Housing inventory in the U.S. has “collapsed” since January and turned negative on a year-over-year basis for the first time in 13 months in June, real estate data provider MarketNsight reported.

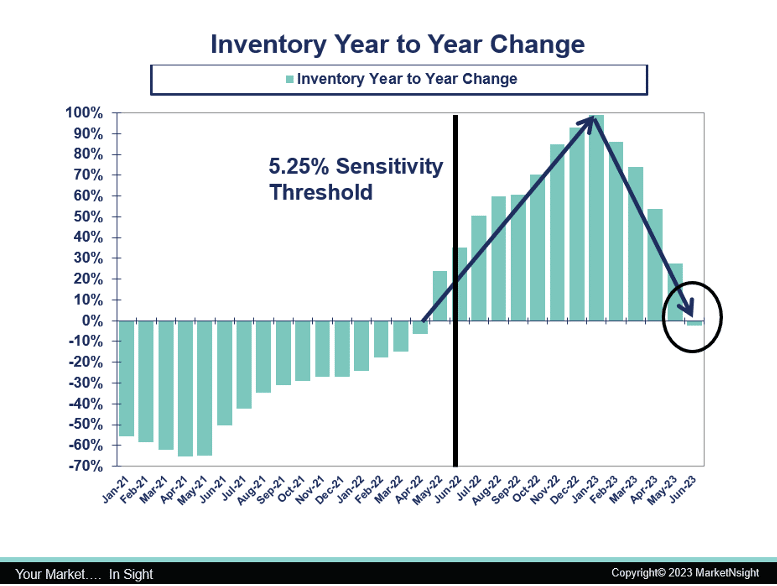

After going negative during the pandemic housing boom, inventory swung to positive territory in summer 2022 as interest rates crossed the 5.25% sensitivity threshold, MarketNsight said. Inventory then rose quickly, peaking in January with double the supply of a year before. However, inventory reversed course just as quickly, turning negative in June.

“There was already a housing shortage before the pandemic. The pandemic housing boom made it worse, and the Fed’s actions will only deepen the inventory crisis,” MarketNsight Principal and Chief Analyst John Hunt said.

Seasonal factors typically drive inventory higher from May to June every year. In 2021 and 2022, the May-to-June increases clocked in at 26% and 38%, respectively, but fell to just 6% this year, representing a dramatic shift toward lower inventory levels, MarketNsight said.

Looking ahead, the firm revised its April prediction of a maximum inventory of three months this year to a maximum of 2.5 months in October or November. At the end of June, inventory stood at 1.8 months.

Inventory will tighten further in the coming quarters, as there is not enough to satisfy existing demand, MarketNsight said, adding that the new-home industry is addressing some of the shortages with new-home market share poised for a dramatic increase. The high level of demand will support stable home prices despite historically high mortgage rates, MarketNsight added.