Houston home prices increased 3.1% on an annual basis in May, the third-highest jump among the country’s largest metro areas, according to CoreLogic’s monthly Home Price Insights report.

Nationally, the year-over-year pace of home-price gains slowed for the 12th month in a row, falling to its lowest rate since early 2012, CoreLogic reported. Nevertheless, prices remained in positive territory for the 136th straight month, rising 1.4% annually and 0.9% monthly.

Nevertheless, prices remained in positive territory for the 136th straight month in May, rising 1.4% annually and 0.9% monthly.

Looking ahead, the CoreLogic HPI Forecast predicts home prices will rise by 1% on a month-over-month basis from May to June and increase on a year-over-year basis by 4.5% from May to May 2024.

“After peaking in the spring of 2022, annual home-price deceleration continued in May,” Chief Economist Selma Hepp said in a press release. “Despite slowing year-over-year price growth, the recent momentum in monthly price gains continues in the face of recent mortgage-rate increases. Nevertheless, following a cumulative increase of almost 4% in home prices between February and April of 2023, elevated mortgage rates and high home prices are putting pressure on potential buyers.”

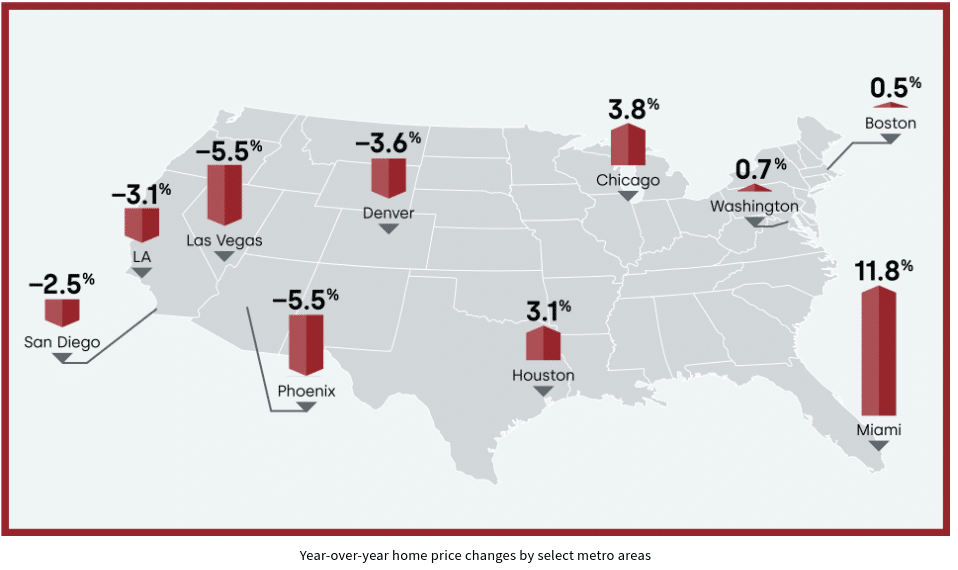

Geographically, the deceleration of home prices was most dramatic in some Western states where people moved to less-urban locations during the pandemic and are now exiting as things return to normal. Conversely, Northeastern states and Southeastern cities continued to see the biggest home-price increases as workers returned to job centers post-pandemic.

Miami posted the highest annual increase among the country’s 20 largest metro areas, at 11.8%, followed by Chicago at 3.8% and Houston at 3.1%.