Lending

The move was expected, but came amid increasing dissention among Fed officials, who voted for the cut by the sharpest division in six years.

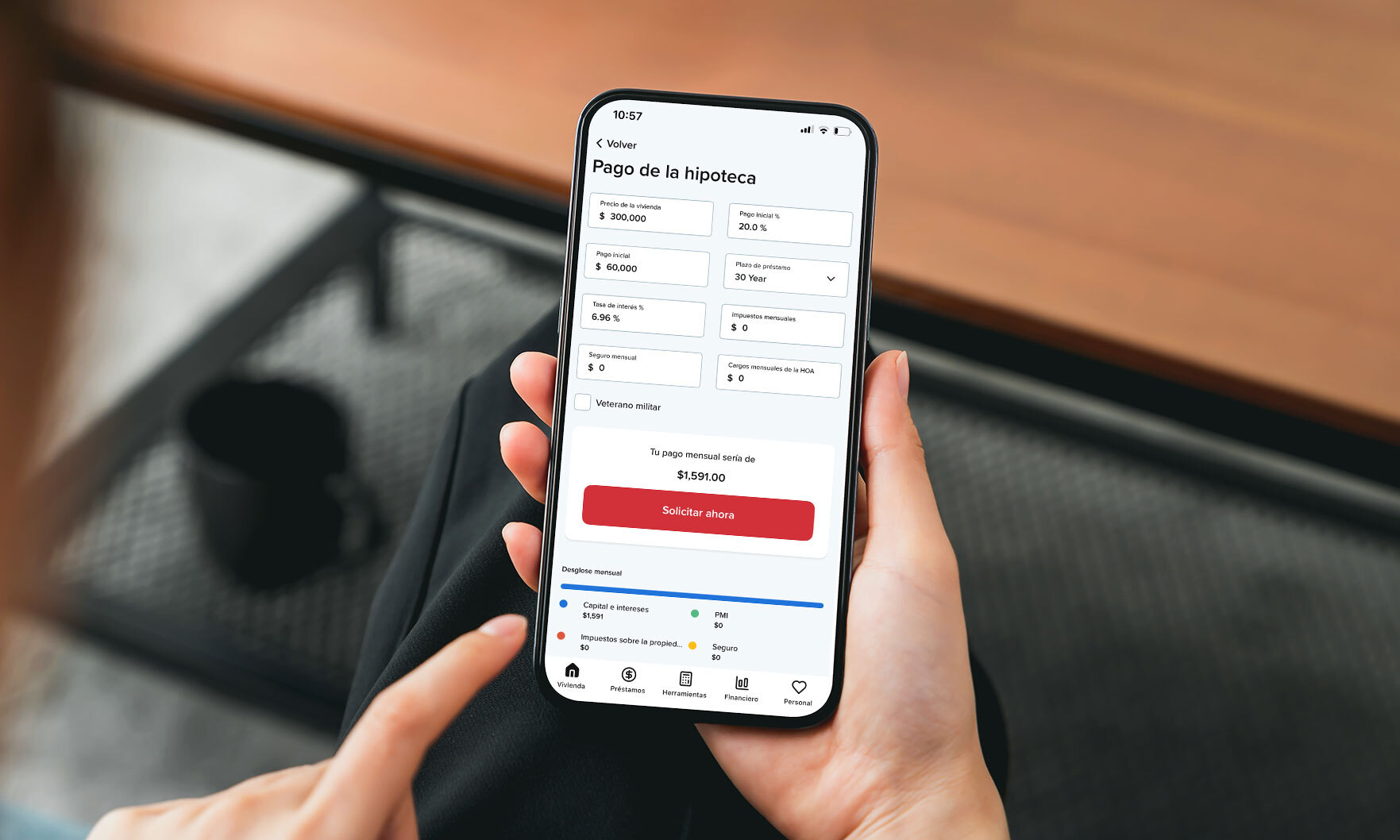

As part of the relaunch, Rate announced the results of a study it conducted, which found almost seven in 10 homebuyers said homeownership keeps them up at night.

Both Aiken and Corbett previously served as executive vice presidents, with Aiken joining the company in 2004 and Corbett joining in 2017.

Fannie Mae also reduced its forecasts for home sales in 2025 and 2026.

Rate has launched the first fully integrated Spanish-language mobile app from a U.S. mortgage lender.

The move was widely anticipated and is expected to be followed by additional cuts this year.

The jump in mortgage activity was driven in large part by refinancings, which surged 58% in the week ended Sept. 12.

The surge comes as the rate on a 30-year fixed-rate mortgage fell to its lowest level since October 2024.

Despite the decrease in borrowing costs, the Mortgage Bankers Association’s Market Composite Index showed a decrease in mortgage applications in the week ended Aug. 29.

The law helps delinquent VA borrowers and allows them to pay buyer-agent commissions when house shopping.

Known in the industry as the “Mortgage Money Man,” Goodwin has over 35 years of experience and is ranked as one of the top mortgage lenders in the state by Scotsman Guide.

Purchase applications slowed to their lowest level since May as economic worries dampened activity, the Mortgage Bankers Association said.

The FICO alternative is expected to greatly expand the number of eligible borrowers by allowing rent and utility payments to count toward a credit score.

Purchase applications hit their highest level since February 2023.

The Mortgage Bankers Association said the post-Memorial Day increase came despite economic uncertainty and largely static interest rates.

The most recent Weekly Mortgage Applications Survey shows homebuyer activity continued despite the economic uncertainty.