Courtesy of National Association of REALTORS® 2025 Profile of Home Buyers and Sellers.

First-time homebuyers are becoming older and fewer and further between as much of the U.S. housing inventory remains rate-locked and priced out of reach, according to the latest annual Profile of Home Buyers and Sellers from the National Association of REALTORS®.

At just 21% of all homebuyers, the share of first-time buyers fell to its lowest level since NAR first published the report in 1981, while the median age of first-time buyers hit a record high of 40. Historically, first-time buyers accounted for roughly 40% of all home sales and had a median age of about 30.

“The historically low share of first-time buyers underscores the real-world consequences of a housing market starved for affordable inventory,” said Jessica Lautz, NAR deputy chief economist and vice president of research. “The share of first-time buyers in the market has contracted by 50% since 2007 — right before the Great Recession. The implications for the housing market are staggering. Today’s first-time buyers are building less housing wealth and will likely have fewer moves over a lifetime as a result.”

Courtesy of National Association of REALTORS® 2025 Profile of Home Buyers and Sellers.

Caryn Prall, broker and operating partner of KW Inspire in Chicago, agreed, but said waiting to buy rarely benefits consumers in the long run and, historically speaking, interest rates are still relatively affordable.

“Even in a higher-rate environment, homeowners continue to gain equity at a pace that renters simply can’t match,” she said. “Every year someone delays homeownership, they’re missing out on appreciation and the compounding effect that builds real long-term wealth. Remember, the interest rate for renting is 100%.”

Existing homeowners are loaded with cash

The same high prices that are keeping many would-be first-time buyers out of the market are giving existing homeowners plenty of equity to purchase their next homes. Cash home purchases hit a new high of 26% of all purchases, and the size of down payments is hitting levels not seen in decades.

“One of the bright spots in this market is how much equity homeowners have built,” Prall said. “That appreciation gives repeat buyers the freedom to right-size, relocate, upgrade or buy a vacation home that wasn’t possible 10 years ago.”

Meanwhile, the rate-lock effect that’s kept existing homeowners with low mortgage rates from selling has driven the median age of home sellers to 64 — another record high — and people are now owning their homes for a median of 11 years before selling — the longest ownership period in the report’s history.

“Unfolding in the housing market is a tale of two cities,” Lautz said. “We’re seeing buyers with significant housing equity making larger down payments and all-cash offers, while first-time buyers continue to struggle to enter the market.”

Courtesy of National Association of REALTORS® 2025 Profile of Home Buyers and Sellers.

What buyers want in a home

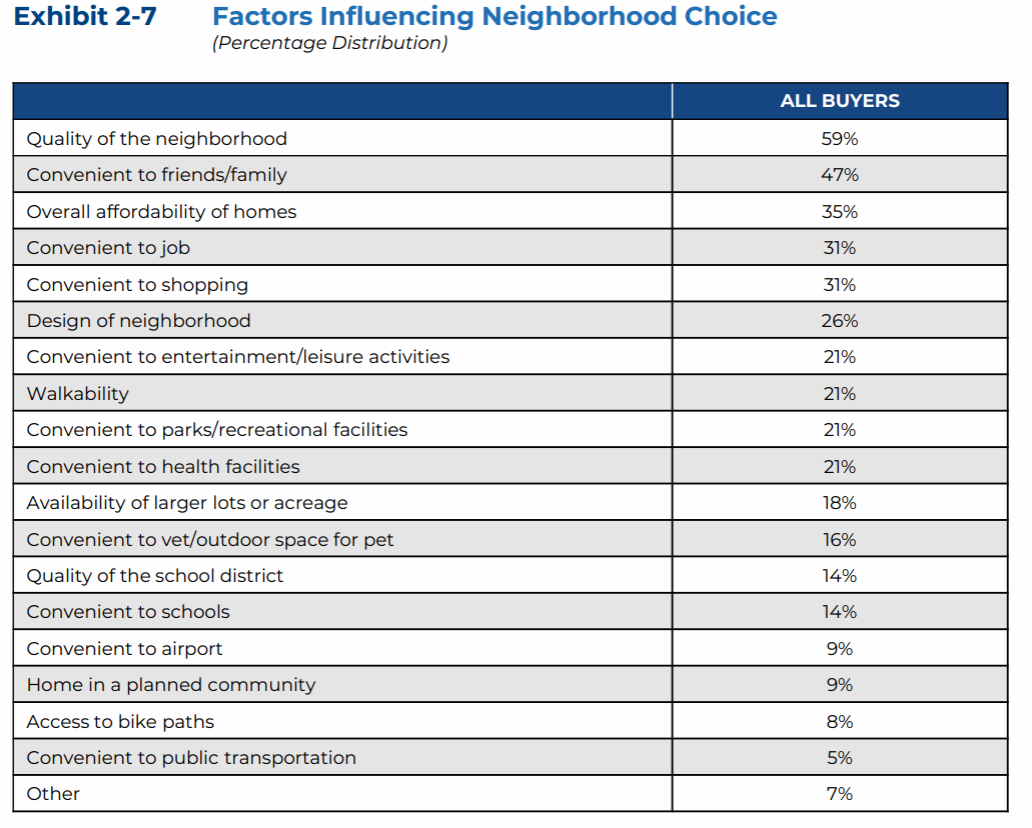

The reasons for picking a particular home are shifting, too. Distance to one’s job has continued to decline as the primary factor behind a purchase — from 52% in 2014 to 31% now — as neighborhood quality (59%) and proximity to friends and family (47%) have increased as key drivers.

“The move-up buyers and ‘move closer’ generations are driving today’s market,” said Steve Rettig, eXp Realty’s designated managing broker for Illinois. “People now want to be closer to friends and family. Buyers are prioritizing the quality of areas and proximity to lifestyle rather than convenient commuting.”

The share of new homes purchased reached a 19-year high of 16%, while previously owned homes fell to 84% — a level not seen since 2006. Most new-home buyers (43%) said avoiding renovations or maintenance problems was the main reason for their decision, followed by the ability to customize (22%), community amenities (17%) and lack of inventory (10%).

The value of an agent

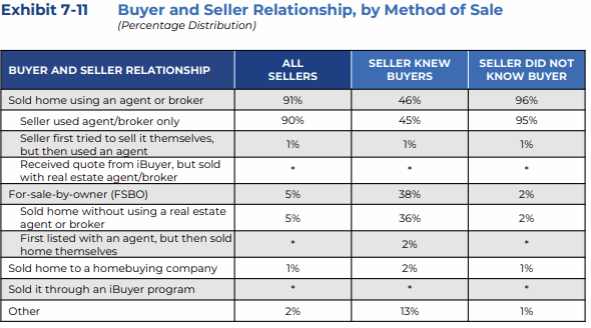

Despite the evolving market dynamics, the role of a real estate agent in the home buying or selling process remains central. According to the survey, which was conducted between July 2024 and June 2025, 88% of buyers used an agent or broker in their purchase, while 91% of sellers — which matches a previous high — used an agent to help sell their property. Only 5% of homeowners — a record low — completed for sale by owner transactions.

Courtesy of National Association of REALTORS® 2025 Profile of Home Buyers and Sellers.

“Sellers are seeking leadership,” Prall said. “Selling is a complex emotional and financial process, which is difficult to navigate. Sellers are not just paying for the service — the numbers show they are earning more on average. Homes sold via agents routinely fetch higher prices, which often more than offsets the commission cost. In other words, the cost of not using an agent shows up in lower proceeds.”

An agent’s reputation is key to securing clients, the survey found. Sixty-six percent of sellers used an agent who was referred to them or had helped them in the past, and the agent’s reputation was the most important factor influencing a seller’s decision to hire them, at 35%. For buyers, 58% picked their agent based on reputation or previous experience with them.

When it comes to what buyers want most from their agents, help finding the right property to purchase topped the list, at 50%, followed distantly by help negotiating the terms of sale (13%), help with price negotiations (12%) and help with paperwork (7%).

Sellers, on the other hand, most wanted their agents to help them market their home (23%), followed by help pricing their home competitively (19%), help selling their home within a specific timeframe (19%), help finding ways to fix up the home to sell it for maximum profit (13%) and help finding a buyer (12%).

“In today’s world of AI and applications, it is easy to think that selling real estate can be automated or that agents can be replaced,” RE/MAX Premier Broker Mike Opyd said. “But real estate is a very personal purchase — not to mention a huge financial commitment — and most people are not willing to spend hundreds of thousands of dollars with the tap of an application. The role of an agent is vital to helping people understand what they are purchasing before they decide to commit.”