Current Market Data

Agents from Douglas Elliman Real Estate listed the two Houston-area properties that sold for the highest prices last month.

There’s a reason many homeowners opt for neutral shades when trying to sell their house — certain flashy colors may be off-putting to buyers.

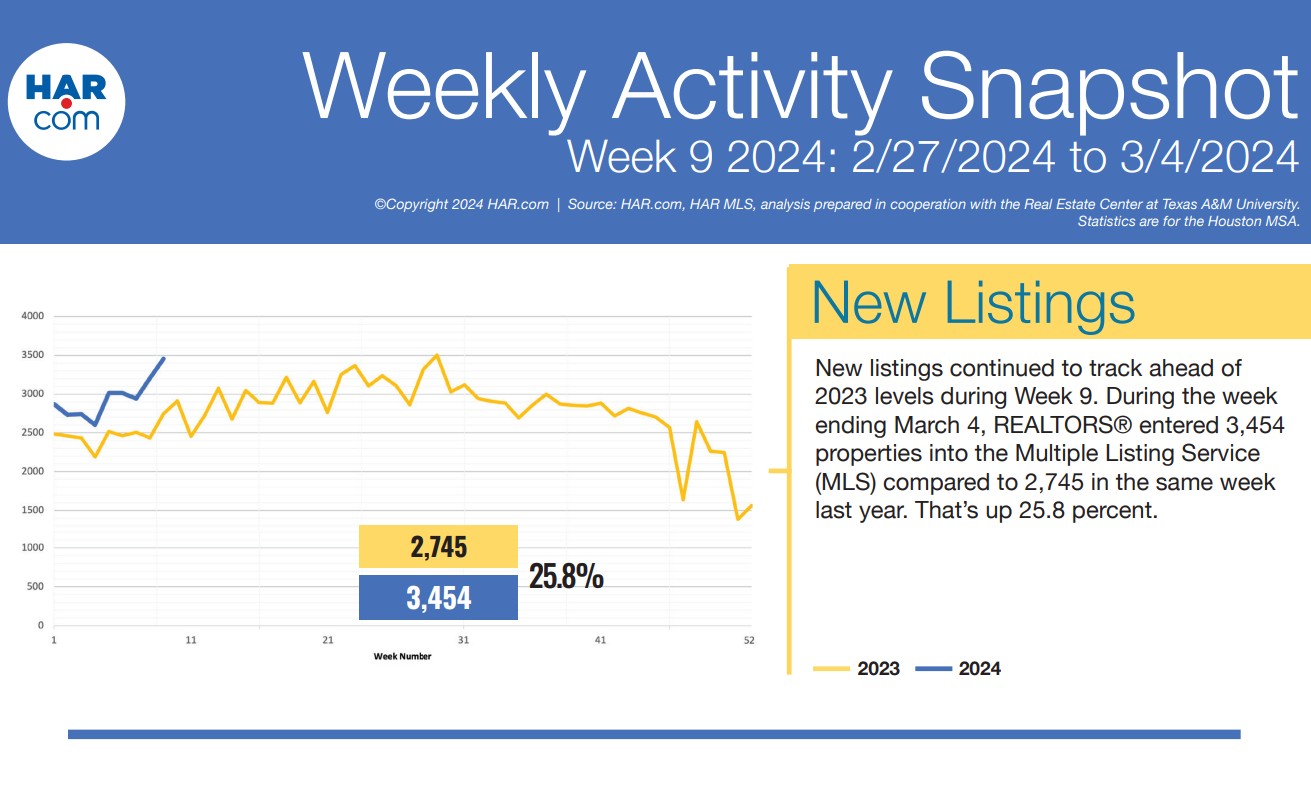

Realtors added 3,394 properties to the MLS during the week, a 16.6% increase over the same week in 2023, when 2,912 properties were added.

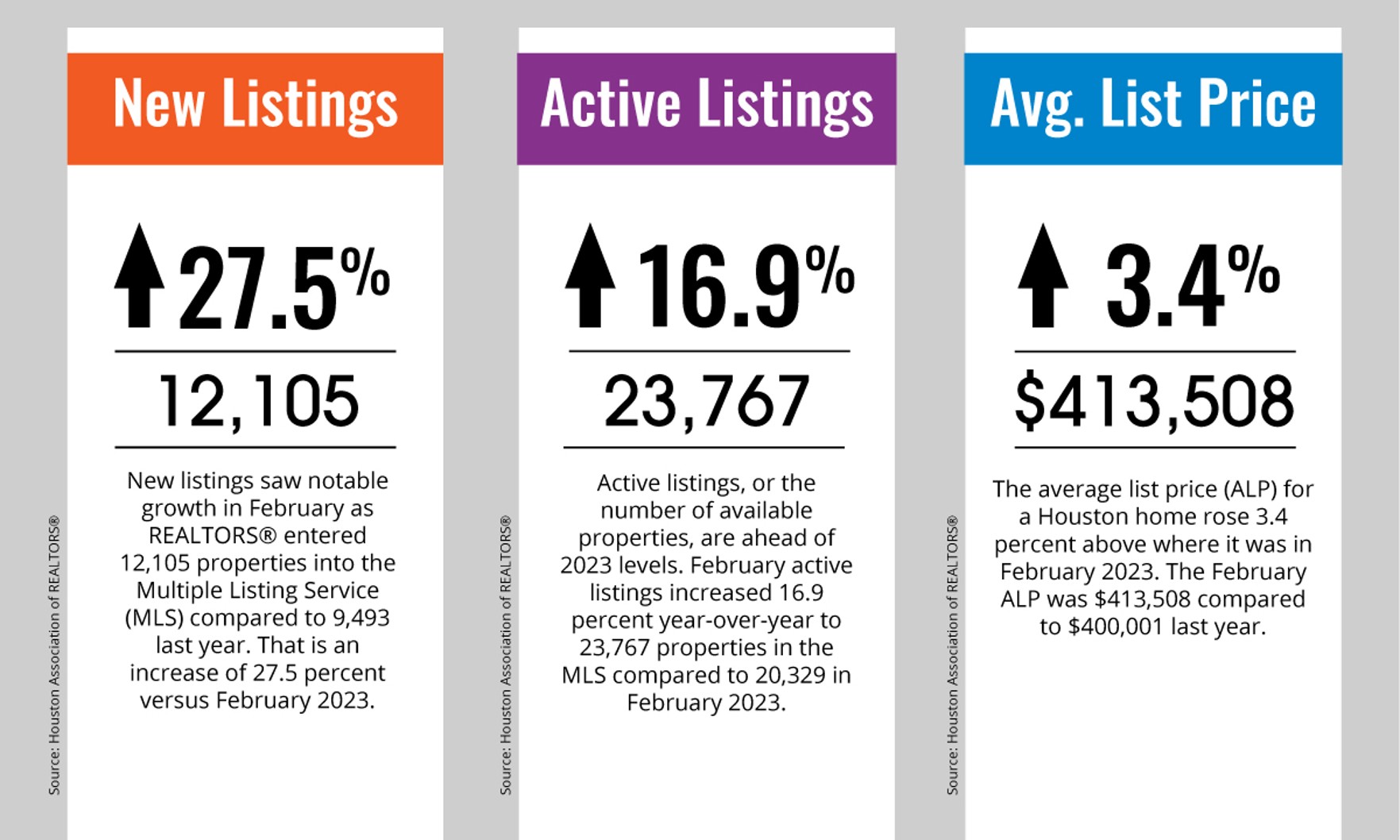

Single-family home sales rose by 7.6% annually, with 6,221 units sold compared to 5,781 in February 2023.

Many buyers entered the housing market for the first time in 2023. But who were these first-timers, and what did their homebuying experience look like?

With the spring market right around the corner, the U.S. housing supply finally got a boost.

Texas home sales dipped in 2023, according to the 2023 Texas Real Estate Year in Review report from Texas REALTORS®.

New listings have yet to dip below 2023 volumes this year, and Week 9 was no exception.

Location, location, location … at least that’s how the old real estate adage goes, right?

Houston is among the best cities for job, salary and new resident growth, according to a new report from moveBuddha.

A healthy addition of new listings allowed active inventory to expand in Houston last month, according to the FRESH Report from the Houston Association of REALTORS®.

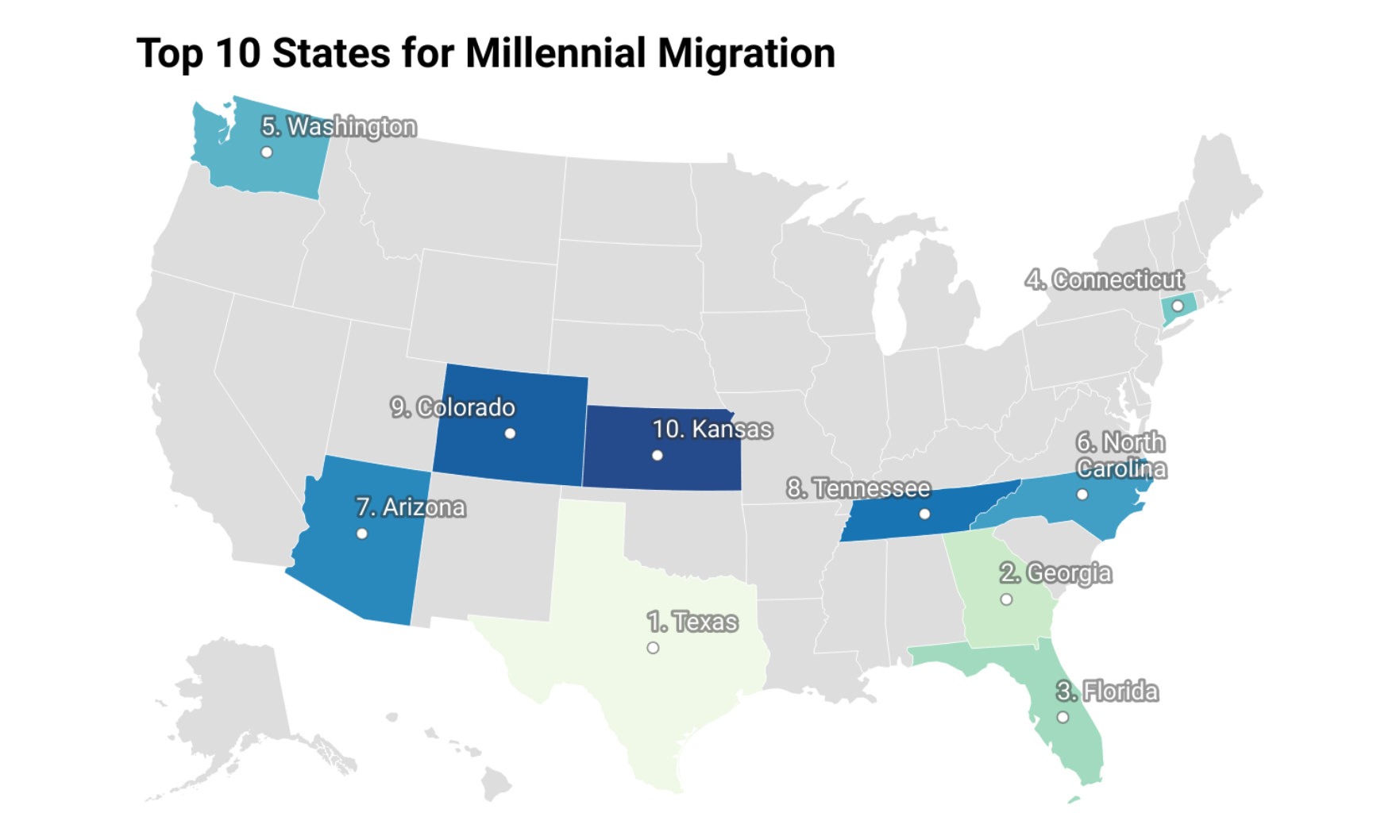

Roughly 2.8 million millennials moved across state lines in 2022 — and a huge chunk of them moved into Texas, according to a report from StorageCafe.

Two of the most expensive new listings in the Lone Star State come from Gary Dolch, an agent with COMPASS RE Texas.

Following nearly two months of year-over-year increases, new listings continued to outpace 2023 volumes during the week ended Feb. 26.

Single homebuyers need an extra 10 years to save for homeownership compared to couples in a majority of Texas’ largest cities, according to a report from Point2Homes.

The octagonal home is the most popular style in the United States — but what about in Houston?