Current Market Data

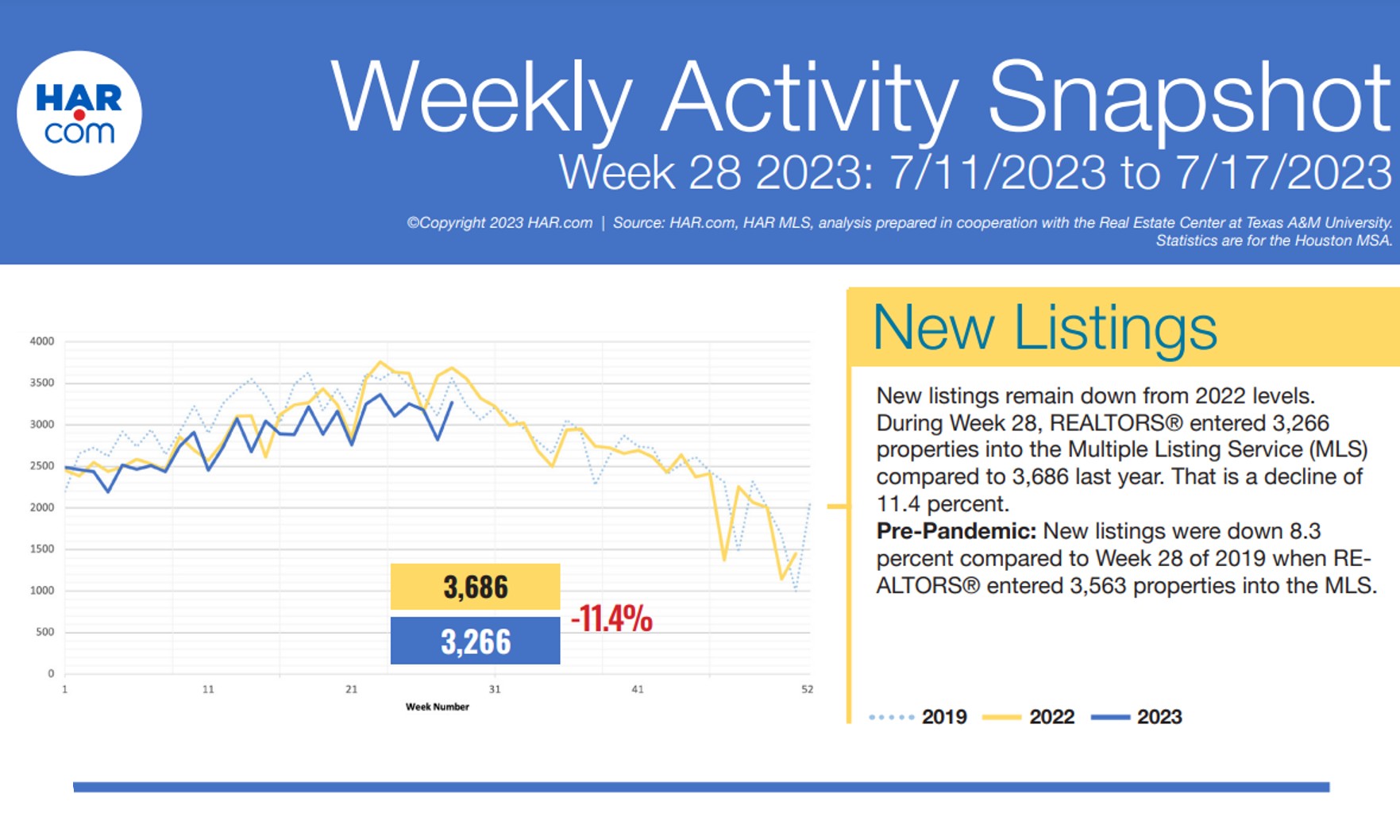

New listings are down again in Houston, according to the Houston Association of REALTORS® Weekly Activity Snapshot for the week ended July 17.

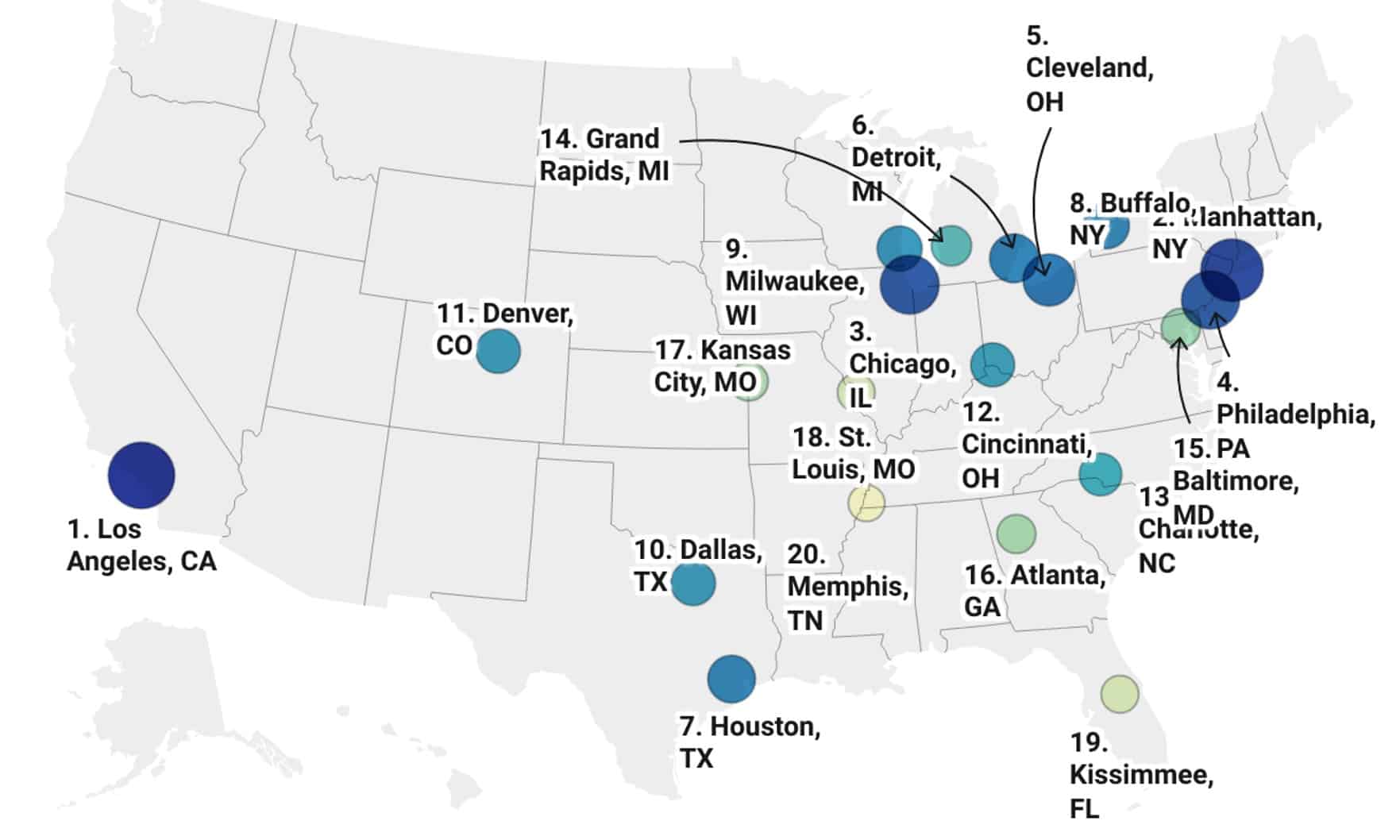

When it comes to repurposing old buildings into residential communities, Houston is poised to become one of the top cities in the country.

As closings decreased across the Lone Star State, the average home spent 87 days on the market during the second quarter, up 20 days year over year.

The median existing-home price for all housing types in June rose to $410,200, 0.9% less than the all-time high of $413,800 reached in June 2022, the National Association of REALTORS® said.

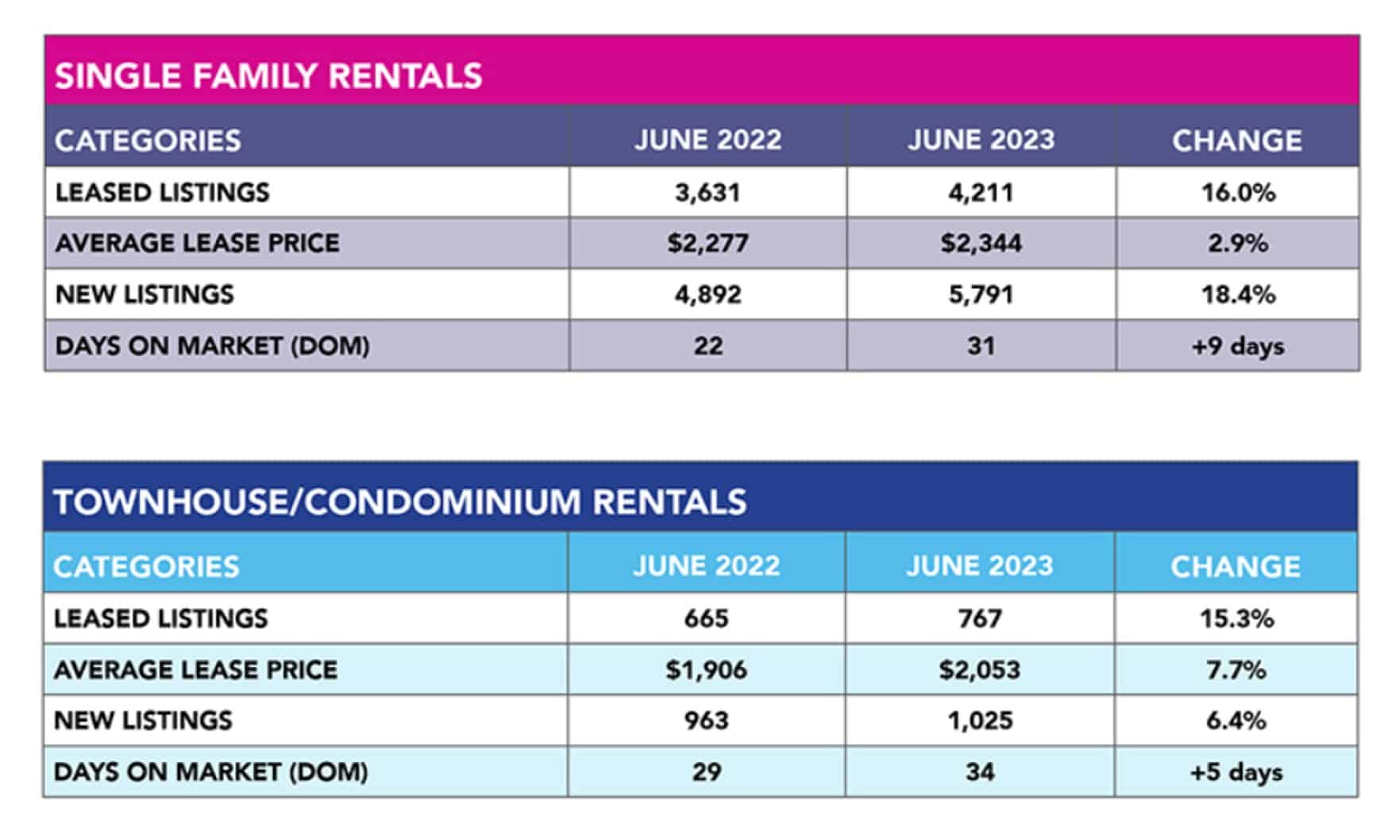

Leases of single-family rental homes increased by 16% year over year, with the average lease price inching up 2.9% to $2,344.

Back in 2018, Freddie Mac stated that the country still needed about 2.5 million extra homes in order to meet demand. Then the pandemic homebuying boom depleted already-low inventory levels and high mortgage rates in the second half of 2022 chained many homeowners to their existing low rates.

Low inventory and high demand are buoying builder sentiment in the face of several headwinds.

The drop in the pace of new-home construction follows a significant surge the month before, according to government statistics.

For the first time in nearly a year, the average home sold above list price, fueling bidding wars in some markets.

Closings are also down by 18.6% year over year, with 1,717 homes sold during the week versus 2,110 a year ago.

As more owners continue to hang onto their houses, home values locally and across the nation have reached a new peak, but it comes at a cost.

According to HAR’s June 2023 Market Update, single-family home sales were down 12.8% year over year but up 3.9% from June 2019 (pre-pandemic).

The typical apartment is leased in 43 days in Houston — a year ago, apartments were leased within 38 days.

Despite the declining rate of increase, home prices have risen for the last 136 months, CoreLogic said.

It takes the average Houstonian eight years to save up for a 10% down payment on a home, according to a recent Axios analysis.

New listings and pending listings have surpassed 2022 volumes for the first time in weeks, according to HAR.