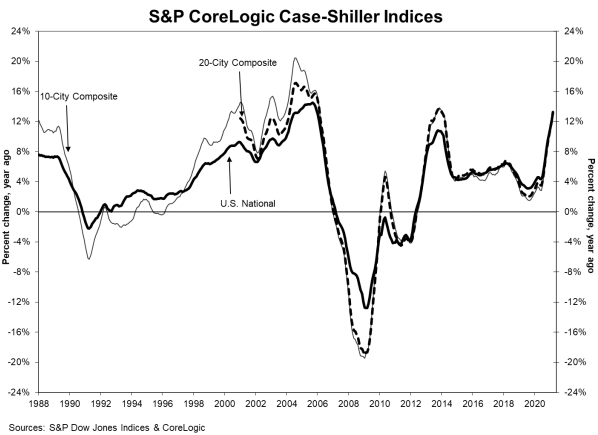

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index shows a 13.2% year-over-year price gain in March.

The pace of housing-price gains nationwide quickened in March, according to the S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, which showed a 2% increase from February and a 13.2% increase from a year earlier, compared to a monthly gain of 1.2% the previous month.

The national year-over-year gain is the highest recorded since December 2005, Craig Lazzara, managing director and global head of index investment strategy at S&P Dow Jones Indexes, said in a press release.

The 10-city composite index rose 2.0% on a monthly basis and 12.8% on a yearly basis, while the 20-city composite rose 2.2% monthly and 13.3% annually.

All 20 cities in the composite index posted gains, and the increases in every city are above that city’s median level, Lazzara said.

“These data are consistent with the hypothesis that COVID has encouraged potential buyers to move from urban apartments to suburban homes,” Lazzara said. “This demand may represent buyers who accelerated purchases that would have happened anyway over the next several years. Alternatively, there may have been a secular change in preferences, leading to a permanent shift in the demand curve for housing. More time and data will be required to analyze this question.”