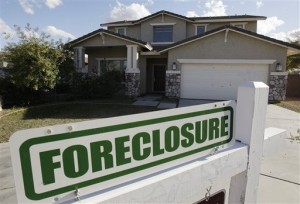

Realtors have become increasingly fed up with the delays in the sale of foreclosed properties – an area of widespread concern for many homeowners and agents alike, said the Wall Street Journal.

Within the press release regarding the “Pending Home Sales Index,” Lawrence Yun, NAR chief economist criticized HUD, saying “…a nonsensical situation has developed recently in some states with HUD unable to complete foreclosure deals because of insufficient funds to pay attorney fees at closing, even with buyers offering the full listing price.”

While the index for the month of May demonstrated a national increase in the number of contracts signed, Yun admits that the national index is below the ideal “healthy” level, which would be marked by a PHSI of 100.

Properties that have fallen into HUD’s possession due to default loans backed by the FHA, have been the primary reason for the delays. New England stands out with more than 540 properties affected, and another 190 properties were also in this category in Massachusetts, said Wall Street Journal.

An agency official told Wall Street Journal that HUD ran out of money to pay lawyers and closing agents negotiating these sales due to high demand for foreclosed properties.

The article states that “buyers should only face temporary delays in the other states.”

These types of instances have caused lenders to act with caution, bringing up another issue Yun mentioned-the difficulty of obtaining a loan, demonstrated by 2010’s rejection rates, when (in comparison to 2009) over 23 percent more loans were denied.