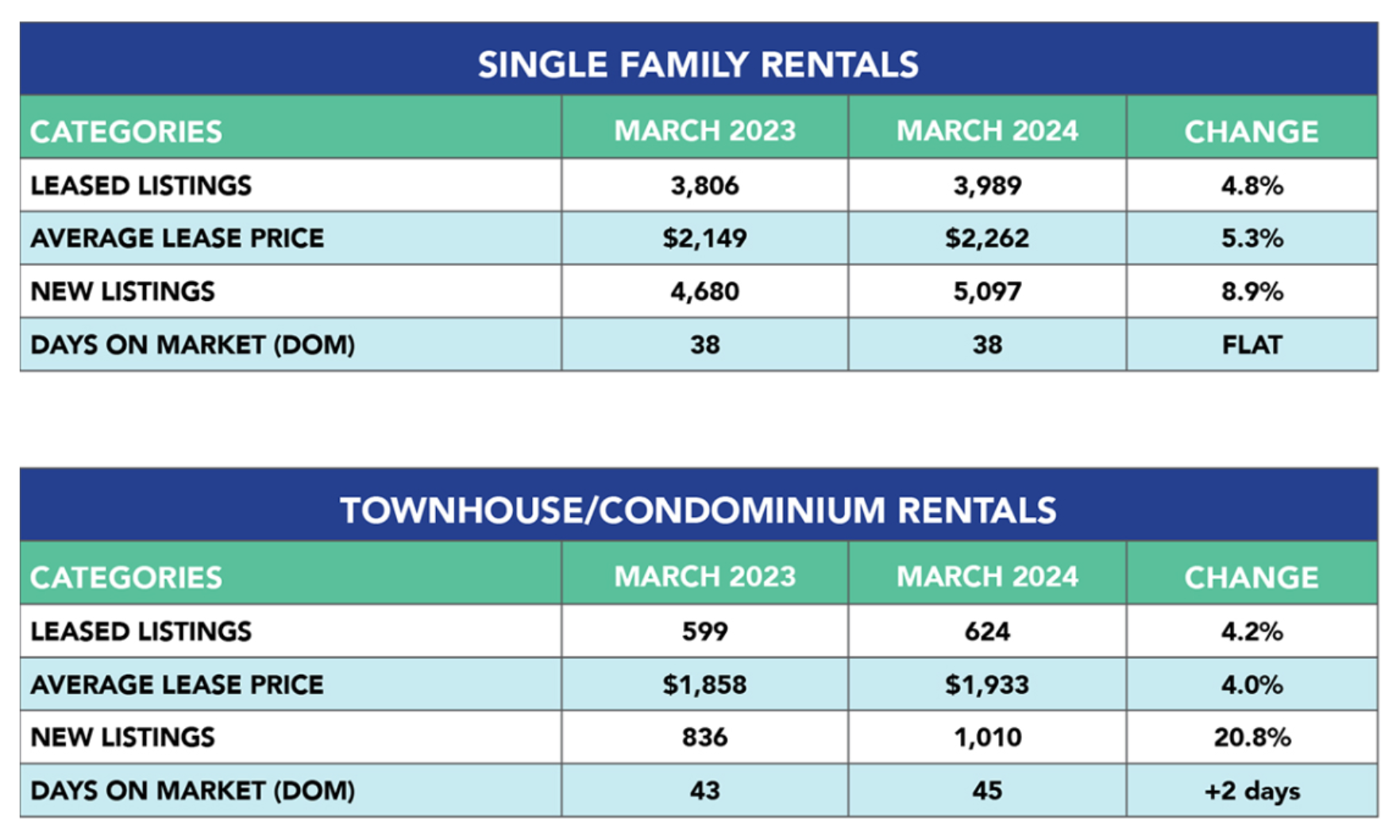

Available rental properties rose in March, providing a bountiful supply of single-family homes for Houston renters.

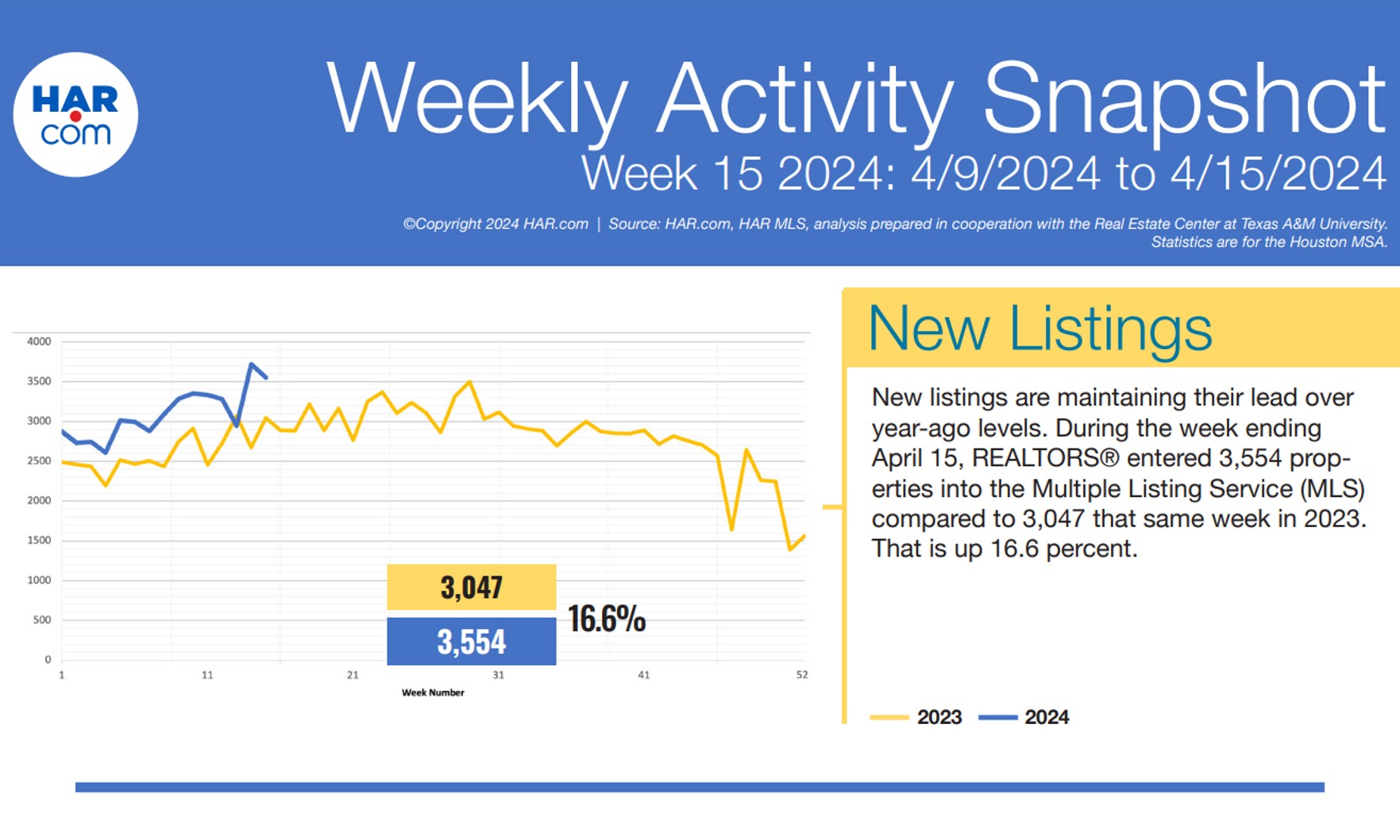

Realtors added 3,554 properties into the MLS during the week ended April 15, a 16.6% increase year over year.

A $20 million estate spanning over 17,000 square feet in the River Oaks area was the most expensive home sold in greater Houston last month.

Realtors entered 3,813 properties into the MLS during the week. That’s a 42.5% increase over the same week in 2023, when 2,676 properties were added.

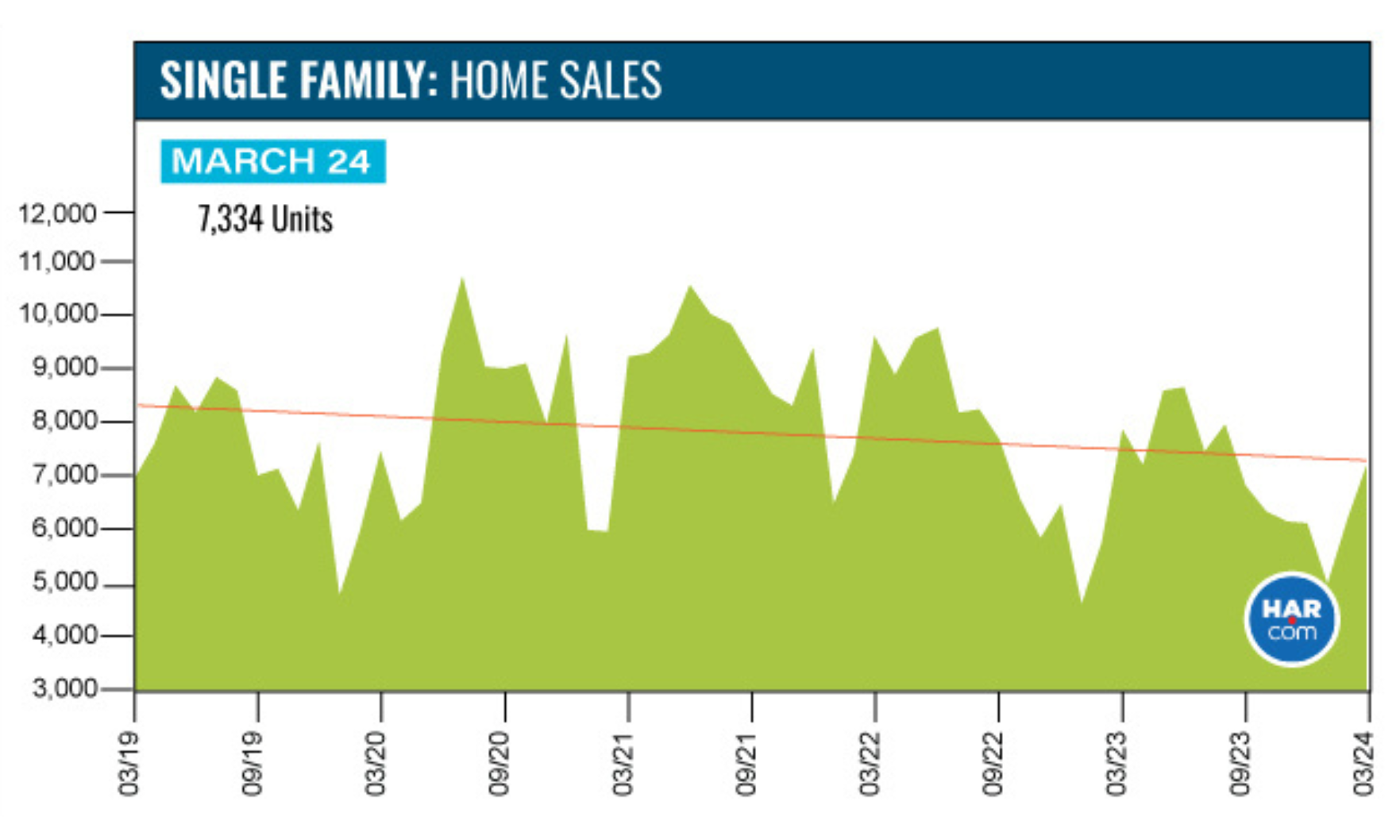

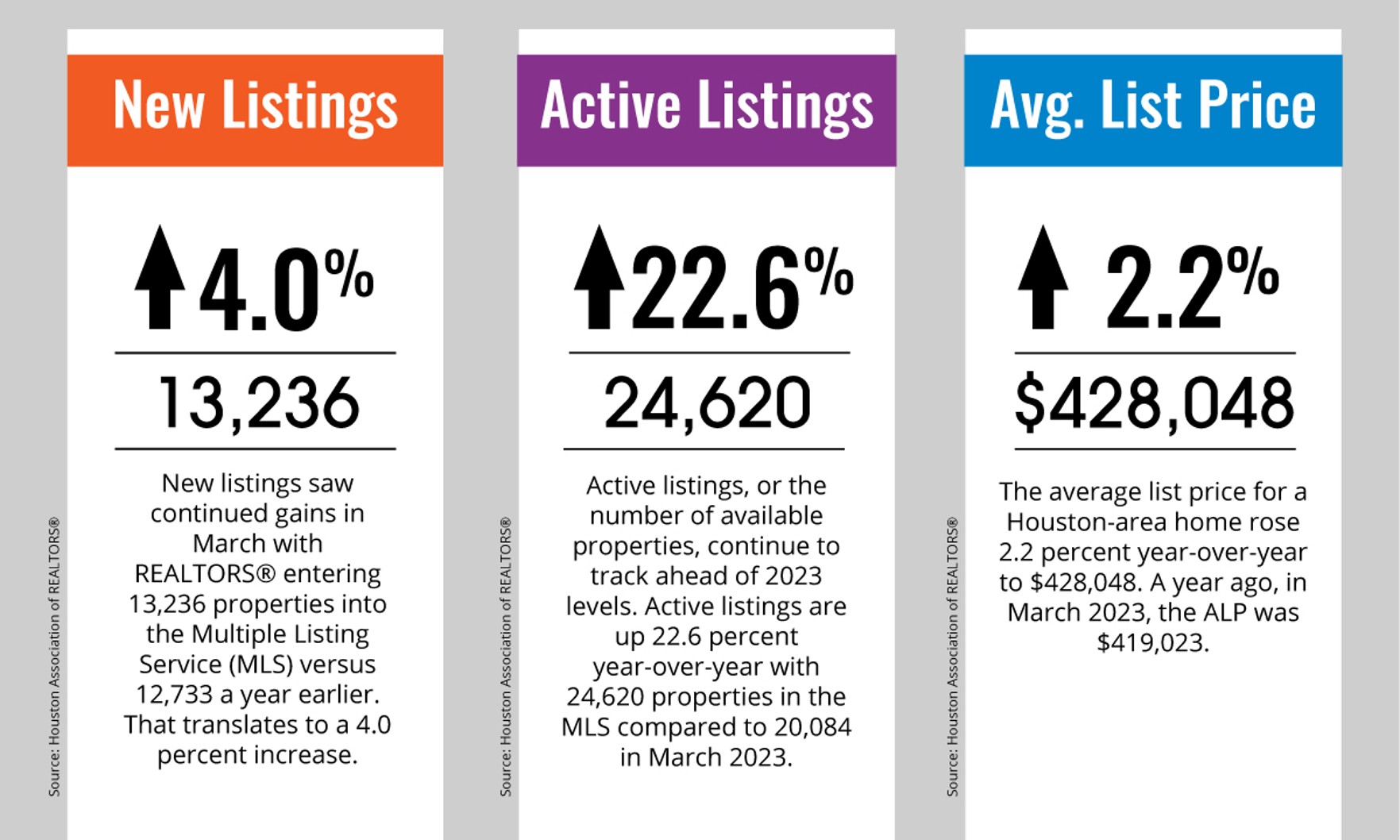

Data from the association’s March 2024 Market Update shows that single-family home sales fell 7.5% year over year last month, with 7,334 closings.

Monthly home payments hit new records last month reaching an all-time high of $2,747, an 11% increase from last year.

Over 70% of Texas homebuyers who used a real estate agent last year said they’d do so again in the future.

Realtors entered 2,889 properties into the MLS during the week ended April 1, a 6% decrease from the same week in 2023.

New listings continued to fuel active inventory in Houston last month, according to the latest FRESH Report from HAR.

A lakefront Austin property with a luxurious lap pool tops the most expensive new listings in Texas.

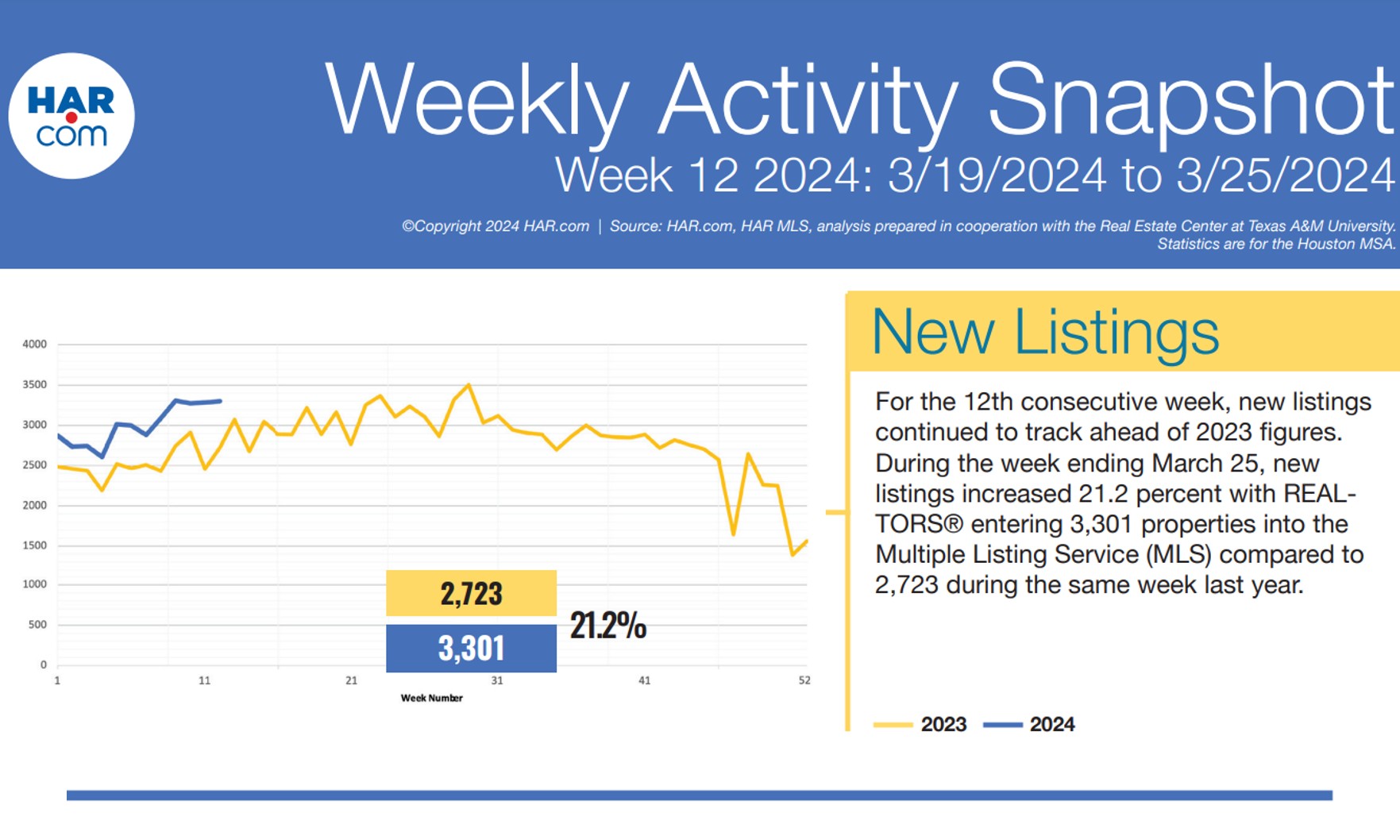

Realtors added 3,301 properties into the MLS, a 21.2% jump year over year. That marks the 12th consecutive week of year-over-year increases in 2024.

In 2020, median renovation spending was $15,000. That amount increased by 60% in three years, with the median home renovation costing $24,000 in 2023.

Furniture retailer Joybird surveyed over 2,500 Americans and asked them to describe their dream living room.