By the Numbers

The National Association of Home Builders’ monthly survey found continued pessimism among the nation’s homebuilders at the end of a tough year.

Greater Houston’s priciest home sale in November was a $15.995 million estate in the River Oaks neighborhood.

Geographically, trends varied widely, with formerly hot areas like Florida and the Southeast posting the deepest declines and formerly cool areas, like the Midwest, showing healthy gains.

Dallas-area homes top the November ranking of the 10 most expensive new listings in Texas, claiming the three most expensive spots.

By region, sales rose in the Midwest, Northeast and South but fell in the West.

The typical asking rent for an average rental unit reached $1,646. Though that’s a 0.2% increase from last year, the median household income outpaced this acceleration, growing 3.9% during the same time frame.

Agents from Compass RE Texas had a hand in nine transaction sides for October’s ranking of the 10 most expensive homes sold in greater Houston. That includes Laura Sweeney, who worked as the buyer’s agent on the priciest sale of the month.

The chief economist for the National Association of REALTORS® also predicts home prices will climb 4% compared to 2025.

Houston households need a minimum of $2,510 to afford their monthly housing costs, including principal, taxes and insurance. That’s down from $2,550 during the third quarter of 2024.

Nationwide, the median price for a single-family home increased 1.7% year over year to $426,800. Prices increased by the same annual rate during the second quarter.

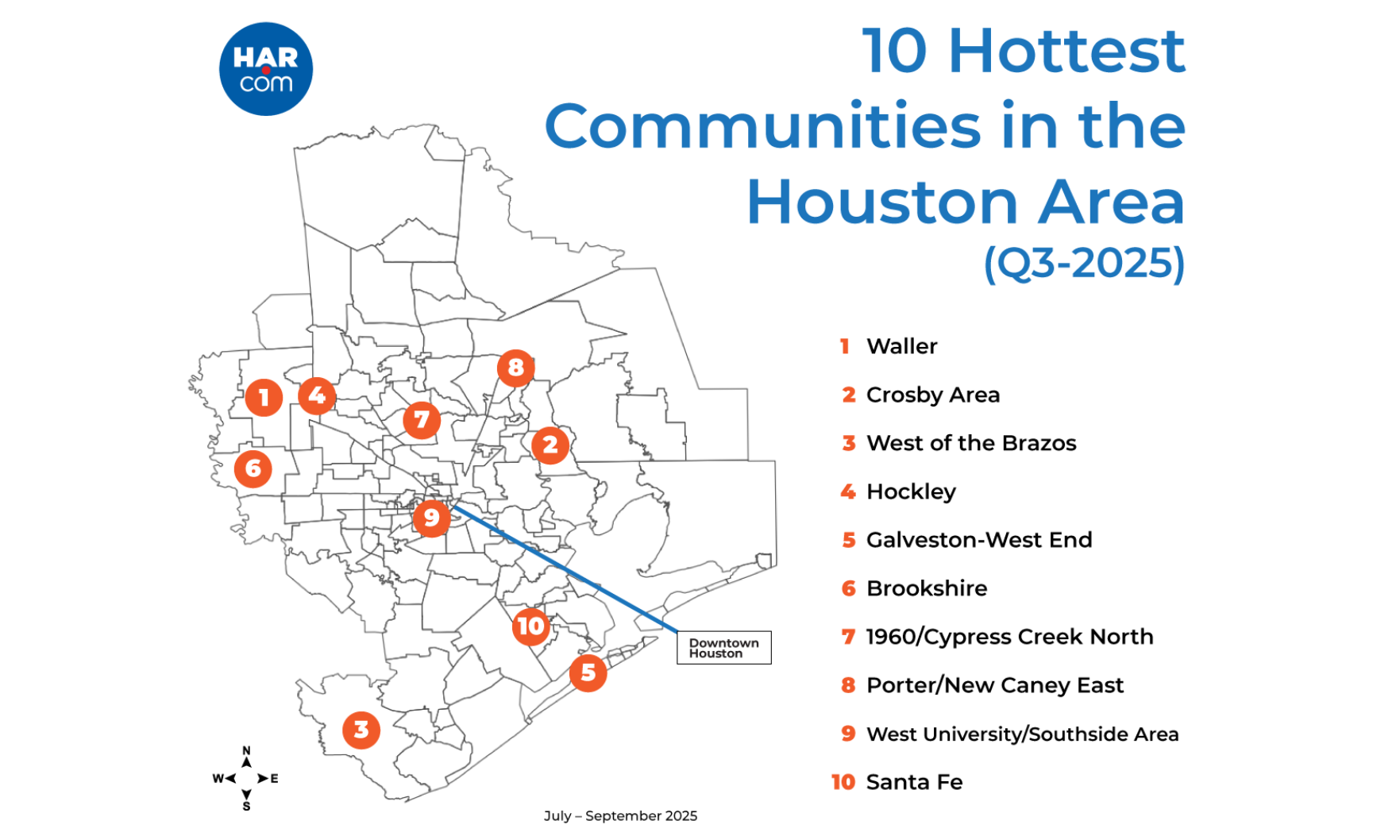

Waller’s average home price of $335,255 was down 13% annually and was well below the area average of $421,655, HAR said.

Given the rate of sales, the nation had a 4.6-month housing supply, up from 4.2 months a year prior.

Nationally, home sales in the 52 metro areas surveyed by RE/MAX increased 8.5% year over year for the fourth time in 2025, but declined 4.6% month over month.

Agents from Compass RE Texas were responsible for listing six — and selling four — of the 10 most expensive homes sold in greater Houston last month.

The pace of home sales, meanwhile, remained at “multi-decade lows” even as affordability reached its most favorable level since 2022.

The priciest new listing in Texas this past month is a $22 million estate that spans 14,341 square feet — that’s over $1,500 per square foot.