News / Features

For its inaugural Texas Homebuying Experience Report, the association surveyed Texas Realtors about their experiences with buyer clients during the first six months of the year.

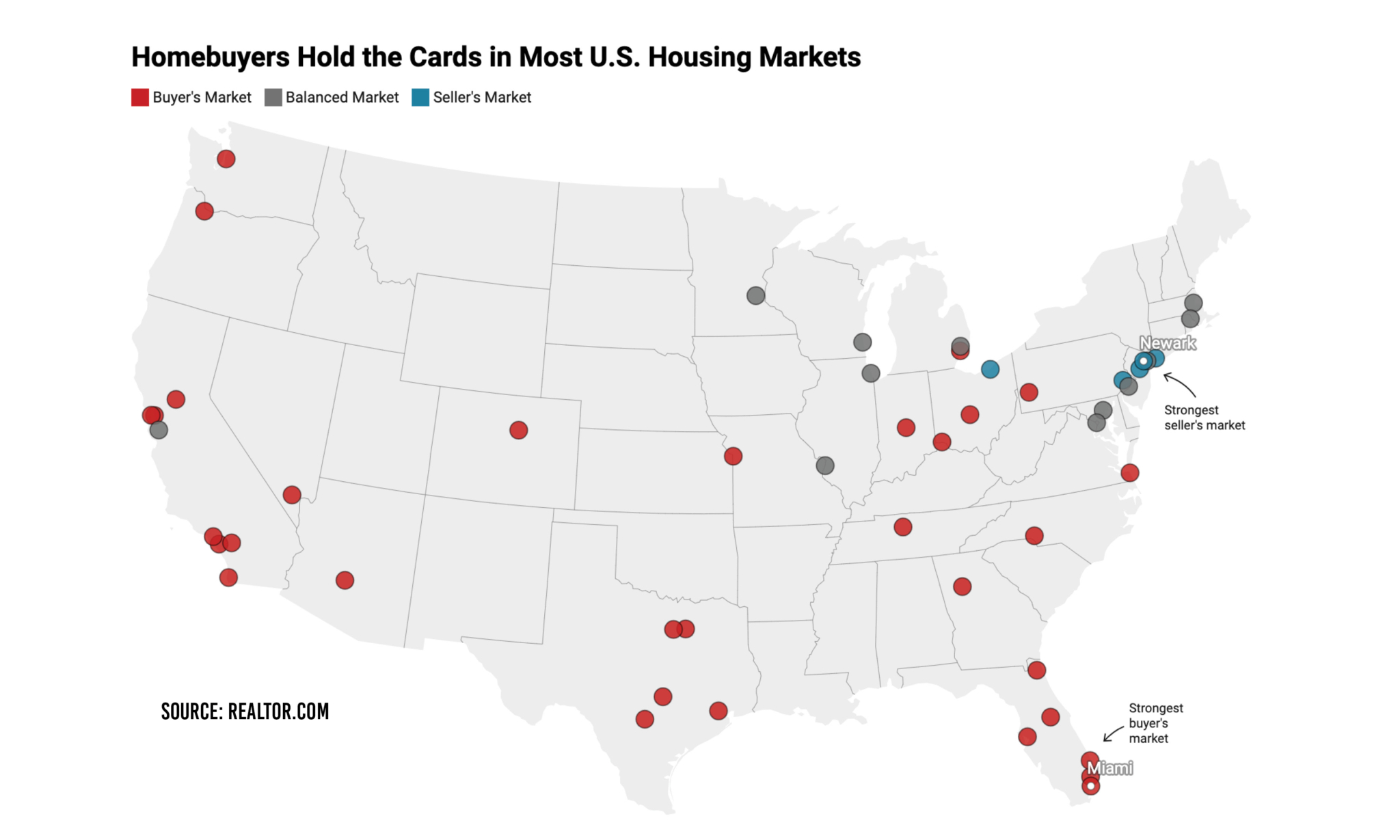

Across reports from Realtor.com, Zillow and Redfin, the data converges on one clear truth: the housing market’s momentum is tilting toward those shopping for homes rather than those selling them.

The partnership, initially announced in February, means that HAR MLS subscribers will now have access to over 80% of all Texas listings.

The priciest new listing in Texas this past month is a $22 million estate that spans 14,341 square feet — that’s over $1,500 per square foot.

Talk about a modern farmhouse! This former working dairy farm in Oswego, Illinois, now boasts a rustic open floor plan with modernized living quarters upstairs.

Searches for “fixer-upper” on Realtor.com in July 2025 have more than tripled in volume compared to four years ago.

The pace of new-home sales hit an annual rate of 800,000, its highest level since January 2022.

“At Gary Greene, we don’t just provide a place to hang your license,” said Linsey Ehle, vice president of growth and development. “We provide the systems, strategic coaching and marketing horsepower that enable our agents to grow.”

Fannie Mae also reduced its forecasts for home sales in 2025 and 2026.

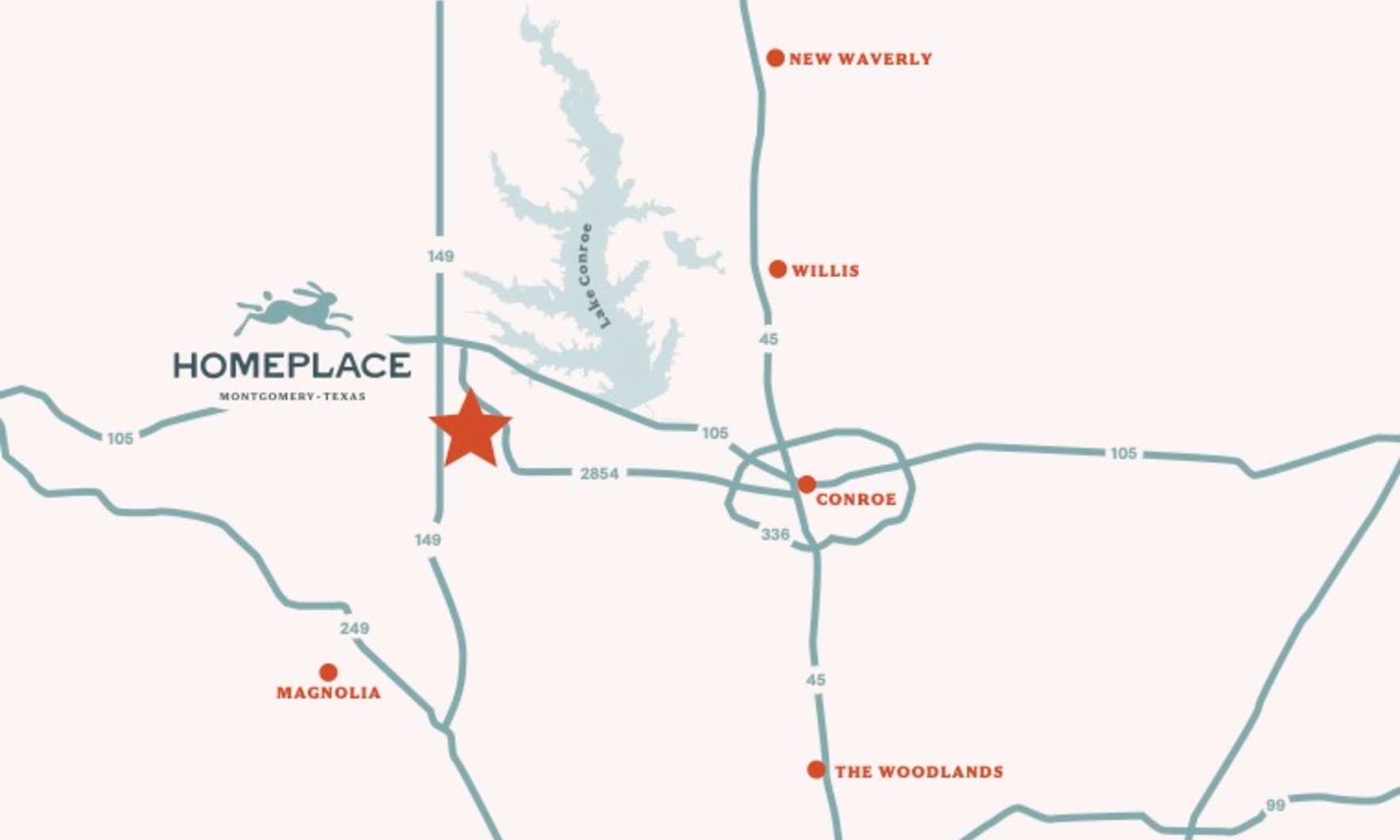

Rochester plans to break ground on Homeplace early next year and deliver initial lots to builders in 2027.

The stock-swap deal will bring Anywhere’s brands, including Better Homes and Gardens, CENTURY 21, Coldwell Banker and Sotheby’s International, under the Compass umbrella.

The annual survey finds most Realtors pay at least $50 a month for work technology, despite a majority feeling satisfied with the tech provided by their brokerages.

The decline in sales came as a 17-month run of year-over-year increases in new listings came to a close.

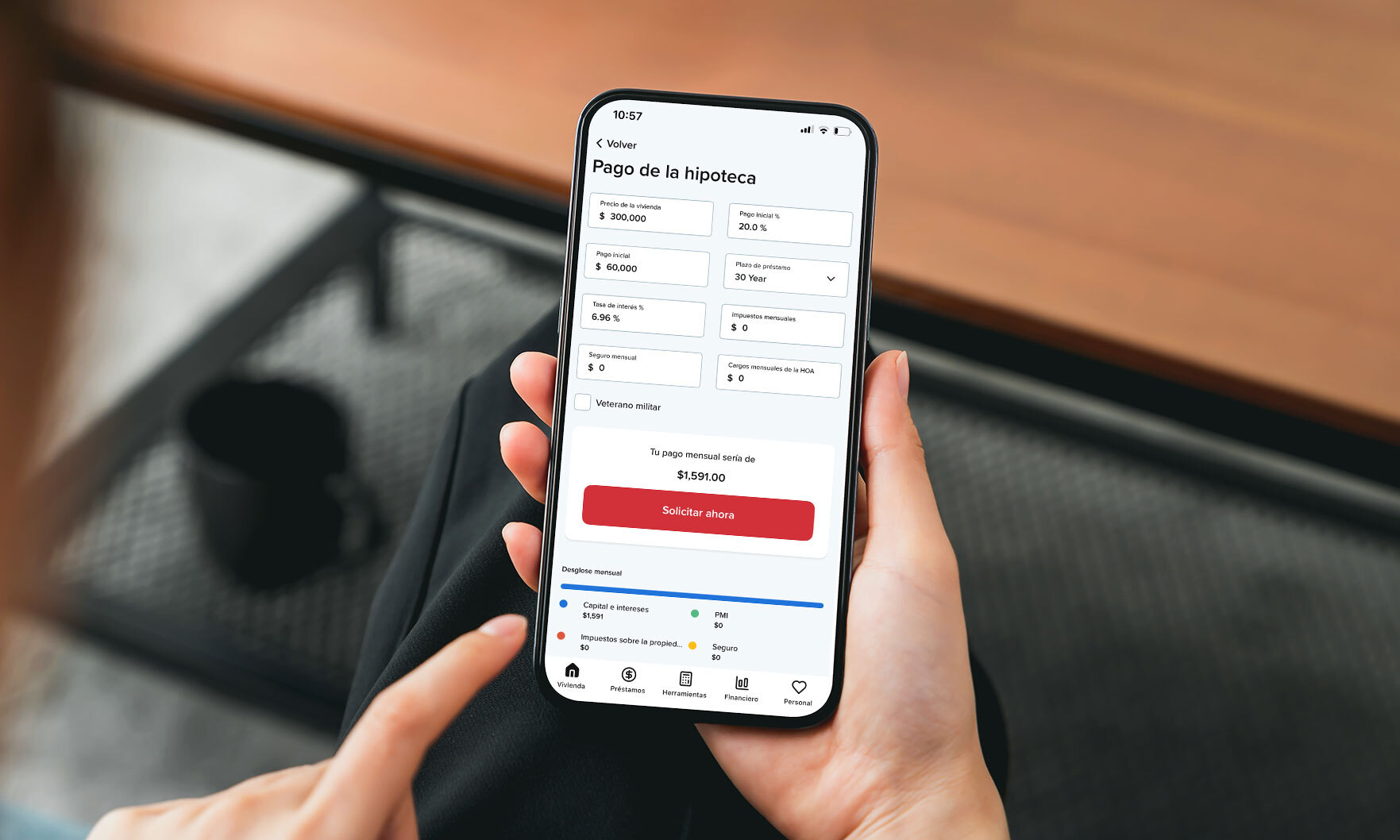

Rate has launched the first fully integrated Spanish-language mobile app from a U.S. mortgage lender.

Altivo Insurance will provide options from Goosehead’s portfolio of insurance providers, offering more choices than typically available to Houston buyers, Nan and Company said.

The move was widely anticipated and is expected to be followed by additional cuts this year.