Housing prices nationwide have skyrocketed since the onset of the pandemic and continue rising today. While this is bad news for prospective buyers, rising home prices equal a surge in home equity, leading to a much more stable financial future for homeowners.

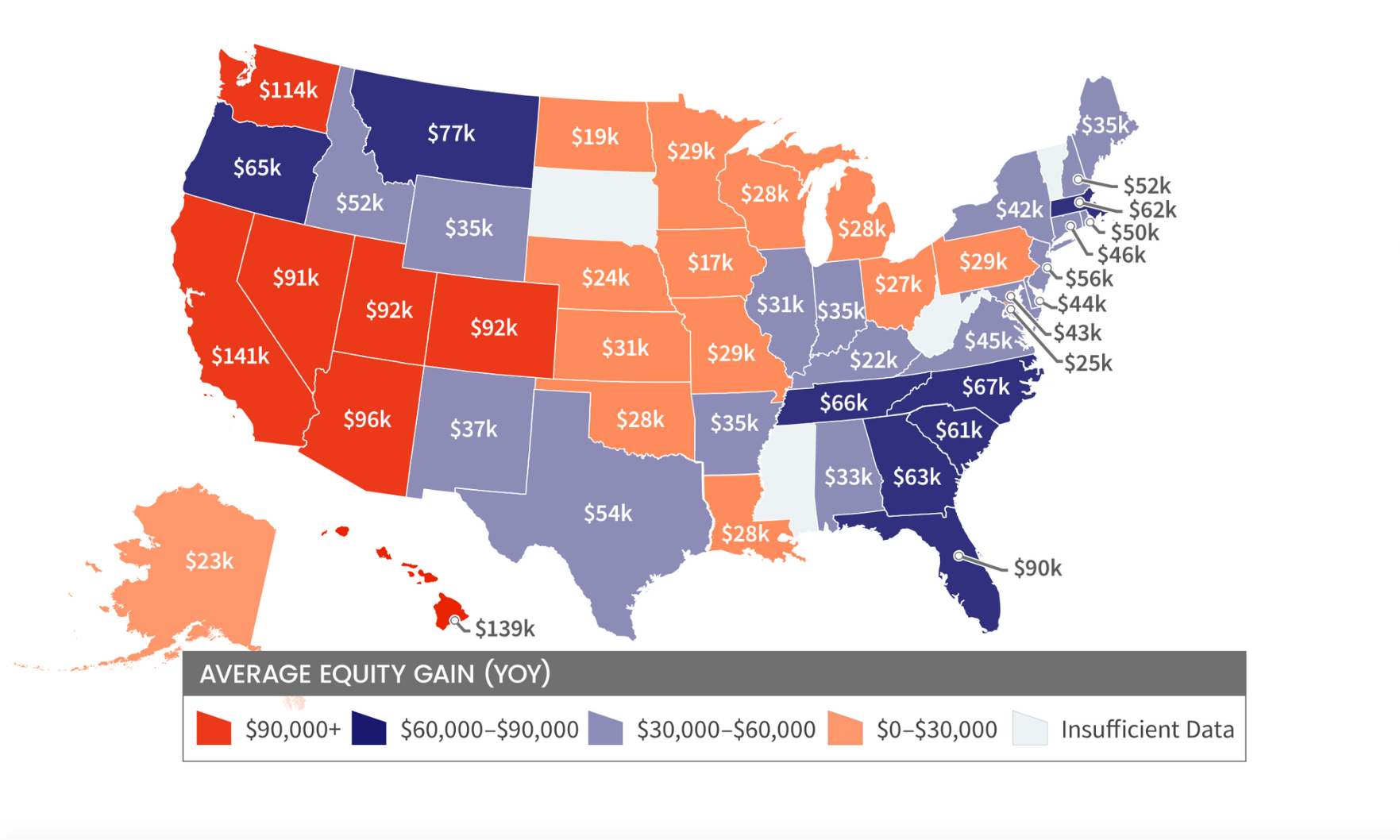

During the first quarter of 2022, Texas homeowners with mortgages saw an average gain of $54,000 in equity from the first quarter of the previous year, according to a new CoreLogic report.

The report analyzed U.S. mortgaged properties only, which account for roughly 62% of all properties in the country.

Locally, Houston borrowers gained an average of $46,500 in equity.

On a national scale, rising home values led to a collective $3.8 trillion increase in home equity for American borrowers in 2022’s Q1. This represents a 32% year-over-year increase or a record $63,000 per borrower, CoreLogic reported.

Homeowners in California, Hawaii and Washington led the country in annual equity increases, each gaining more than $100,000 in one year.

“Price growth is the key ingredient for the creation of home-equity wealth. Home prices were up by 20% in March compared to one year earlier in CoreLogic’s national Home Price Index,” said Patrick Dodd, president and CEO of CoreLogic. “This has led to the largest one-year gain in average home equity wealth for owners and is expected to spur a record amount of home-improvement spending this year.”

Only 2% of U.S. homeowners with a mortgage remain underwater, a slight decline from the fourth quarter of 2021.