Current Market Data

Houston mortgage payments have grown 46.4%, as housing affordability hits a 15-year low, according to a new report. Zillow’s latest market report found rising mortgage costs, along with skyrocketing prices and interest rates have made mortgages less affordable than

New-home inventory rose to 444,000 homes in May from 437,000 homes in April, the U.S. Census Bureau and the U.S. Department of Housing and Urban Development reported.

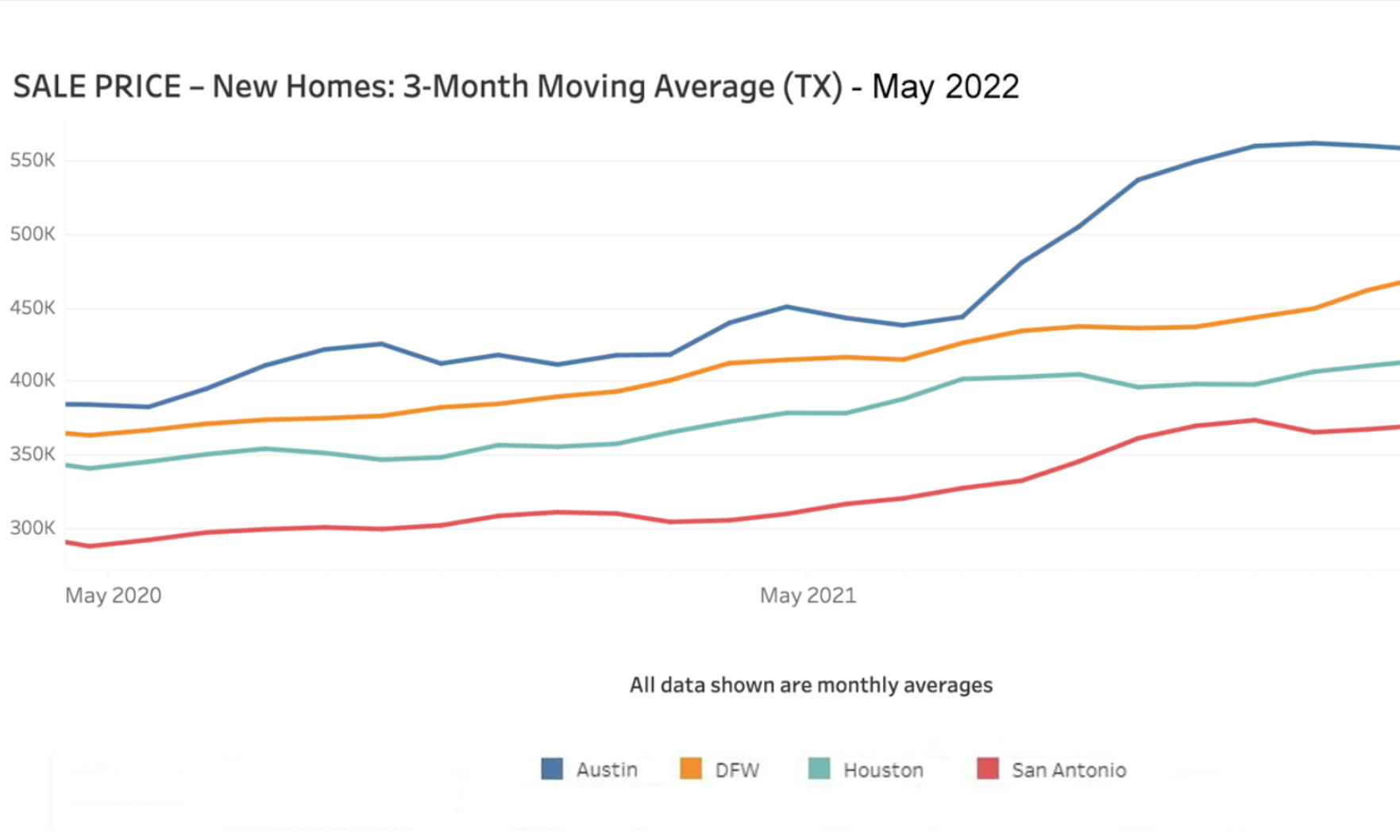

Houston’s new-home sales defied inventory challenges and rose for the fourth straight month in May. New homes sold faster and at a higher average price than the previous month, according to HomesUSA.com.

Meanwhile, existing-home sales slid 3.4% from April to a seasonally adjusted annual rate of 5.41 million, according to the National Association of REALTORS®.

Houston was fourth on the list with 844 iBuyer home sales in the first quarter, accounting for 3.5% of home sales in the market.

Realtor.com’s updated 2022 forecast sees housing demand returning to pre-pandemic levels.

The number of homes for sale in May rose 16.3% month over month and 2.2% year over year. Months’ supply of inventory rose to 0.9 from 0.8 in April and fell from 1 in May 2021.

New-home completions rose during the month, however, with the increased inventory representing a rare bright spot in an otherwise gloomy government report.

Mortgage lending took a nose dive across the U.S. in the first quarter of 2022

Redfin economists say they expect the cooldown in budgets to lead to a cooldown in price growth over the next few months.

Worsening affordability challenges are affecting first-time homebuyers

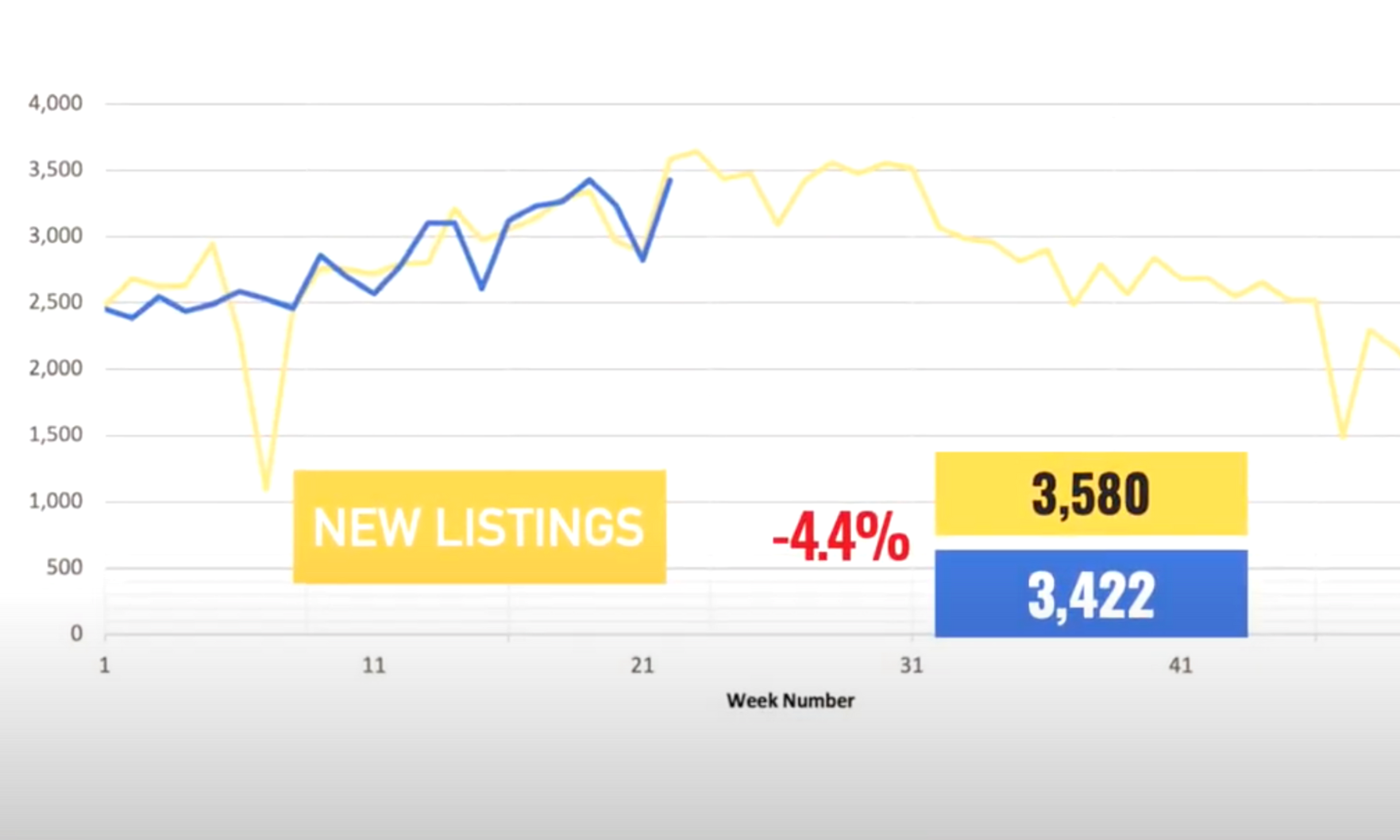

New listing activity was vibrant during the first week of June, although it trailed the previous year’s numbers by 4.4%, according to the Houston Association of REALTORS®.

May home sales maintained a healthy pace despite climbing housing prices and mortgage interest rates. And, due partly to an increase in new listings, housing inventory reached its highest level of the year, HAR reports.

The shift comes at a great cost as rising mortgage rates continue to keep buyers out of the market.

Nationally, the index posted its highest annual increase ever.

With affordability reduced, some buyers are pulling back from the market forcing sellers to adjust their price expectations.