It’s been a groundbreaking time for new home construction — literally.

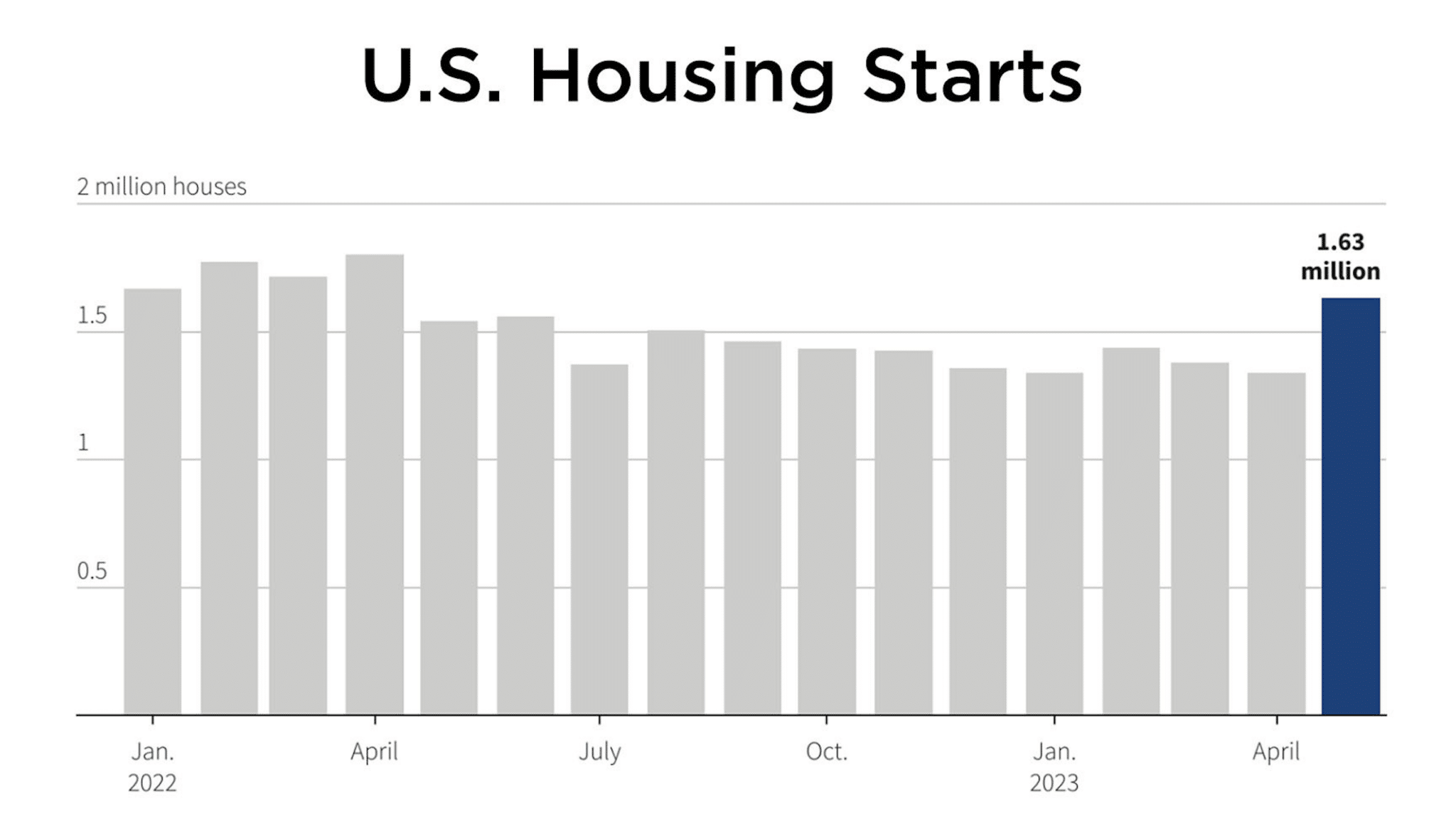

The annual rate of new construction surged to 1.631 million units in May (the most recent data available). That marks a month-over-month bump of 291,000 units, the biggest leap in 33 years, according to Reuters. May’s rate of construction was also the highest since April 2022, which itself was the highest since 2006.

Single-family starts were up 18.5% nationwide while multi-family projects rose 28.1%. Regionally, housing starts rose by double-digit percentages in the South, Midwest and West, though they declined by about 19% in the Northeast.

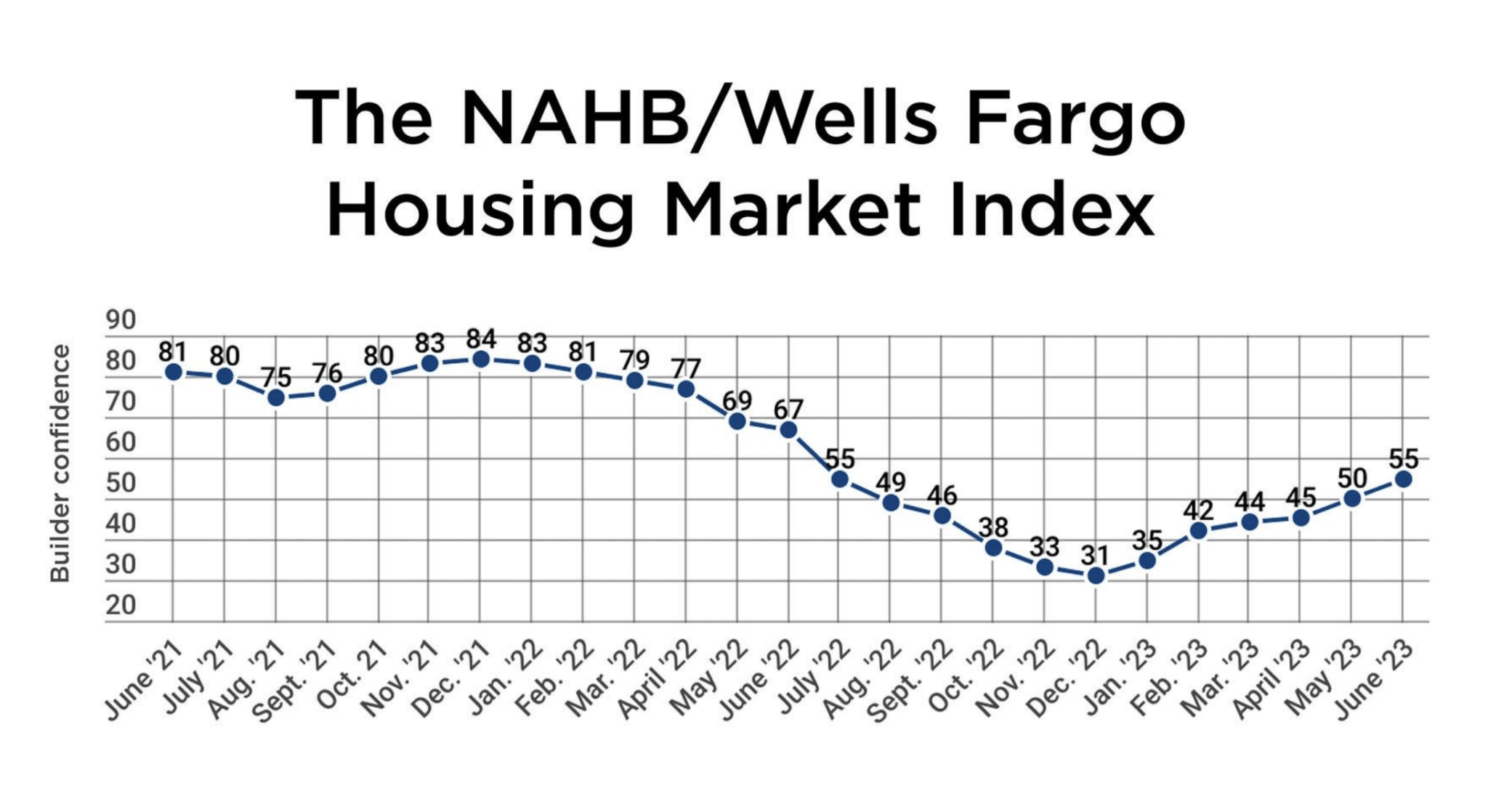

In turn, builders are gaining confidence in the market. According to data from the National Association of Home Builders (NAHB), builder confidence was up for the first time in 11 months during May. Based on a monthly survey of association members, the NAHB/Wells Fargo Housing Market Index (HMI) showed confidence was up five points entering June, surpassing, for the first time, the confidence midpoint of 50 seen in July 2022. In all, the index has rebounded by an impressive 77% since December’s low of 33.

According to the NAHB, the bounce in homebuilder confidence reflects an improved supply chain. However, NAHB Chairman Alicia Huey characterized the sentiment as “cautiously optimistic” in a recent statement, citing “low levels of existing home inventory and ongoing gradual improvements for supply chains.”

Huey also pointed out issues with financing eventually will affect lot supplies. “Access for builder and developer loans has become more difficult to obtain over the last year, which will ultimately result in lower lot supplies as the industry tries to expand off cycle lows,” she said.

Jefferies U.S. Economist Thomas Simons further qualified the data in a message shared with Reuters. “The strength is so far off trend that it calls sustainability into question,” Simons said, noting the surge in the Midwest in May could be the result of post-tornado season rebuilding and is therefore not likely to repeat.

Mortgage rates also play an important role, said NAHB Chief Economist Robert Dietz, who analyzed the effect of the Federal Reserve’s decision to abstain from a rate hike in June for the first time since early 2022. As buyers are adjusting to the “new normal in terms of interest rates,” he said, “The Federal Reserve nearing the end of its tightening cycle is also good news for future market conditions in terms of mortgage rates and the cost of financing for builder and developer loans.”

Dietz further stressed the pivotal role that policymakers in Washington will continue to play. “Shelter cost growth is now the leading source of inflation, and such costs can only be tamed by building more affordable, attainable housing – for-sale, for-rent, multifamily and single-family,” he said. “By addressing supply chain issues, the skilled labor shortage and reducing or eliminating inefficient regulatory policies such as exclusionary zoning, policymakers can play an important and much-needed role in the fight against inflation.”

But for now, Dietz said, “A bottom is forming for single-family home building as builder sentiment continues to gradually rise from the beginning of the year.”

Looking past historic May, at June’s numbers specifically, 25% of builders reduced home prices to bolster sales, down 2% month over month and down 5% from April. Fifty-six percent of builders also offered incentives to buyers, up 2% month over month but still far below the 62% rate seen in December. Meanwhile, permits for future construction rose 5.2% to 1.491 million units: the highest amount since October, led by a 27.1% surge in the Northeast.

In the end, June marked the first time in a year that both the current and future sales components of the HMI have exceeded 60, boding well for builder confidence — at least in the near future.