Local News

Real estate news in Houston

Ashton Woods celebrated the grand opening of a new section of development in Imperial Oaks, a master-planned community in Conroe.

With 488 build-to-rent units completed in 2023, Houston is the No. 15 metro in the nation for this type of new construction.

A $20 million estate spanning over 17,000 square feet in the River Oaks area was the most expensive home sold in greater Houston last month.

Highland Homes is in the process of adding automated external defibrillators (AEDs) to all of its model homes throughout Texas.

Over 70% of Texas homebuyers who used a real estate agent last year said they’d do so again in the future.

High Street Residential will deliver nearly 300 units in the Residences at Kingwood, a multifamily development in Humble, this spring.

Among the honorees was Shadrick Bogany, a broker associate with Better Homes and Gardens Real Estate Gary Greene.

The strategic acquisition expands COMPASS’ Gulf reach from Texas to Florida and brings with it a brokerage that closed $3.6 billion in transactions last year.

A lakefront Austin property with a luxurious lap pool tops the most expensive new listings in Texas.

Crystal View, a build-to-rent community of single-family homes in the Texas City master-planned community of Lago Mar, is now open to residents.

The project marks Trophy Signature Homes’ debut in the Houston new-home market.

Brightway Insurance, a national provider of home, flood, condo and renters insurance, is expanding into Houston with a new branch named The Cloud Agency.

Johnson Development will host its 10th annual “Best of the Burbs” tour in April, showcasing over 120 model homes and nearly 500 available homes throughout the greater Houston area.

Located near Morton Road and FM 2855, Grange will be zoned to Katy Independent School District.

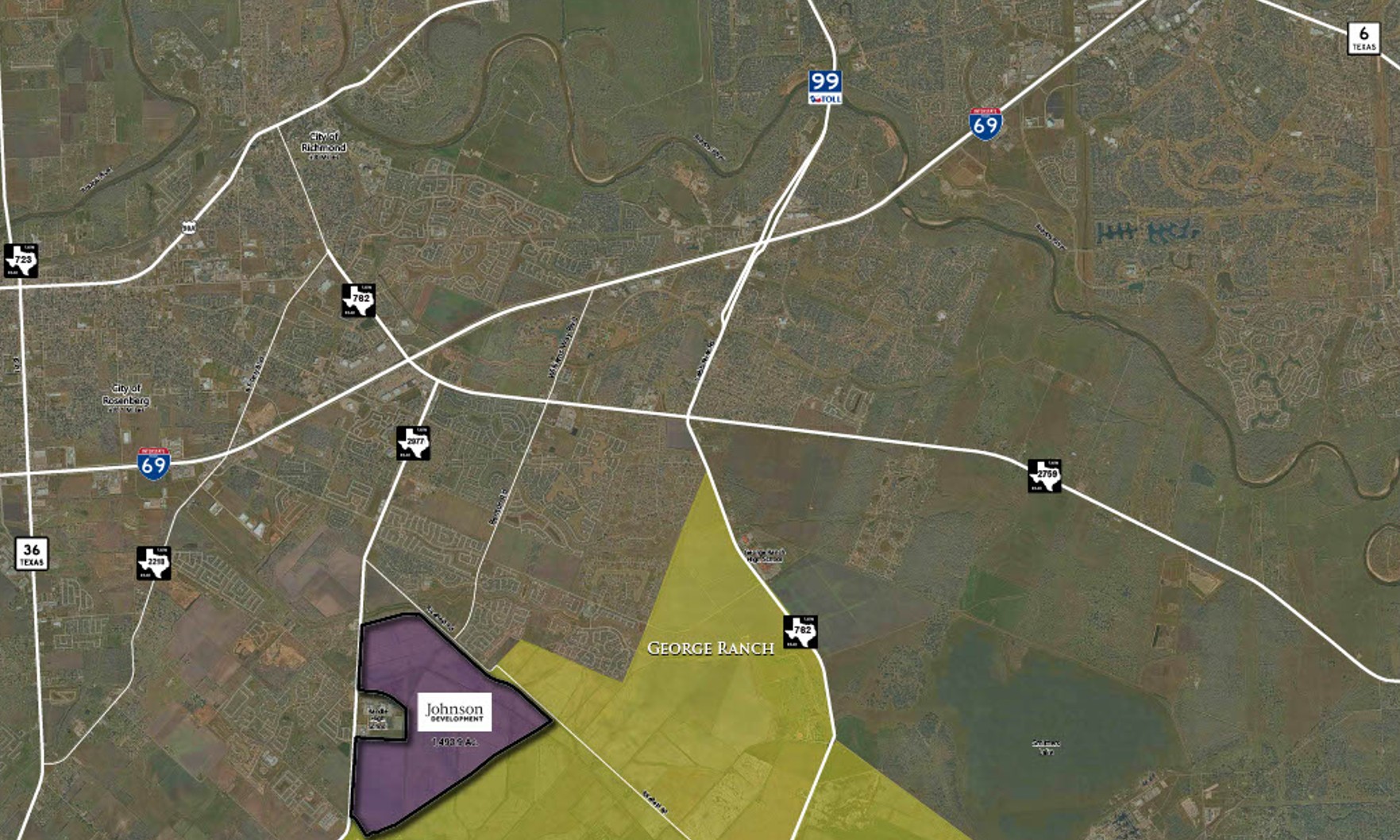

The George Foundation, a charity that supports nonprofits in Fort Bend County, sold 1,500 acres of land in west Fort Bend to Johnson Development for a new-home community.

One of the top-producing Texas agents was Renay Cohen, who ranked as the No. 1 agent in the state by gross commission income (GCI) and sales transactions.