By the Numbers

CoreLogic expects prices to continue to grow through the year.

The most expensive new listing in the Lone Star State carries a price tag of nearly $50 million.

Agents from COMPASS were responsible for listing and selling many of the most expensive properties in greater Houston last month.

These are the most expensive new listings in Texas, all added to the MLS in the past month.

The average American spends roughly $1,700 on their monthly rent, according to a new report from RentCafe.

The only region of the U.S. that didn’t experience an annual decline in existing home sales was the Midwest, where sales were unchanged year over year.

Last month’s most expensive Houston home sales range from a grand estate in the heart of River Oaks to an opulent condominium in The Huntingdon high-rise.

The agent with the most $1 million-plus listings was Laura Sweeney of COMPASS RE Texas, who accomplished a sales volume of over $71.8 million across 19 transactions.

Agents from Moreland Properties are responsible for the most expensive and second-most expensive new listings in the state of Texas.

The median price of a new home sold during the month fell to $418,800 from $433,100 in August, the U.S. Census Bureau and the U.S. Department of Housing and Urban Development reported.

The median existing-home price for all housing types in September was $394,300, up 2.8% from $383,500 in September 2022.

Specifically, single-family homes were built at a seasonally adjusted annual rate of 963,000, up 3.2% from 933,000 in August and up 8.6% from 887,000 a year earlier, according to government figures.

COMPASS agent Laura Sweeney tops the list of the most expensive Houston home sales yet again, this time representing both the buyer and the seller on a $14.5 million transaction in River Oaks.

A 15% rise in applications for adjustable-rate mortgages drove overall mortgage applications higher in the most recent weekly survey.

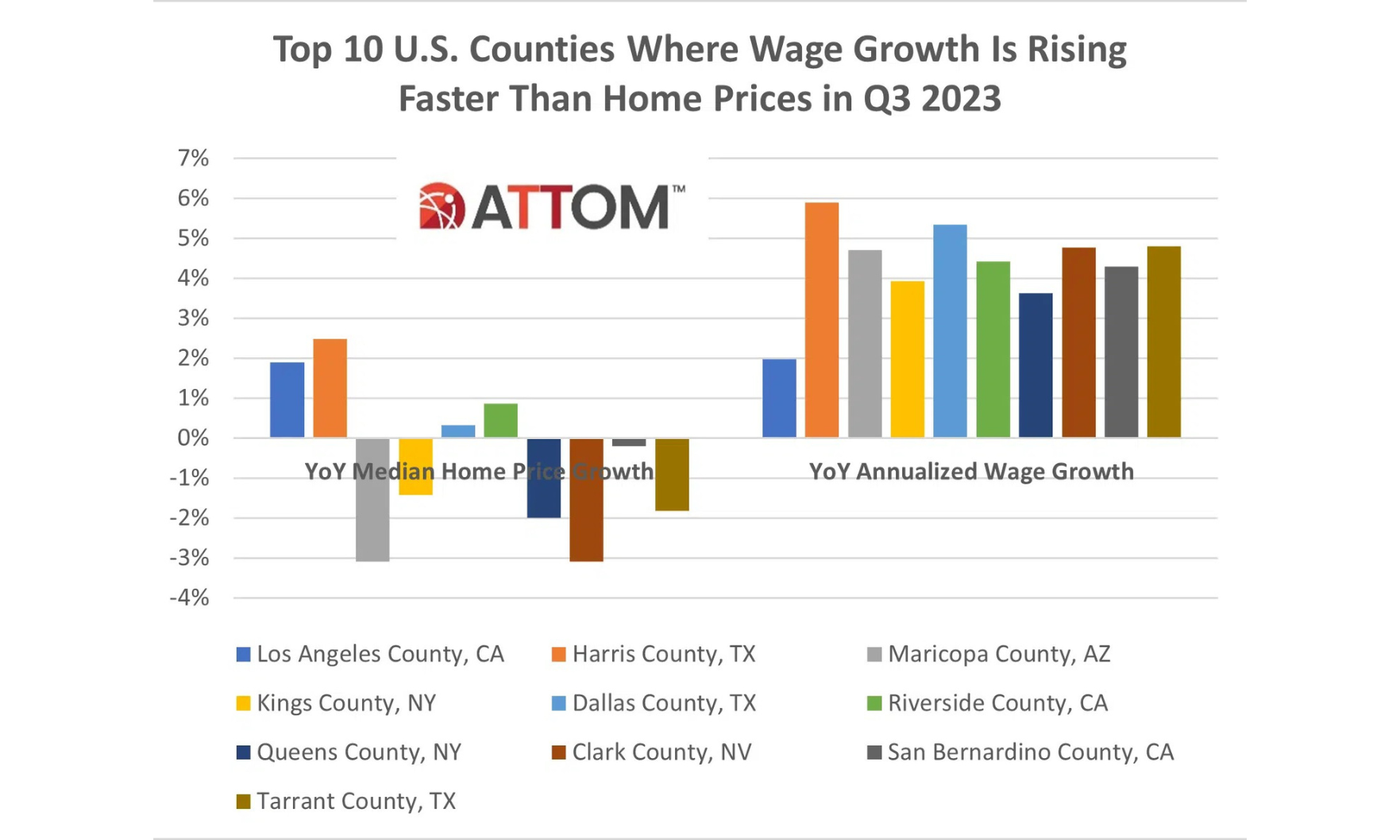

Housing affordability has worsened in many parts of the country as wages fail to grow at the same pace as home prices — but Harris County is one area where wage increases are outpacing price increases.

Here are the priciest new listings for sale in The Lone Star State, all posted to the Multiple Listing Service within the past 30 days.