Increases in consumer demand caused the Houston rental market to heat up during the spring and summer — but decreases in occupancy and an uptick in multifamily construction allowed apartment absorption to triple during the second quarter.

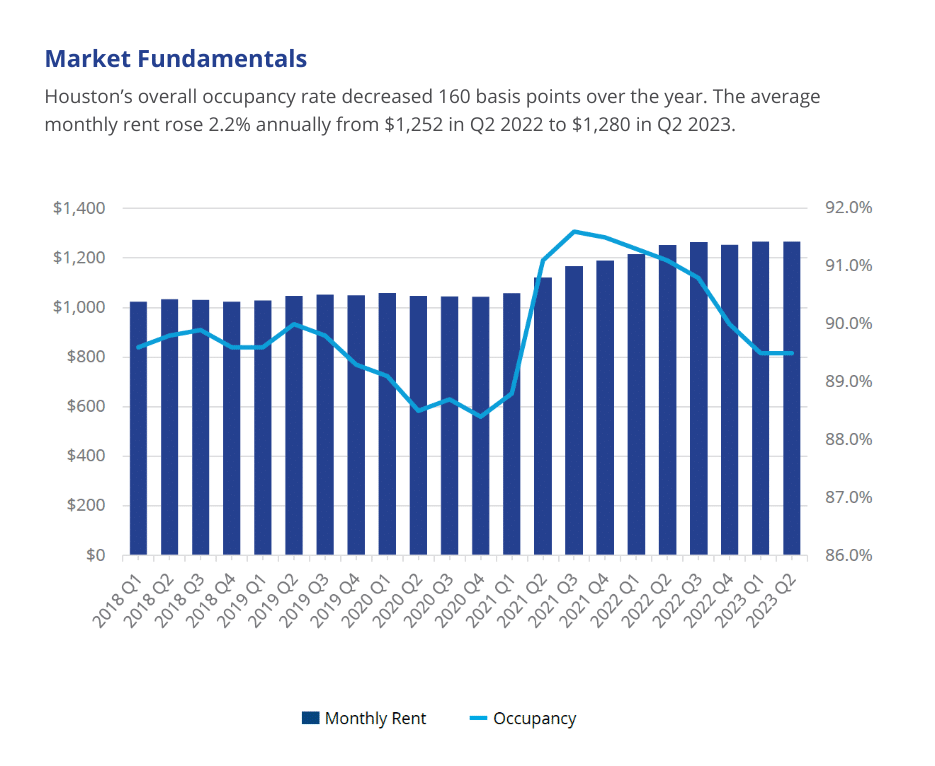

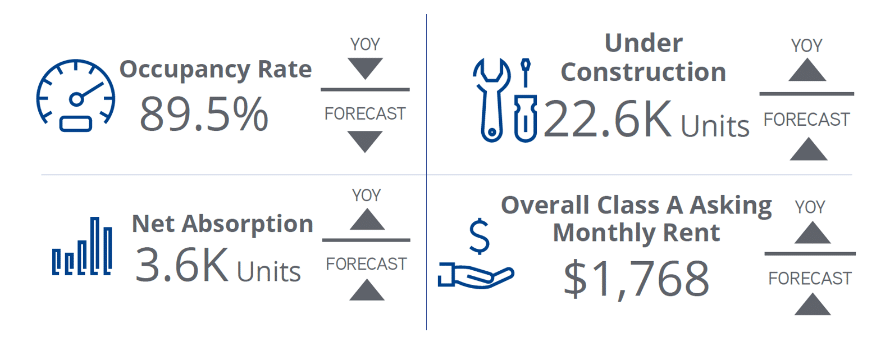

According to data from Colliers’ Houston Multifamily Market Report for Q2 2023, occupancy has fallen on a year-over-year basis, opening up a plethora of new options for renters in the city. However, occupancy remained consistent at 89.5% during the first six months of the year.

While the total number of available apartments increased by 5,222 units during Q2, bringing the total inventory to 734,748 units, occupancy remained stable due to increased consumer demand, as indicated by Houston’s positive net absorption rate. About 3,600 more units were leased than were vacated during Q1. Last quarter, net absorption was about one-third of that rate at 1,156 units.

Meanwhile, the average rent jumped 2.2% year over year to $1,280 per month. That’s up approximately $14 per month from Q1 and up $28 from Q2 2022.

Construction of multifamily apartments also ramped up during the second quarter, with a total of 22,555 units in Houston’s construction pipeline. Last quarter, there were 21,711 units under construction — a year ago, just over 15,000.

“The Houston multifamily market during the second quarter showed signs of stabilization,” said Colliers President Danny Rice. “The light at the end of the interest rate hike tunnel looks to be glowing brighter, signaling clarity for investors in the coming quarters.”