Current Market Data

“Investors are weighing the impacts of rapidly increasing inflation in the U.S. and many other parts of the world against the potential for a slowdown in economic growth due to a renewed bout of supply-chain constraints.” — MBA associate vice president of economic and industry forecasting Joel Kan

Of the homes that went under contract during the four weeks ended March 6, 58% had an accepted offer within the first two weeks of going on the market, and 45% had an accepted offer within just one week, Redfin reported.

Foreign buyers accounted for less than 2% of U.S. residential real estate transactions last year, and Russian buyers accounted for less than 1% of those, the National Association of REALTORS® reported.

“Looking ahead, the potential for higher inflation amidst disruptions in oil and other commodity flows will likely lead to a period of volatility in rates.” — MBA associate vice president of economic and industry forecasting Joel Kan

Despite the slight uptick in new listings from last week, Houston’s numbers during the first week of March remained statistically flat compared to the same week in 2021.

According to the Houston Association of REALTORS® February 2022 Market Update, single-family home sales totaled 7,372 last month, a 22.9% jump from the previous year.

Currently, median rents in Houston stand at $1,012 for a one-bedroom apartment and $1,204 for a two-bedroom. Houston’s median two-bedroom rent is below the national average of $1,294, an Apartment List report noted.

The average list price (ALP) for a Houston home rose to an all-time high in February, supporting ongoing concerns about housing affordability in 2022, the Houston Association of REALTORS® (HAR) reported this week.

Homeowner tenure has flattened since its 2020 peak.

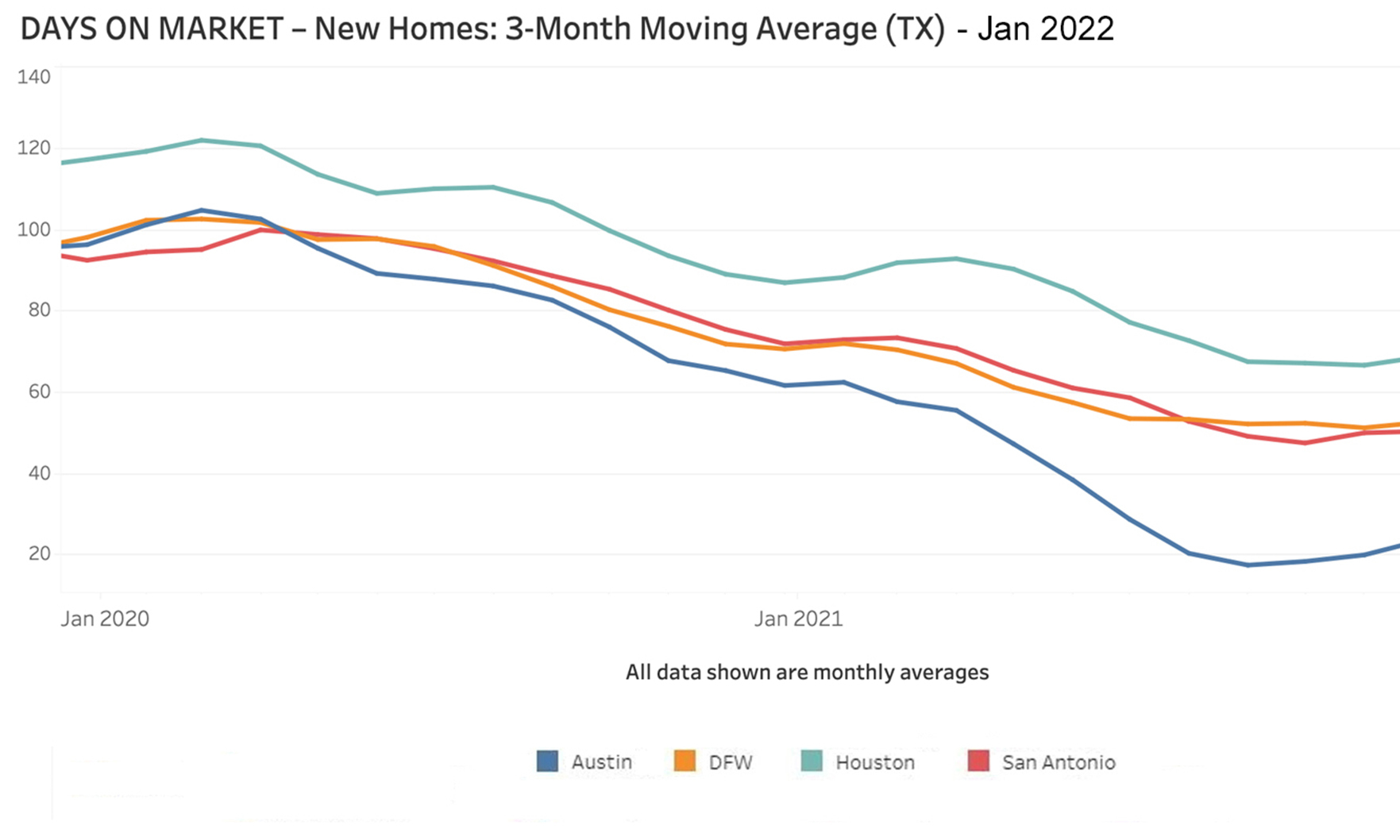

Despite inventory challenges, the market for new homes in Houston is showing signs of improvement. A new report from HomesUSA.com revealed that new homes are staying on the market longer and prices and sales are stabilizing.

Demand has been trending up since the beginning of the pandemic.

Houston’s new home listings began to level out during the week ended Feb. 28, following skewed readings resulting from the mid-February winter freeze in 2021.

The pace of new home listings is gaining steam, a welcome development in the face of high demand from buyers, Redfin reported.

Buyers faced bidding wars as more rushed to purchase a home before mortgage rates jumped again.

“Given the situation in the market — mortgages, home costs and inventory — it would not be surprising to see a retreat in housing demand.” — NAR chief economist Lawrence Yun

The Houston area had more than 392,000 single-family home building permits from January 2012 to December 2021, the report said.