Existing-home sales slid in April as macroeconomic factors continued to buffet the U.S. housing market, the National Association of REALTORS® announced.

Existing-home sales slid in April as macroeconomic factors continued to buffet the U.S. housing market, the National Association of REALTORS® announced.

“Home sales are bouncing back and forth but remain above recent cyclical lows,” NAR Chief Economist Lawrence Yun said in a press release. “The combination of job gains, limited inventory and fluctuating mortgage rates over the last several months have created an environment of push-pull housing demand.”

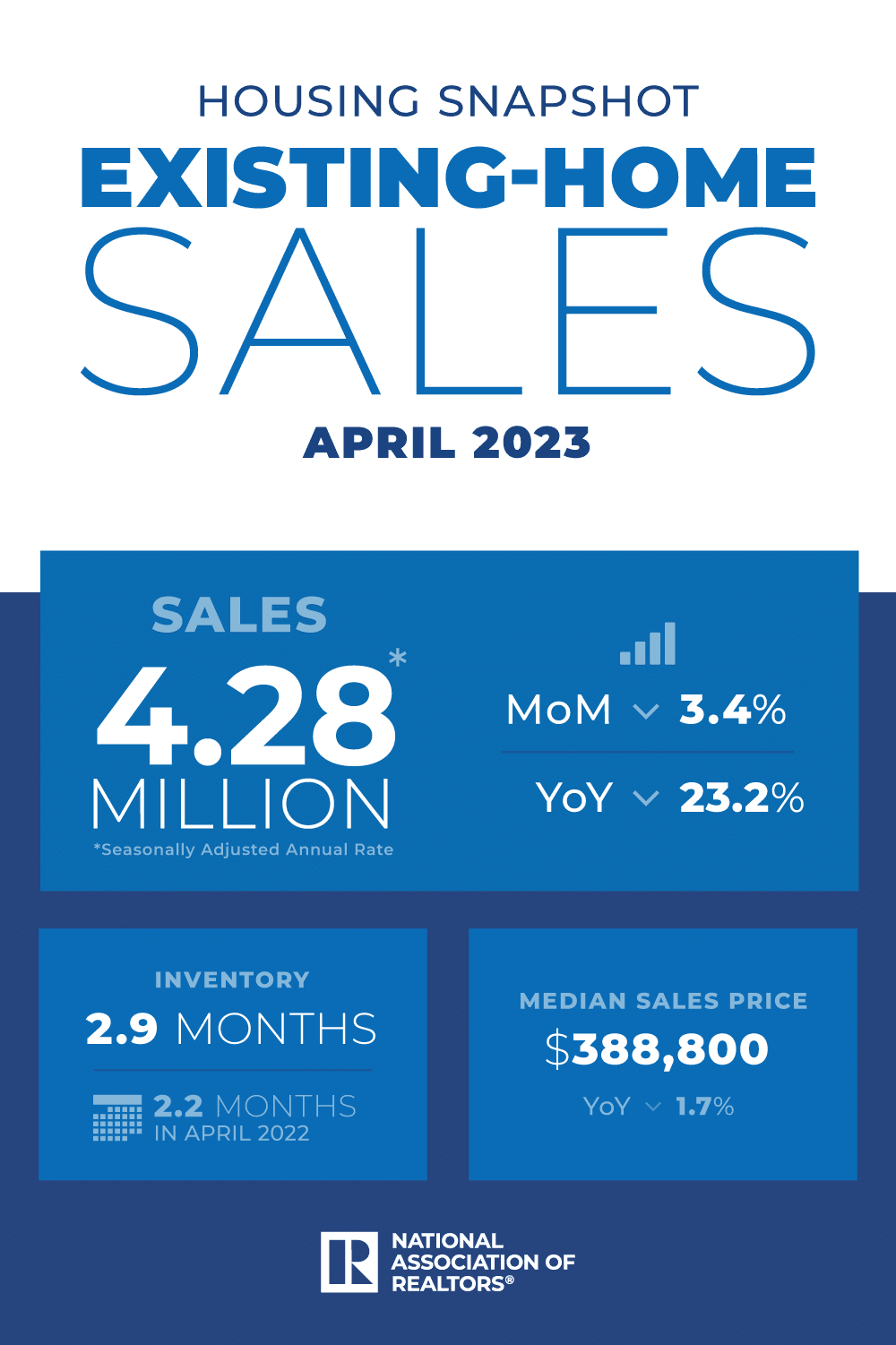

Specifically, existing-home sales slid 3.4% from March to a seasonally adjusted annual rate of 4.28 million. Year-over-year, sales were down 23.2% from 5.57 million in April 2022. Sales were down in all four major U.S. regions on both a monthly and annual basis.

The median existing-home price for all housing types in April slid 1.7% year over year to $388,800. The median price rose in the Northeast and Midwest but fell in the South and West.

“Roughly half of the country is experiencing price gains,” Yun said. “Even in markets with lower prices, primarily the expensive West region, multiple-offer situations have returned in the spring buying season following the calmer winter market. Distressed and forced property sales are virtually nonexistent.”

The 30-year fixed-rate mortgage averaged 6.35% as of April 11, down from 6.39% a week before but up from 5.30% a year earlier, according to Freddie Mac.

Total housing inventory at the end of April was 1.04 million units, up 7.2% from March and up 1% on a year-over-year basis. At the current sales pace, unsold inventory represented a 2.9-month supply, up from 2.6 months in March and 2.2 months in April 2022.

Properties typically remained on the market for 22 days in April, down from 29 days in March but up from 17 in April 2022. Seventy-three percent of homes sold in April were on the market for less than a month.

By property type, single-family home sales in April slid 3.5% month over month to 3.85 million. The median existing single-family home price was $393,300, down 2.1% on a year-over-year basis.

Existing condominium and co-op sales also decreased, coming in at a seasonally adjusted annual rate of 430,000 units in April, down 2.3% from March and 29.5% from April 2022. The median existing condo price rose 0.7% year over year to $348,000.