Trends

For data-driven stories, to appear under “Trends” menu

Brutalist style and sensory gardens may seem at odds — but they are both hot home design trends that will rule 2024. At least, according to new predictions from Zillow.

COMPASS agent Laura Sweeney tops the list of the most expensive Houston home sales yet again, this time representing both the buyer and the seller on a $14.5 million transaction in River Oaks.

A 15% rise in applications for adjustable-rate mortgages drove overall mortgage applications higher in the most recent weekly survey.

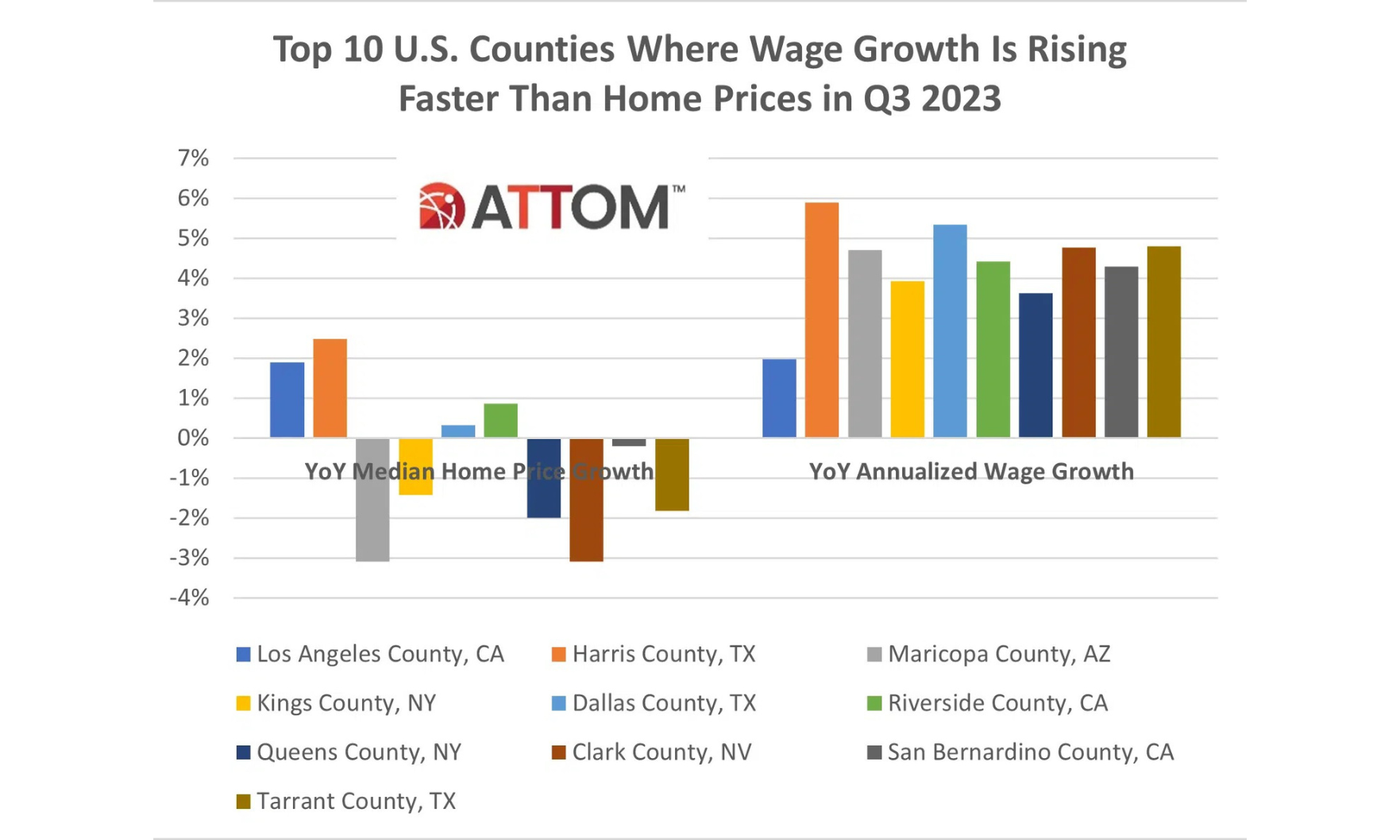

Housing affordability has worsened in many parts of the country as wages fail to grow at the same pace as home prices — but Harris County is one area where wage increases are outpacing price increases.

Here are the priciest new listings for sale in The Lone Star State, all posted to the Multiple Listing Service within the past 30 days.

Point2Homes analyzed listings in every U.S. state and Washington, D.C. to determine the most expensive home for sale in each.

Regionally, pending sales were down across the board on both a monthly and an annual basis, the National Association of REALTORS® said.

Among the top upgrades: large showers.

Total housing inventory at the end of August was 1.11 million units, up 3.7% from July but down 14.6% on a year-over-year basis, the National Association of REALTORS® said.

The most expensive Houston home sales last month ranged from a $12.5 million mansion in River Oaks to a $3.4 million property known as “The House of Many Palms.”

The Houston-area city of Bellaire is one of the most family-friendly cities in the U.S., according to Opendoor’s second-annual ranking.

Sidelined homebuyers can breathe a sigh of relief. According to Realtor.com, the best week of the year to buy a home is still ahead of us.

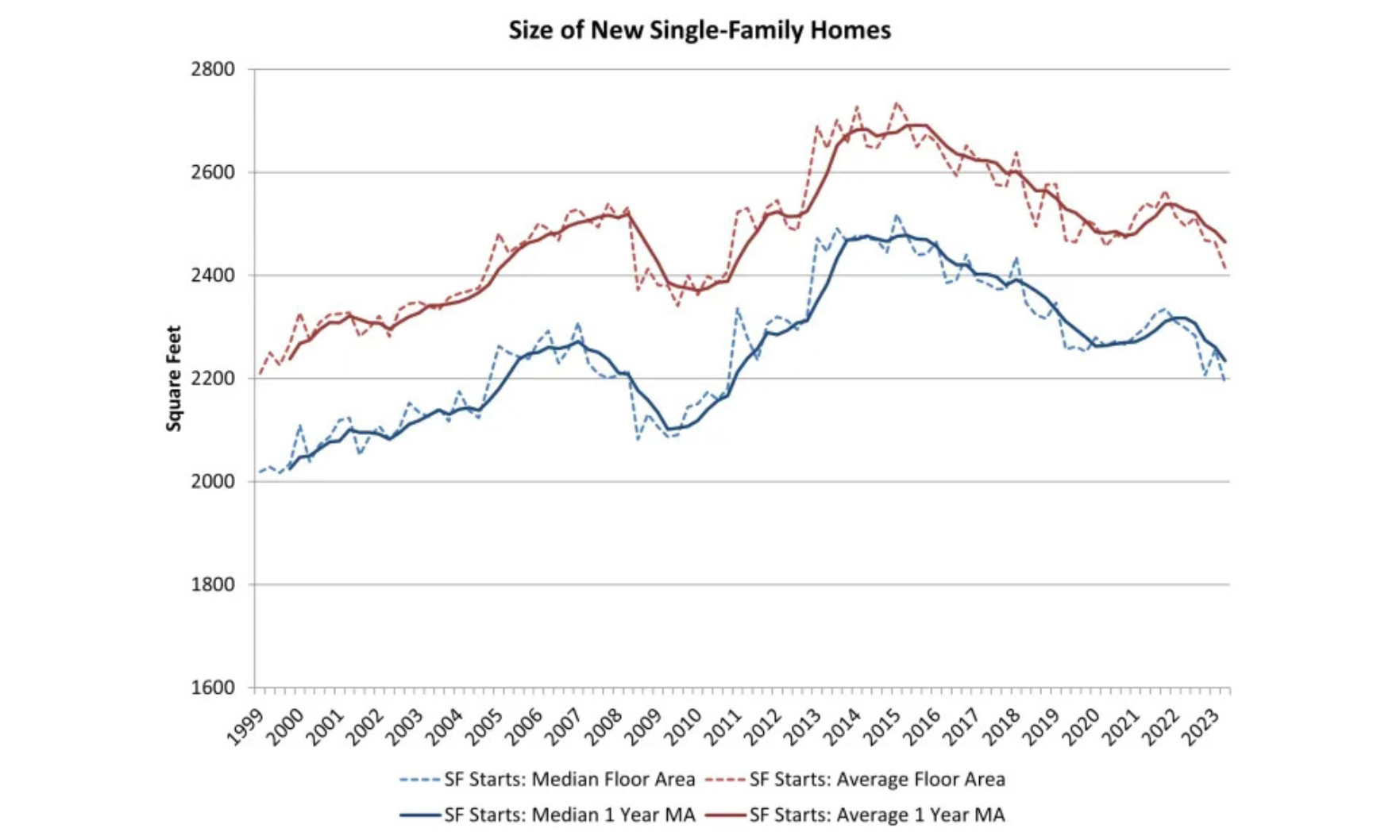

The median area for a new single-family home fell to 2,191 square feet in the second quarter — the lowest recorded size since 2010.

CoreLogic expects prices to continue to grow through next year, albeit at a more traditional pace than in the height of the pandemic.

Those looking to buy a house will be paying a premium as inventory continues to be an issue.

Eighteen percent of millennials — approximately one in five — believe they will never become a homeowner, according to a recent survey from Redfin.