Current Market Data

The median price of a new home sold during the month fell to $418,800 from $433,100 in August, the U.S. Census Bureau and the U.S. Department of Housing and Urban Development reported.

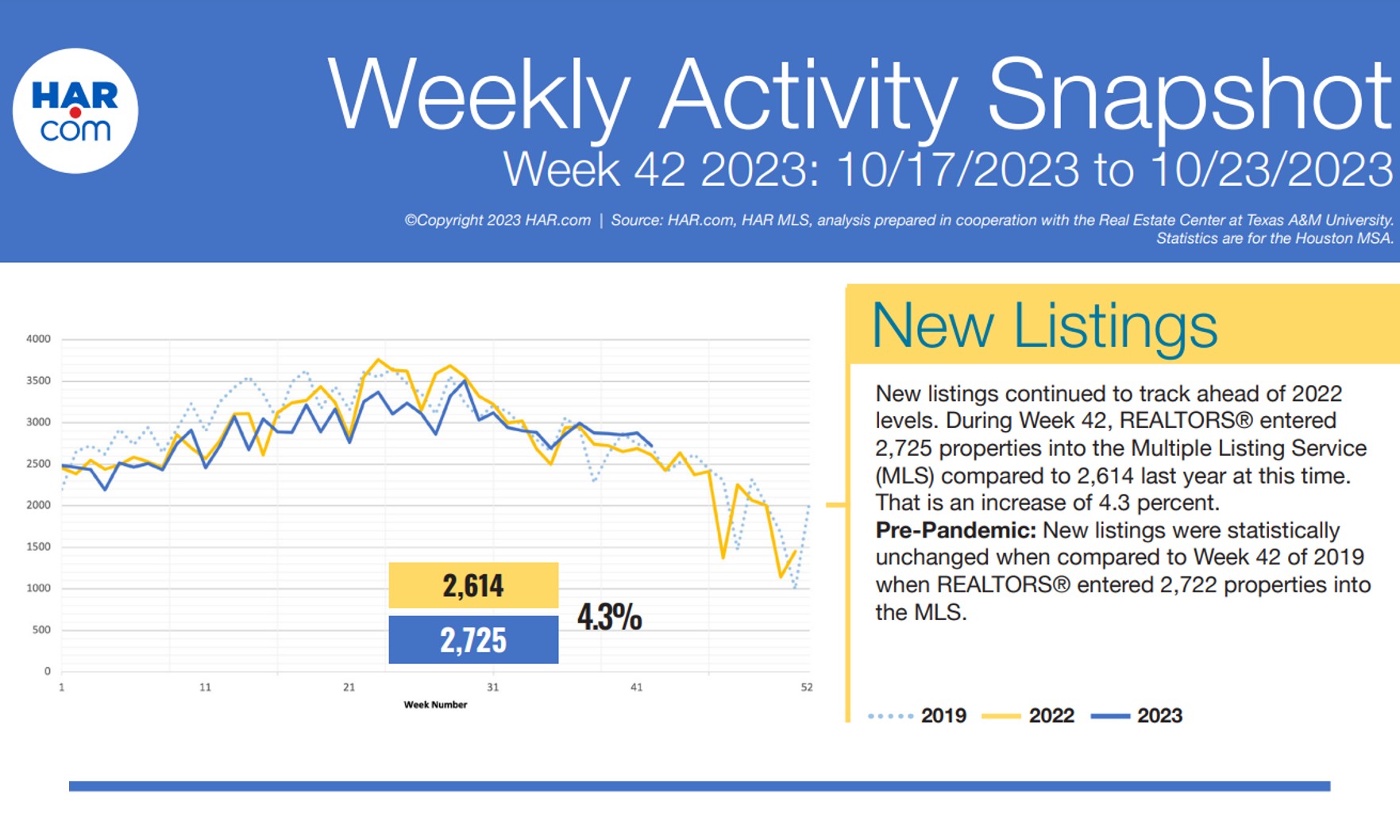

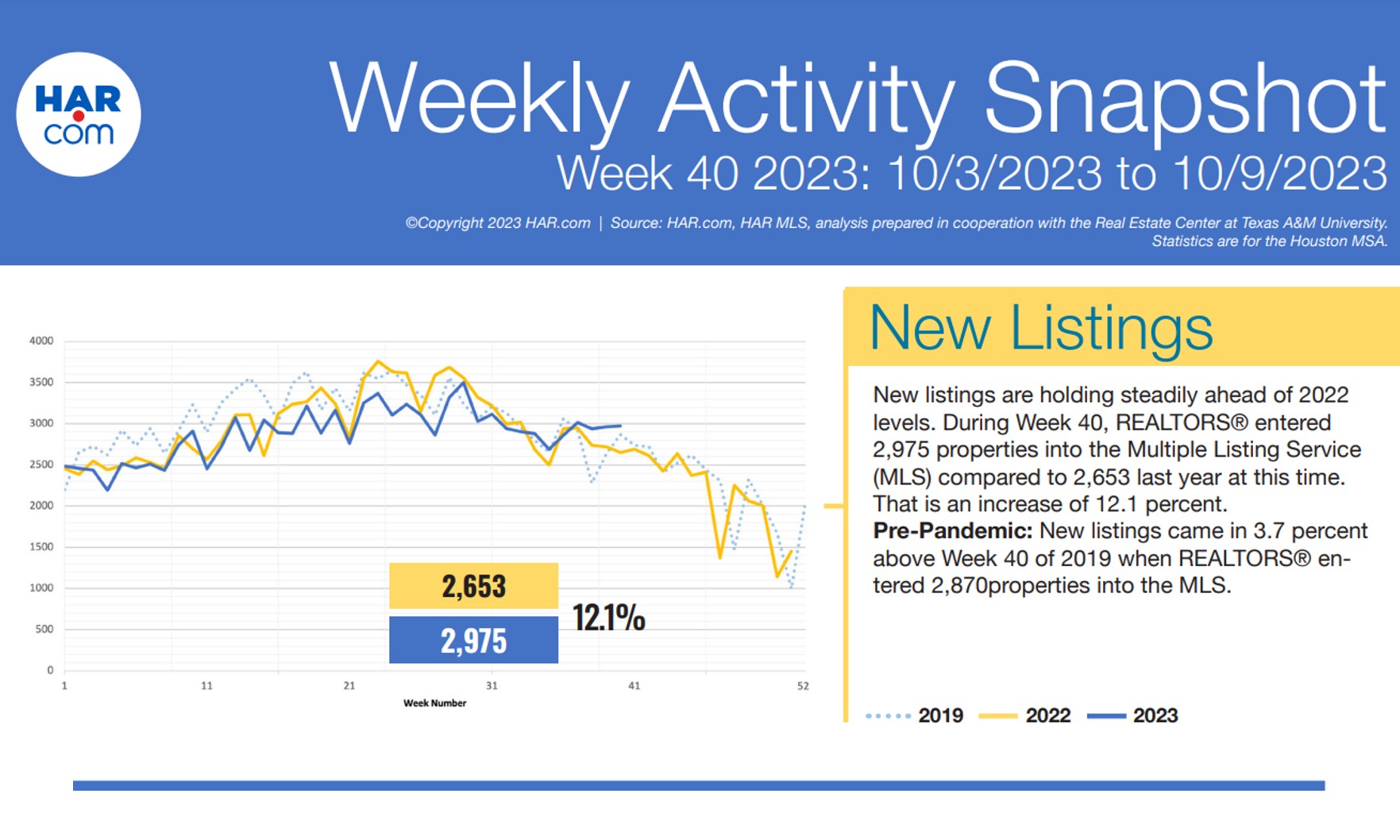

New listings continue to rise above 2022 levels in Houston, according to the Weekly Activity Snapshot from HAR.

Across the Lone Star State, closings were down 9.8% year over year, while the median price dropped 1.5% to $340,000.

Texas new-home sales declined in September — but according to HomesUSA CEO Ben Caballero, that’s just a product of market seasonality.

However, the average home sold in 38 days — a day faster than last year.

The median existing-home price for all housing types in September was $394,300, up 2.8% from $383,500 in September 2022.

New listings jumped 9.4% during the week, with 2,943 properties entered into the MLS compared to 2,691 the year prior.

Houston single-family rental demand remained strong in September as high mortgage rates continued icing out potential buyers.

Specifically, single-family homes were built at a seasonally adjusted annual rate of 963,000, up 3.2% from 933,000 in August and up 8.6% from 887,000 a year earlier, according to government figures.

Brutalist style and sensory gardens may seem at odds — but they are both hot home design trends that will rule 2024. At least, according to new predictions from Zillow.

COMPASS agent Laura Sweeney tops the list of the most expensive Houston home sales yet again, this time representing both the buyer and the seller on a $14.5 million transaction in River Oaks.

Realtors entered 2,975 properties into the MLS, up from 2,653 properties during the same time period last year.

Amid sky-high mortgage rates, single-family home sales fell 10.9% year over year, allowing inventory to climb to a 3.5-month supply.

A 15% rise in applications for adjustable-rate mortgages drove overall mortgage applications higher in the most recent weekly survey.

New home listings are still on the rise, despite mortgage rates hitting the highest level in more than 20 years. And those high mortgage rates are pushing monthly housing payments higher than they’ve ever been.

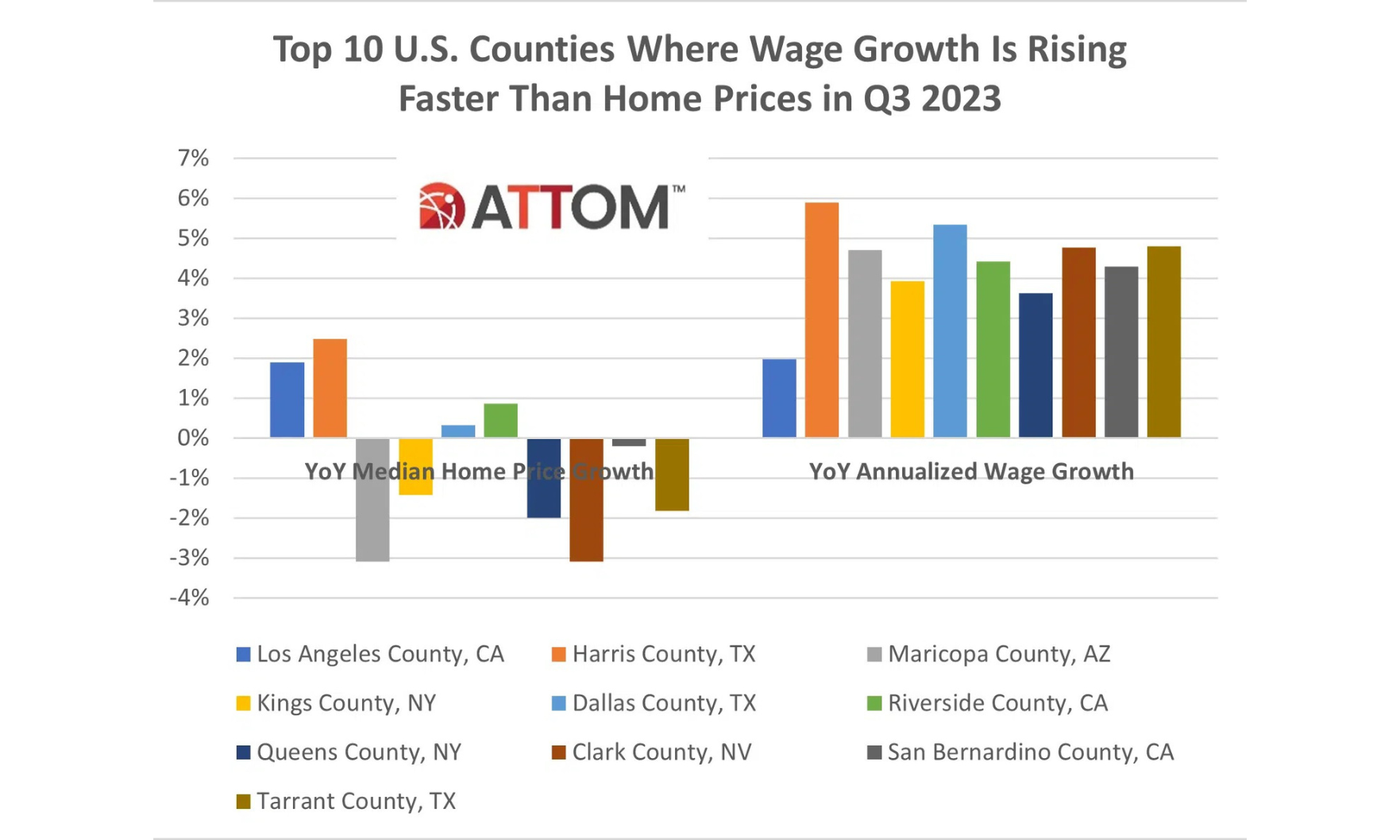

Housing affordability has worsened in many parts of the country as wages fail to grow at the same pace as home prices — but Harris County is one area where wage increases are outpacing price increases.