National News

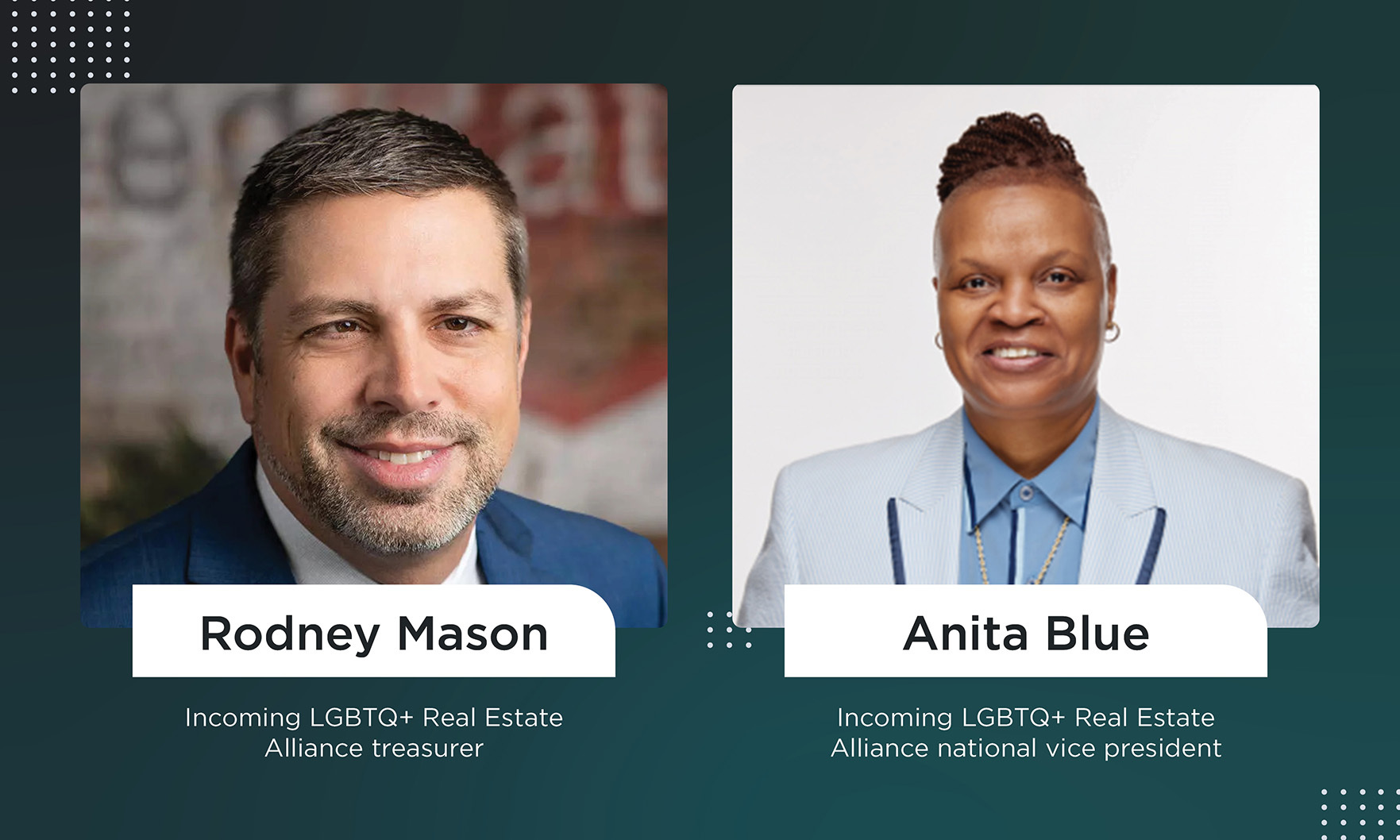

Atlanta’s Rodney Mason, who serves as vice president of mortgage lending with Guaranteed Rate, was named treasurer of the nonprofit, while Anita Blue, who works as an agent and credit restoration consultant at Cap Tex Realty, was named national vice president.

“Mortgage rates decreased for the first time since August, as concerns about supply-chain bottlenecks, waning consumer confidence, weaker economic growth and rising inflation pushed Treasury yields lower.” — MBA associate vice president of economic and industry forecasting Joel Kan

“This will be the first time a home lender will provide an end-to-end ‘mortgage-as-a-service’ solution through Salesforce Financial Services Cloud — a platform that thousands of financial institutions already heavily rely on.” — Rocket Cos. Vice Chairman and CEO Jay Farner

Zillow announced today it’s ending its iBuyer service, Zillow Offers, and cutting roughly a quarter of its workforce, citing the volatility the service created for the online brokerage as the motivation for the move.

Millennials are purchasing houses — finally. Over the past year, millennials made up the largest share of homebuyers: 37% according to Barron’s.

“Contract transactions slowed a bit in September and are showing signs of a calmer home price trend, as the market is running comfortably ahead of pre-pandemic activity.” — NAR chief economist Lawrence Yun

Home-price gains were once again broadly distributed, as all 20 cities in the S&P CoreLogic Case-Shiller Home Price Index rose, although in most cases at a slower rate than a month ago.

It’s been a more than a year and a half of technological innovation in real estate in response to the COVID-19 pandemic, and the Federal Housing Finance Agency has decided to make one tool — desktop appraisals — permanent.

Pet ownership increased dramatically during the pandemic. 73% of homeowners report at least one pet in the home.

“There simply aren’t enough homes for sale relative to the demand fueled by millennials armed with low mortgage rate-driven house-buying power.” — First American Deputy Chief Economist Odeta Kushi

The median existing-home price for all housing types in September was $352,800, up 13.3% on an annual basis, as every region in the country registered price increases.

The decrease was driven by a 5.1% month-over-month slide in the rate of multifamily starts, while single-family construction was flat.

Zillow announced it will not sign any new contracts to buy homes until the end of the year due to a “backlog in renovations and operational capacity constraints.”

The acquiring group includes First Multiple Listing Service in Atlanta, MIAMI REALTORS®, ACTRIS MLS in Austin, Texas, and Heartland MLS in Kansas City.

At 37 years old, the new president will be the second-youngest leader of the national nonprofit trade organization, which works to improve the homeownership rate in the Asian-American Pacific Islander community.

The median household wealth for U.S. Latinos is set to triple by 2024 — largely due to recent real estate gains. This information comes from data released by NAHREP®.