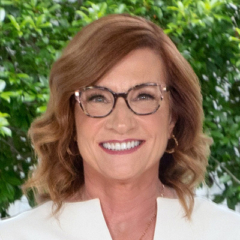

Hannah Kirby, COO

Nikki Huynh, CEO

“Goodbye glass ceiling,” says Hannah Kirby, COO of Tiger Tex Capital. The woman-owned private-equity firm, composed of Kirby and CEO Nikki Huynh, has raised $39 million YTD to fund various debt deals and projects. The team is currently projected to hit $100 million in transactions by the end of the year. Kirby and Huynh are proud of what they have accomplished in a male-dominated space. Kirby explains that underwriting is the key to their success, saying, “A strong underwriting skill set allows us to accurately evaluate factors to protect our clients and investors and mitigate risk.” The team works throughout Texas financing commercial loans for multifamily units, stand-alone buildings, RV parks, land, gas stations and hotels.

Competition doesn’t phase Kirby or Huynh. “Competition happens at the bottom, people at the top are collaborating,” they explain, “Some of our best referrals come from our competitors.” With a combined 25 years of experience in the real estate sector, the Kirby group receives many clients through referrals and the industry networks they’ve developed. The two make a good team. Together they bring a holistic view of the industry and an all-business attitude to their dealings with clients. Kirby explains that their background in both title and lending gives them a unique depth of understanding when helping clients navigate transactions.

Kirby currently sits on the board of Water Works Initiative which provides wells, filtration systems, lifesaving surgeries and medical supplies to vulnerable communities while funding orphanages and homes for the disabled in some of the poorest areas in Southeast Asia. Kirby and Huynh travel to Asia every year to support the cause.

In rare moments of free time, Huynh can be found taking out her stress on the pickleball court with a beer. Kirby is a self-described “cryptocurrency geek” who enjoys managing her own crypto hedge fund.