Less homes are being flipped, for less of a profit, and for those who do, the cost is the most expensive it’s been in nearly 10 years, according to a new report from ATTOM Data Solutions.

Flipping trend on the decline

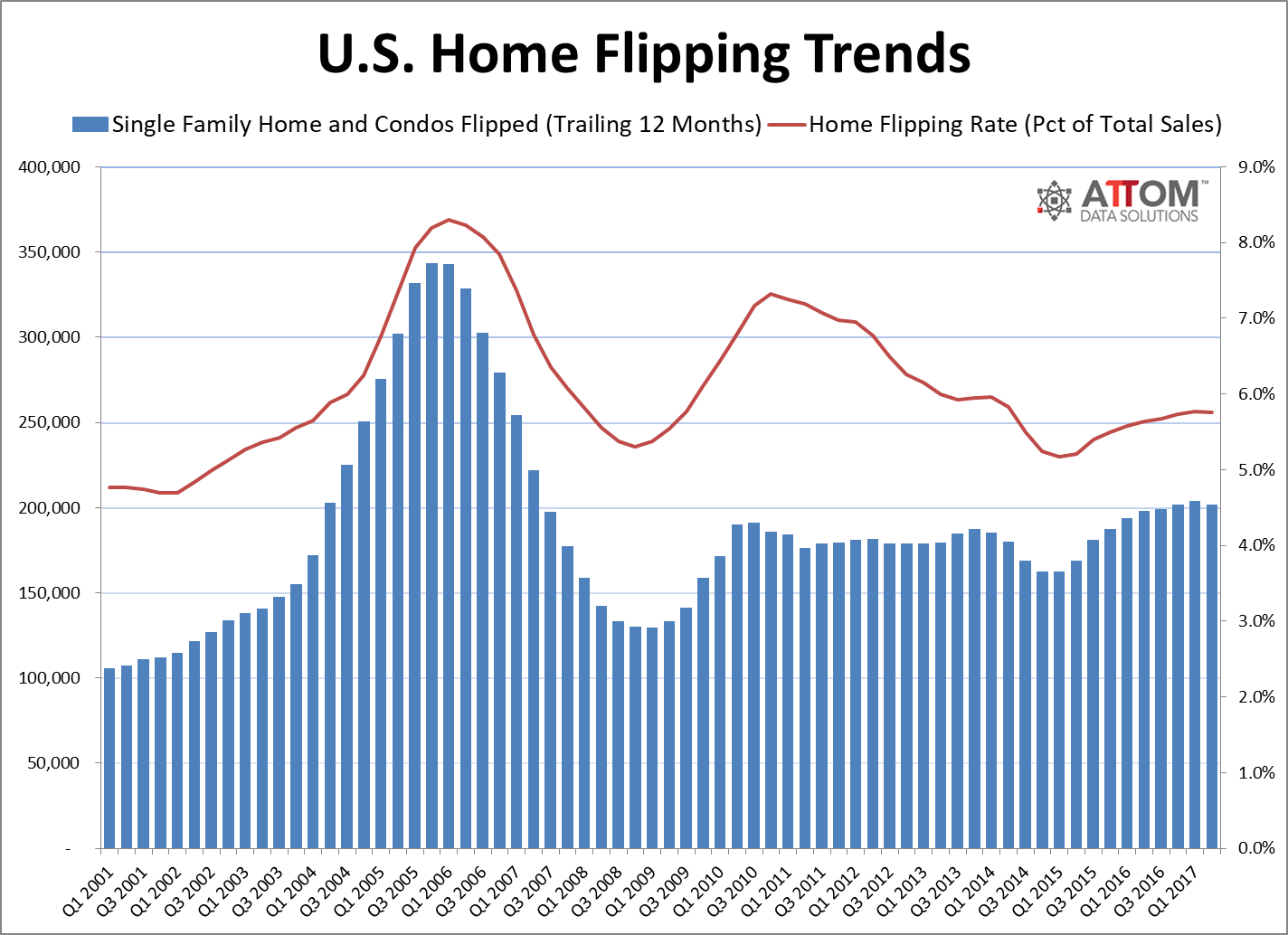

ATTOM Data solutions released their Q2 2017 Home Flipping Report which showed a plateau in the housing market. ATTOM Data also found that this quarter 53,638 single family homes and condos were flipped, or purchased and sold a second time within a 12 month period, nationwide. This means 5.6 percent of all homes sold in Q2 2017, down from nearly 7 percent last quarter, but matching what it was reported this time last year.

Counter to the national trend some local markets are seeing an increase in home flips purchased. The Q2 2017 report found that 53 percent of the nation’s local markets saw increase in home flip sales, namely in the metro areas in Louisiana, New York and Alabama.

Less ROI for flipping

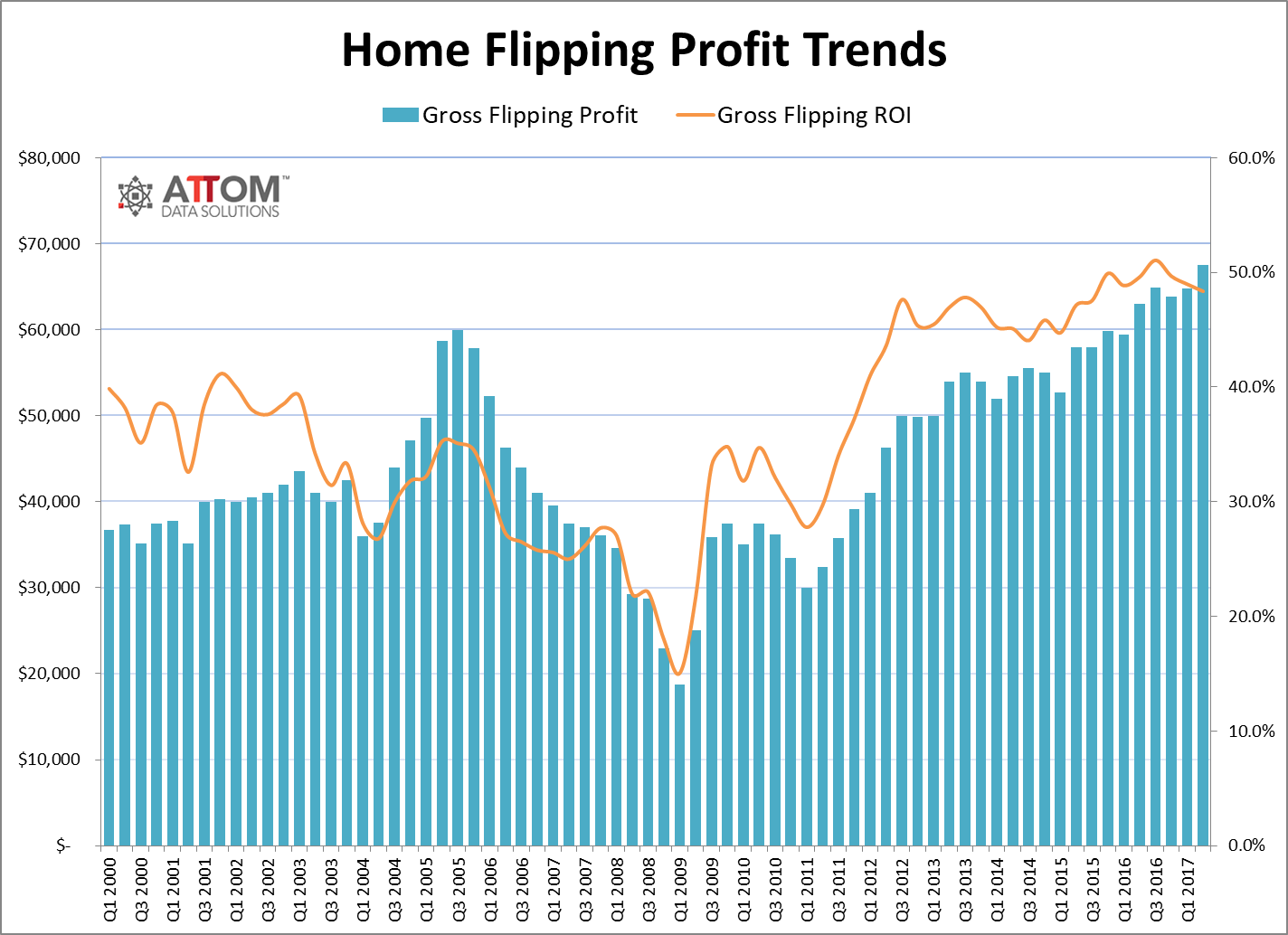

Q2 2017 also saw that the average gross profit for homes flipped in 2017’s second quarter was $67,516, a 48.4 percent return on investment (ROI). This is down from 49 percent in Q1 2017 and down further from 49.6 percent in Q2 2016. Average gross flipping ROI has decreased nationwide for three quarters in a row.

“Home flippers are employing a number of strategies to give them an edge in the increasingly competitive environment where flipping yields are being compressed,” Daren Blomquist, senior vice president at ATTOM Data Solutions, said upon release of the report. “Many flippers are gravitating toward lower-priced areas where discounted purchases are more readily available — often due to foreclosure or some other type of distress. Many of those lower-priced areas also have strong rental markets, giving flippers a consistent pipeline of demand from buy-and-hold investors looking for turnkey rentals.”

Finance rates for flipping highest in nearly a decade

The report also showed that more than 35 percent of of homes flipped in Q2 2017 were purchased by the flipper with financing. This is up from 33.2 percent from last quarter and highest percentage in nearly nine years. The estimated dollar volume of financing of flipped homes this quarter is $4.4 billion. This number is up from Q1 2017’s $3.9 billion, $1 billion more that Q2 2016, becoming the highest level since 2007.

“In markets where distressed discounts have largely dried up, flippers are showing more willingness to leverage financing when acquiring properties, often purchasing closer to full market value and then relying more heavily on price appreciation to fuel their flipping profits,” Blomquist added, during his statement about the Q2 2017 findings.flipp