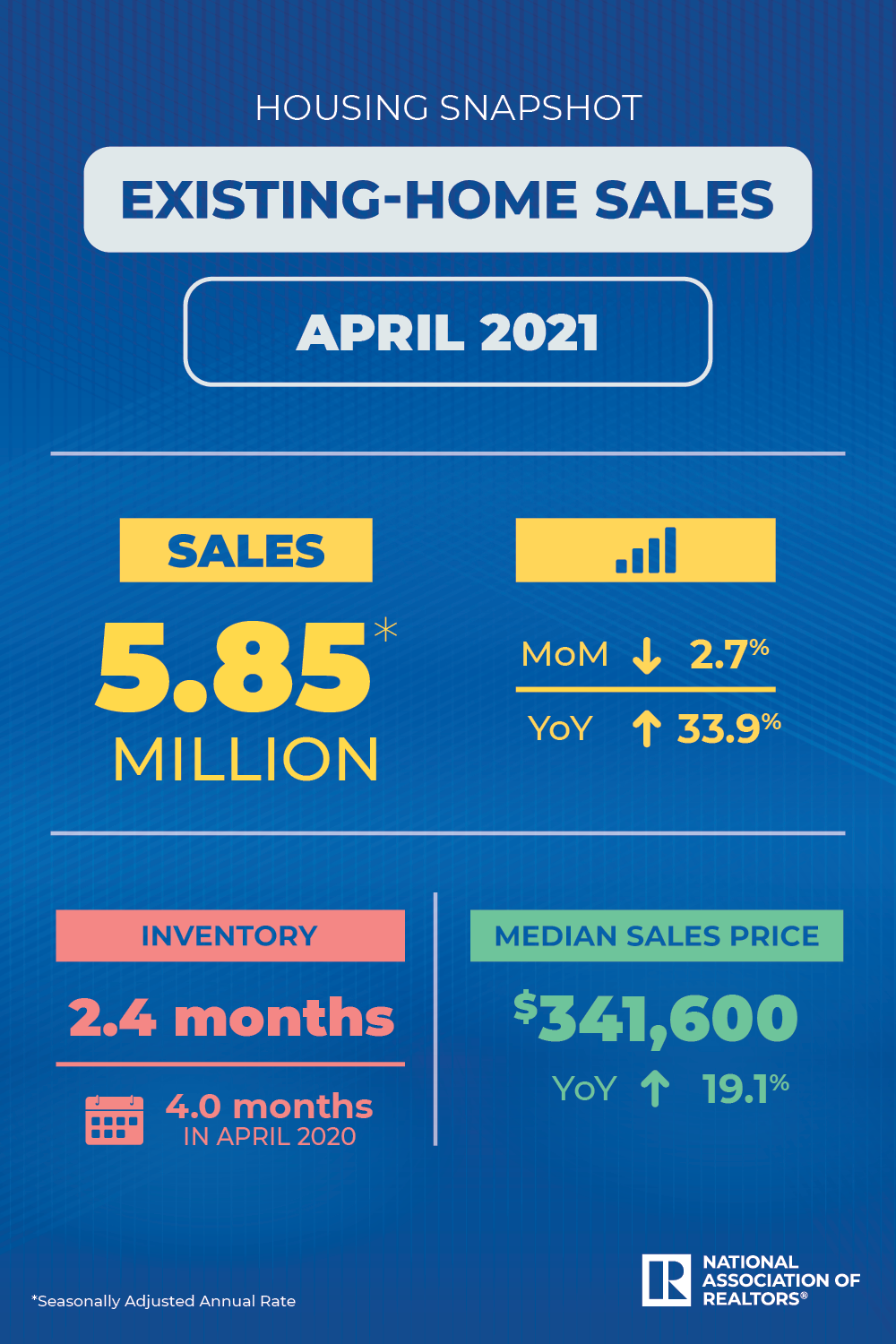

Existing-home sales slid for the third month in a row in April, declining 2.7% from March to a seasonally adjusted annual rate of 5.85 million, according to the National Association of Realtors.

Existing-home sales slid for the third month in a row in April, declining 2.7% from March to a seasonally adjusted annual rate of 5.85 million, according to the National Association of Realtors.

Year over year, sales were up 33.9% from the 4.37 million annual rate registered in April 2020.

“Housing supply continues to fall short of demand,” NAR chief economist Lawrence Yun said in a press release. “We’ll see more inventory come to the market later this year as further COVID-19 vaccinations are administered and potential home sellers become more comfortable listing and showing their homes. The falling number of homeowners in mortgage forbearance will also bring about more inventory.”

The short supply continued to drive increases in the price of homes, with the median existing-home price for all housing types rising 19.1% year over year to $341,600. Every region saw increases, and April’s price represents a record high and marks 110 consecutive months of year-over-year gains.

Total housing inventory at the end of April amounted to 1.16 million units, up 10.5% from March but down 20.5% from a year ago.

Unsold inventory rose to a 2.4-month supply from March’s 2.1-month supply. A year ago, inventory was at 4 months supply.

The pace of sales remained brisk, with properties on the market for 17 days in April, compared to 18 days in March and 27 days in April 2020.

The tight market continued to put the squeeze on first-time buyers, who were responsible for 31% of sales in April, compared to 32% in March and 36% in April 2020.

“First-time buyers in particular are having trouble securing that first home for a multitude of reasons, including not enough affordable properties, competition with cash buyers and properties leaving the market at such a rapid pace,” Yun said.

Mortgage rates continued to remain near rock-bottom, with a 30-year, conventional, fixed-rate mortgage carrying a 3.06% rate in April, down from 3.08% in March, according to Freddie Mac. The rate across all of 2020 was 3.11%.

Looking ahead, Yun expects the 30-year fixed-rate to remain below 3.5% in 2021.