A 15-month run of decreasing year-over-year gains in U.S. home prices ended in July with 3.2 percent growth recorded in the S&P CoreLogic Case-Shiller National Home Price Index.

In general, the top metropolitan areas tracked by Case-Shiller didn’t perform as well as the overall national numbers.

Price growth increased by 1.6 percent in the top 10 metropolitan areas the index tracks – down from 1.9 percent growth in June. Case-Shiller’s top 20 list of metropolitan areas continued into its 16th month of slowing price growth with a 2 percent increase, compared to 2.2 percent in June. Of those top 20 metropolitan areas, 11 experienced lower price increases from the previous month.

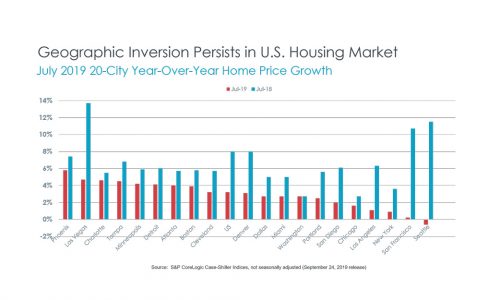

The slowest growth came predominantly from Western markets, with Seattle, San Francisco and Los Angeles as three of the bottom five markets, experiencing price growth of -0.6 percent, 0.2 percent and 1.1 percent, respectively.

Still, the reading marked the first sign of housing market stabilization in more than 18 months, and the report revealed a continued strengthening of geographic inversion in home price growth. Pacific markets constituted half of the 10 markets experiencing the slowest home price growth, while Southern and Midwestern markets made up half of the 10 markets with the fastest growth.

It was welcome news for homeowners in second-tier markets, where home prices have recently struggled to rise above inflation, according to researchers.

“The geographic flip-flop of home price growth has cemented itself strongly across the country. Pacific markets are now making up a majority of housing markets with the lowest price growth, while second-tier markets in the South and Midwest continue to lead the country,” said Dr. Ralph B. McLaughlin, deputy chief economist and executive of research and insights for CoreLogic. “This is a result of years of unprecedented yet unsustainable growth along the West Coast combined with stubbornly solid economic growth that is benefitting areas initially left out of the recovery from the Great Recession.”