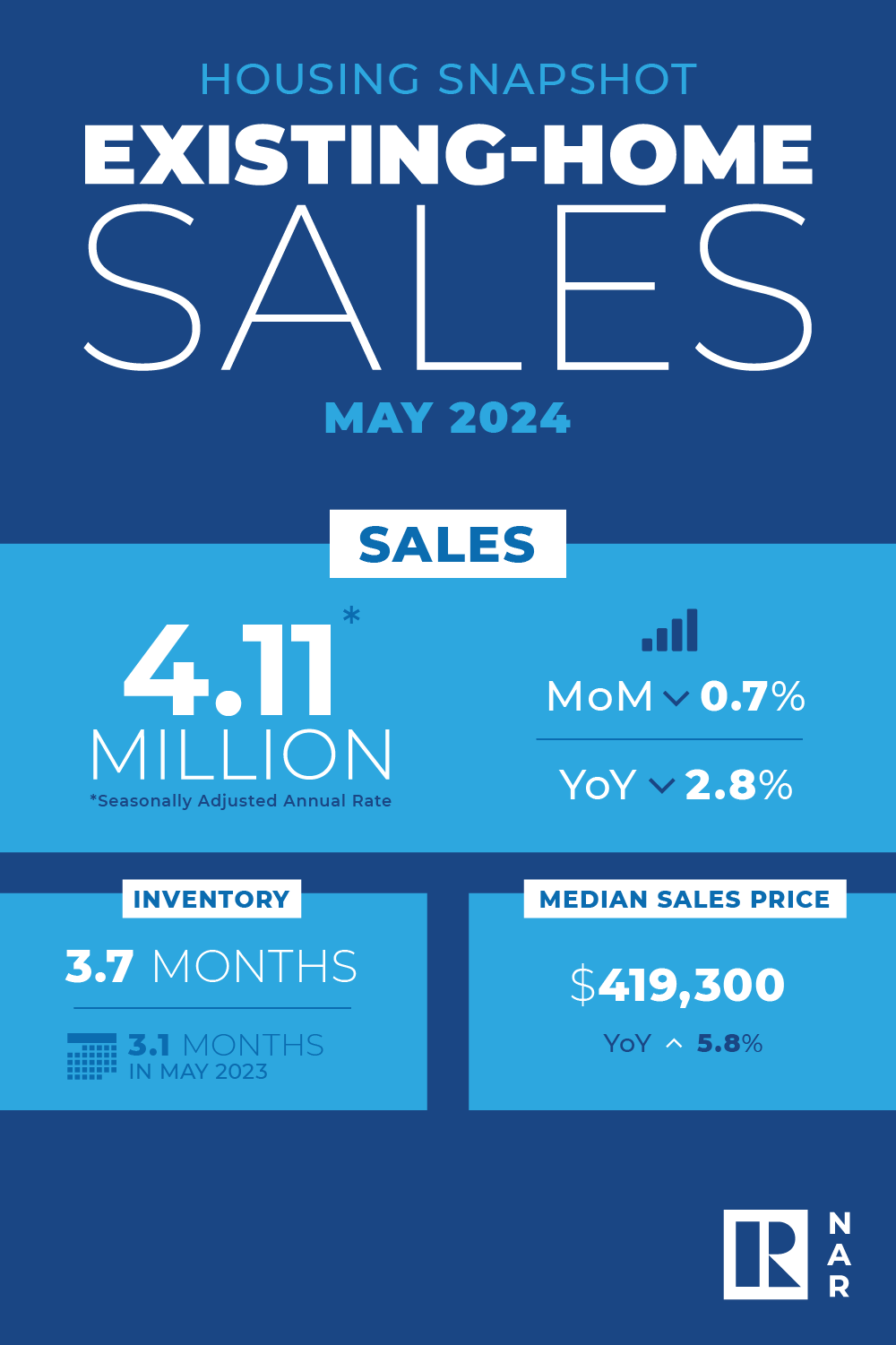

Existing-home sales dipped in May as the median home price hit the highest level on record, the National Association of REALTORS® (NAR) said.

Specifically, sales dipped 0.7% from April to a seasonally adjusted annual rate of 4.11 million. Year-over-year, sales were down 2.8% from 4.23 million in May 2023. The median existing-home price for all housing types in May reached an all-time high of $419,300, up 5.8% from $396,500 a year before.

Specifically, sales dipped 0.7% from April to a seasonally adjusted annual rate of 4.11 million. Year-over-year, sales were down 2.8% from 4.23 million in May 2023. The median existing-home price for all housing types in May reached an all-time high of $419,300, up 5.8% from $396,500 a year before.

The 30-year fixed-rate mortgage averaged 6.87% as of June 20, according to Freddie Mac. That’s down from 6.95% last week but up from 6.67% a year ago.

By property type, single-family home sales in May slid 0.8% month over month to an annual rate of 3.74 million. The median existing single-family home price was $424,500, up 5.7% on a year-over-year basis.

Existing condominium and co-op sales were flat compared to April, at an annual rate of 400,000. The median existing condo price was $371,300, up 5.1% from May 2023.

Coldwell Banker Affiliates President Jason Waugh called the 0.7% decline in home sales “modest” and said it did not come as a surprise.

“This outcome aligns with expectations, reflecting the market conditions and activities observed in April, such as rising interest rates,” he said in an email. “May also marked the third straight month where U.S. home sales have fallen while prices have set another record, underscoring affordability challenges that have plagued the spring selling season.

Total housing inventory at the end of May was 1.28 million units, up 6.7% from April and 18.5% from 1.08 million a year ago. Unsold inventory amounted to a 3.7-month supply at the current sales pace, up from 3.5 months in April and 3.1 months in May 2023.

“More inventory will help boost home sales and tame home price gains in the upcoming months,” NAR Chief Economist Lawrence Yun said in a press release. “Increased housing supply spells good news for consumers who want to see more properties before making purchasing decisions.”

Homes typically remained on the market for 24 days in May, down from 26 days in April and up from 18 days in May 2023.

“What started as a year of recovery offered more of the same for the housing market as we finished the spring home buying season,” CoreLogic Chief Economist Selma Hepp said in a statement. “Home sales disappointed, while mortgage rates remained over 7%. Still, if the Fed makes a move in September, and mortgage rates fall some, the end of the year could be more promising for home sales.”