Arch MI finds Houston in danger of its home prices falling over the next two years, but that may just be what the city needs.

The price of crude is rallying, with West Texas Intermediate climbing 3 percent Wednesday to $58 per barrel, representing the year’s highest price – Brent crude, another worldwide price marker, settled at $66.16 per barrel. Over the next 12 months, WTI price per barrel is expected to continue increasing to $67 per barrel, putting prices well within Houston’s historic housing Goldilocks range of $55 to $90 per barrel – which marks the proximity with which the city’s housing market performs best.

Comparing data with past trends, specifically pointing to the 80s when Houston went through a similar oil crunch, migrating into a healthy crude price range should come as a relief to real estate professionals. But a new analysis of the housing and mortgage market from Arch Mortgage Insurance Company, or Arch MI, found that not only is Texas in danger of falling home prices, but Houston is, as well.

Analyzing the likelihood that home prices in a given statistical area will decrease over the next two years, Arch MI discovered that Houston faces a significant risk of home prices dropping, giving it an index rating of 38. In fact, Texas’ largest metro was found to be the third most likely area to see home price reductions, trailing closely behind Dallas and San Antonio, which were both given a rating of 42.

On the state level, Texas similarly came in third on the group’s index with a rating of 33.

Oil Makes Its Mark

Thus far, the affects on the local housing industry have been relatively muted, with gains in home price and sales remaining uniform. However, the impact to the city’s economy is another story, as energy producers are slashing budgets and cutting workforces by the thousands.

Only recently, Hercules Offshore and Weatherford International both announced major, forthcoming job cuts.

Hercules, which specializes in drilling, said in an April 29 conference call that it would be increasing the extent of its cuts from 30 percent, which it announced in Oct. 2014, to 40 percent. Already, the company has shed a significant portion of its workforce. As of the beginning of this year, Hercules had cut 1,800 employees, the company’s annual report confirmed.

Weatherford announced in late April that it plans to slash its workforce by 18 percent this year, adding to early reductions of 7,000 jobs, bringing company totals by year’s end from 56,000 in January to 39,000 in its core business and 6,000 rig employees.

The cuts are significant, as energy remains a major industry fro both the state and Houston. According to the Texas Railroad Commission, Texas still boasts 42 percent of the country’s oil rigs, despite the state’s count dropping by 500 rigs in the last year and the number of wells falling nearly 50 percent.

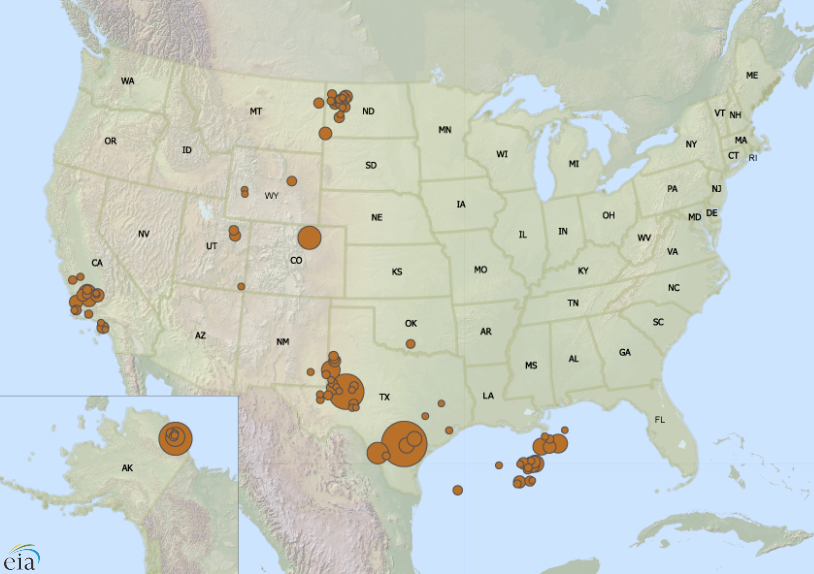

In a recent review from the Energy Information Association, a list of the top 100 oil fields emphasized the important role the Lone Star State plays in U.S. oil production, as three of the top five oil fields were located in Texas. As the below map shows, a majority of the country’s oil fields reside in Texas.

Thankfully for Houston, its economic diversity affords considerable space for other strong industries, such as healthcare, which has long played a vital role in supporting the city’s population.

Helping to avoid a rapidly rising unemployment rate, Texas Children’s Hospital has announced plans to invest $50 million in new projects, aimed at improving and expanding capabilities, as well as satisfying a surge of demand emanating from Houston’s western neighborhoods in suburbs. The additions will include, among others:

- Expanding its operating room count from four to eight.

- A new, twenty-four bed in-patient unit.

- A dedicated interventional radiology suite.

A Good Decline

Where Texas and Houston’s housing markets are headed will depend largely on how the market handles the economic jostling that comes from persistently low oil prices, which Dr. Ralph DeFranco, senior director of risk analytics and pricing at Arch MI, pointed out is the state’s serious concern.

“Our data shows that states with high levels of employment in the oil extraction and related industries continue to have elevated risk scores,” he said. “The spring edition of Arch MI’s Housing and Mortgage Market Review shows that, while the national average risk score remains stable at a low level of 8 percent, North Dakota, Oklahoma and Texas continue to have elevated risks due to their exposure to the oil sector.”

The implication has largely been that a hit to home prices equates to a downturned housing market, but examining the last twelve months, and even beyond, a hit to price appreciation may just be what Houston needs to find long-term stability.

According to the National Association of Realtor’s Affordability Index, affordability in Houston has been falling steadily since 2012. Rating on a scale where 100 points signifies that a family earning the area’s median income has exactly enough to qualify for a mortgage with a 20 percent down payment and anything above that indicates additional income, from 2012 to 2013 the Bayou City’s rating dropped from 225.2 to 191.3, a 15.1 percent decline, and in 2014 the rating dipped again to 180.4.

As we reported in early April, Houston home prices have grown 36.9 percent over the last two years, which is mostly a positive figure, only wages have had trouble keeping pace, rising a significantly less 5.7 percent. As this trend continues, which it is currently, the disparity between what homes cost and what residents can afford is only going grow.

If Arch MI is correct in its analysis that home prices are likely to drop over the next two years in light of oil price declines, as we also predicted in a January article, it may give wages an opportunity to catch up, restoring Houston’s long-standing affordability, which has been an appealing staple of the city for years. Otherwise, Houston may find itself in a situation similar to Boston, where a low inventory and rapidly escalating home prices are essentially stalling the market.