REach, a tech accelerator that the National Association of Realtors launched in 2012 to fund real estate start-ups, recently announced the 2016 companies that will receive funding for their products.

The seven companies that are part of the “2016 accelerator class” have raised more than $30 million, and over the course of the next eight months, they will work within the NAR sphere to develop their ideas.

Those ideas pose interesting things for the future of real estate, and below, we have detailed three of the most interesting for agents:

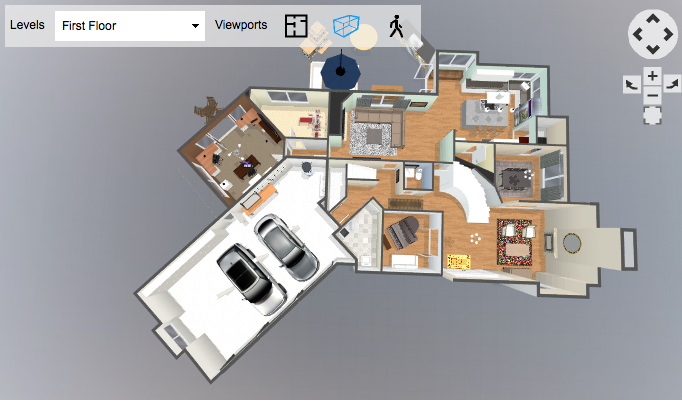

1. HomeDiary – A “digital record of your home,” the HomeDiary program takes the concept of customization to a new level. Although there are already plenty of apps that allow homeowners to visualize how a new piece of furniture or improvement project will look in their living space, HomeDiary applies that concept to the entire home, allowing homeowners to explore remodeling ideas, color palettes and landscaping ideas via full floor plans of their home. Additionally, the app has a robust inventory system, so homeowners can store receipts, log paint colors and save records of their projects.

2. Zenergyst – The Zenergyst program bills itself as “the first fully integrated real estate platform.” Tall words for a market already awash with apps and programs that purport to ease the buying/selling process, but Zenergyst does promise some big things, including: fast-tracking real estate transactions; nurturing leads from the first introduction through the close; and easier collaboration within the program (so no more outside e-mails, spreadsheets or calendars).

3. Sindeo – The mortgage process can be intimidating, and the Sindeo program aims to simplify it for consumers. Using a network of more than 40 lenders and 1,000 loan programs, Sindeo allows users to create a personalized mortgage profile based on financial situation, timing and goals. From there, users can connect with a mortgage advisor, verify their credit score, qualify for the right loan and even sign the necessary documents – all through Sindeo.

Honorable Mention – It has not officially launched yet, but the TrustStamp program is quite intriguing. Utilizing more than 200 public records and social data, TrustStamp verifies identification information in less than a minute, something that will prove very useful in a field like real estate.