It takes the average Houstonian eight years to save up for a 10% down payment on a home, according to a recent Axios analysis.

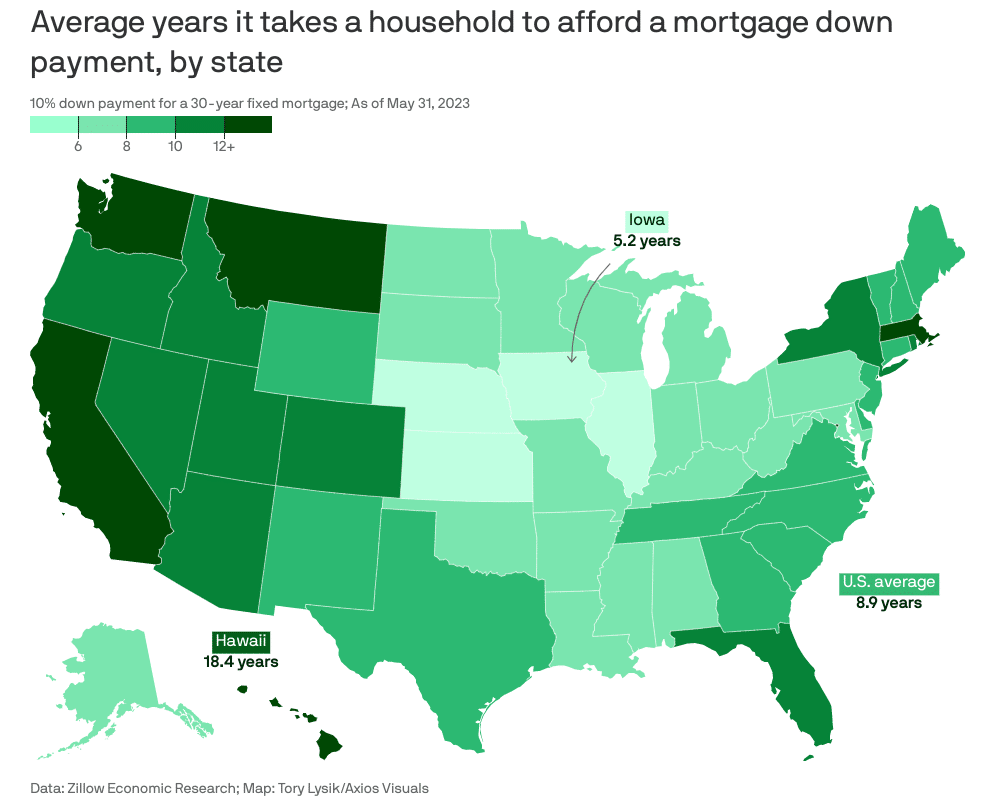

Using data from Zillow, Axios determined the typical amount of time it takes to save for a down payment in every state based on home values and area median household income. The average across the U.S. is 8.9 years, assuming the potential buyer saves 5% of their household income every month.

With a median household income of $77,000 and a typical home value of $307,300, Houston residents can expect to spend 8 years saving for a 10% down payment. Residents in San Antonio can expect a similar timeline of 8.4 years. The average time across Texas is 8.1 years.

While eight to nine years seems like a long time to save, residents in many metro areas have to wait much longer to be able to afford their down payment. In Los Angeles, it takes 19.8 years to save up for a house costing $885,600. The average saving time for the entire state of California is 16.4 years.

Conversely, buyers in several areas analyzed have the shortest waiting periods when it comes to saving. For homebuyers in Iowa, Kansas, Illinois and Nebraska, it takes less than 6 years to save for a 10% down payment.