The U.S. housing market continued its rebalancing act in August, with the pace of home-price growth slowing yet again as regional differences in supply and demand created a more nuanced picture than the national average suggests, Cotality reported.

Home sales, meanwhile, remained at “multi-decade lows” even as price easing and a recent decline in mortgage rates brought overall affordability to its most favorable level since 2022, when rates began to rise.

On average, home prices rose a “meager” 1.3% year over year in August after slowing to 1.4% the month before, Cotality said in its U.S. Home Price Insights report. The national median home price slid to $400,000 from $405,000 in July.

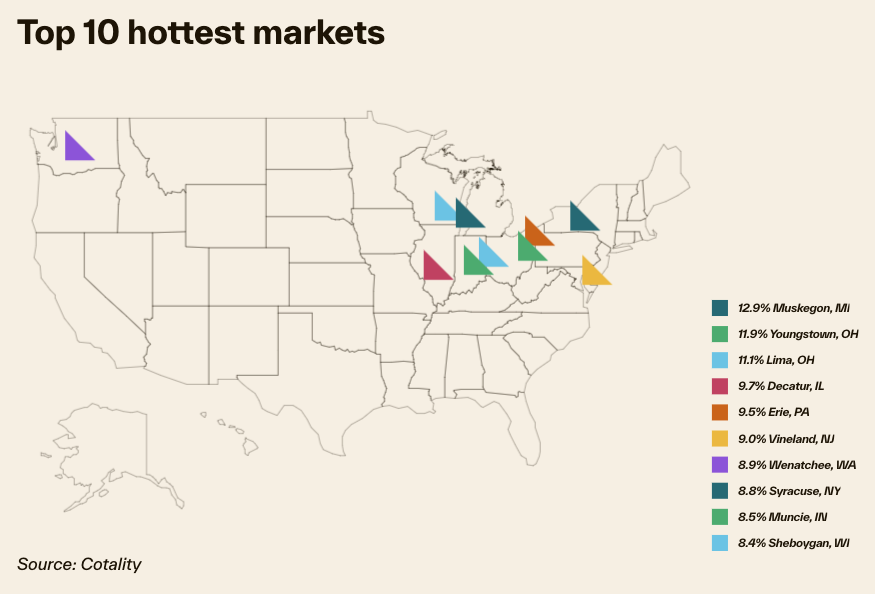

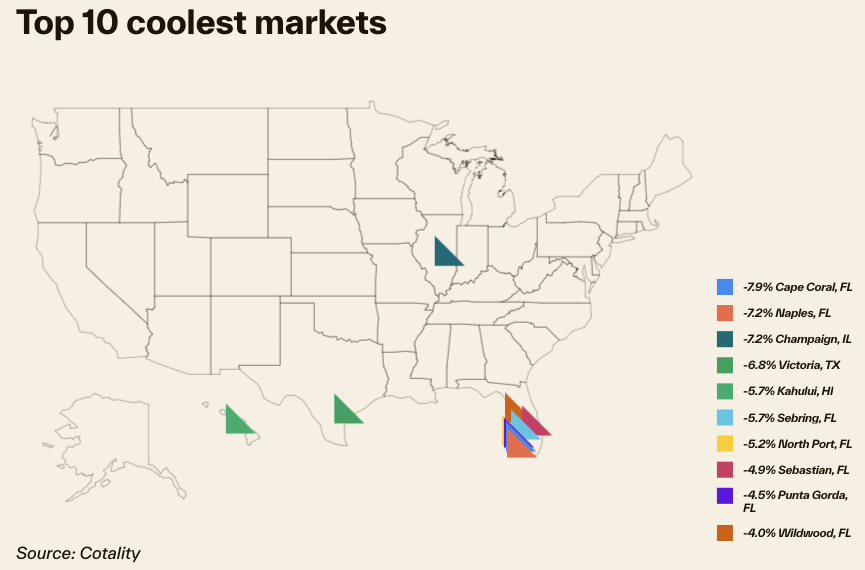

Markets in the Midwest and Northeast that did not see the same level of pandemic-era appreciation as those in the South in the West posted gains in the upper single digits and above, while those with the most post-pandemic growth saw annual declines.

“The housing market remains at a crossroads — where mortgage rates, inventory shifts, local dynamics and policy decisions converge,” Cotality Chief Economist Selma Hepp said in the report. “Whether demand unlocks further or stalls will depend not just on market and economic fundamentals, but perhaps, most crucially, on consumer sentiment, which remains fragile particularly when it comes to job security and financial prospects. Until buyers feel confident in both the market and their own financial footing, many will remain on the sidelines.”

Looking ahead, Cotality expects September to show a 0.1% median-price increase and August 2026 to have a 3.9% increase.

“[R]ecent increases in mortgage application activity indicate that homebuyers are gradually re-entering the market,” Hepp said. “Rising inventories are providing buyers with more choices while price cuts are now more common in certain local markets. This has slowly shifted negotiating power toward buyers — if they can afford to act. But, with some sellers pulling back and further expected decline in mortgage rates, price pressures could resurge.”

“[R]ecent increases in mortgage application activity indicate that homebuyers are gradually re-entering the market,” Hepp said. “Rising inventories are providing buyers with more choices while price cuts are now more common in certain local markets. This has slowly shifted negotiating power towards buyers — if they can afford to act. But, with some sellers pulling back and further expected decline in mortgage rates, price pressures could resurge.”