As usual, many media outlets have been focusing on the screaming headlines on construction, but more important trends simmer below the surface.

By now, you’ve surely seen the screaming headlines – in April, housing starts skyrocketed 13.2 percent from March and 26.4 percent year-over-year to an annual rate of 1.072 million, while building permits rose 8.0 percent monthly and 3.8 percent yearly, according to the latest numbers from the Census Bureau.

Those are mighty big increases, and given how lukewarm the new construction markets have been so far this year, many media outlets have reported on them in rather spectacular terms; of course, there’s more to new construction than a single month’s numbers, so here are the seven key things to keep in mind:

1. This report was more of the same – Something we should be clear about – though April’s numbers were positive, they did not suggest any change to the status quo in construction. As Richard Moody, the chief economist at Regions Financial Corp, said to the Wall Street Journal, “For anyone tempted by these shiny headline numbers to conclude all the recent worry about the state of the housing market was much ado about nothing, we suggest you curb your enthusiasm, at least for now … [the report] shows more of the same.”

2. Multifamily owns new construction right now – So what does “more of the same” mean? Simply, a vibrant multifamily housing sector, which is the real reason that April’s new construction report was so positive. In April, multifamily buildings made up 39 percent of starts, the highest share since 1974; even more impressive, the 413,000 multifamily starts was only the third month since 1990 when starts exceeded 400,000.

3. This year is all multifamily – Beyond April, though, multifamily has been a fixture in 2014. In fact, year to date, multifamily starts are up an impressive 16 percent, so although many analysts have pointed (correctly) to multifamily’s volatile nature, it’s been trending up this entire year.

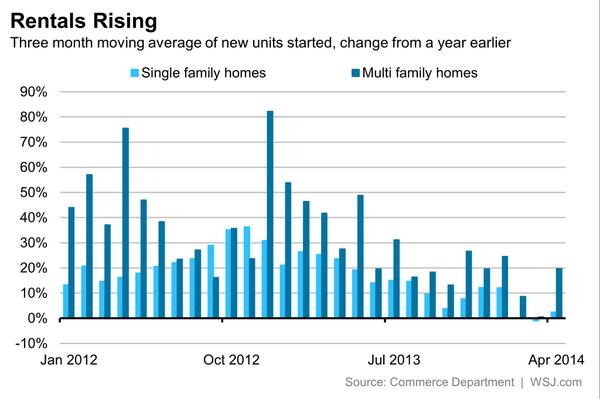

4. The recovery has been all multifamily – Even beyond 2014, multifamily has been driving the construction sector in the post-bubble marketplace. See this graph, from the Wall Street Journal, for a stunning picture of just how radically multifamily has been outpacing single family in recent months:

5. Those multifamily starts, though, are NOT condos – When people think multifamily housing, they’re prone to think of condos, but the vast majority of multifamily housing lately has been for rental units. Just how much does “vast majority” denote, you may wonder? In 2014’s first quarter, 93 percent of multifamily starts were intended for rent, and for buildings with 20-plus units, that number was 89 percent…and that’s compared to 60 percent during the bubble years.

6. This does not mean that housing has changed – As Trulia’s Jed Kolko pointed out, though multifamily is very prevalent right now, that doesn’t mean that housing has completely flipped away from suburbs and towards dense urban areas; rather, it’s more a characteristic of our housing recovery.

7. Single-family construction will return – And on that note, as Bill McBride explained on Calculated Risk, we can expect single-family construction (which remains quite low) to pickup as the economy recovers, and for multifamily starts to move mostly sideways.

Linda….Thought you might be interested. We have several projects we are looking at so If you have some investors you might start talking to them.

Ward/Phillip