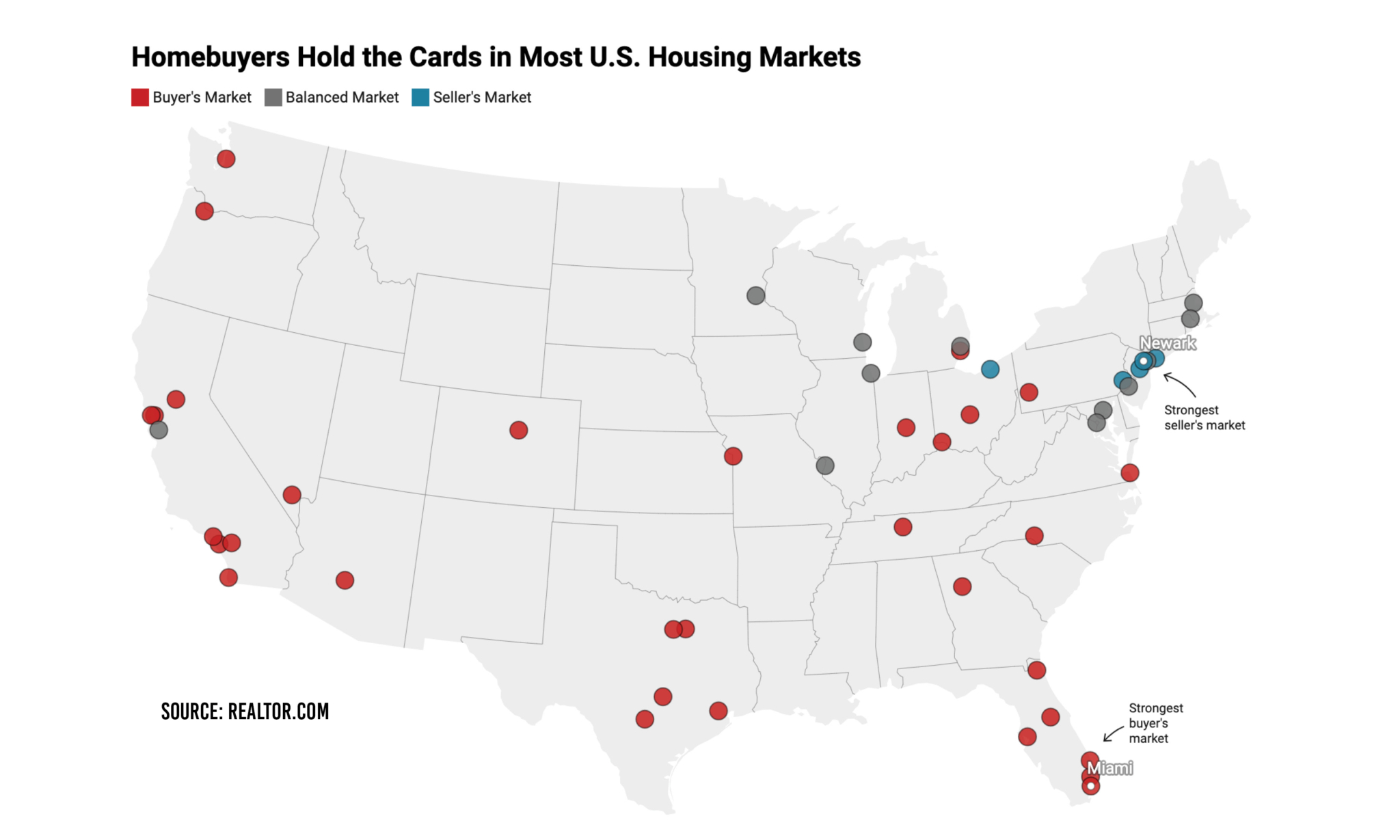

In 2025, buyers are quietly — but meaningfully — wielding more power than they have in years. Across reports from Realtor.com, Zillow and Redfin, the data converges on one clear truth: the housing market’s momentum is tilting toward those shopping for homes rather than those selling them.

From seller’s market to buyer’s edge

For much of the past decade, sellers enjoyed the upper hand. Bidding wars, lightning-fast sales and double-digit price growth were the norm. But this summer marked a turning point. Redfin’s August 2025 analysis described the season as the strongest buyer’s market in more than a decade of records. In August alone, there were more than half a million additional sellers than buyers, creating a surplus gap of 35.2%. By Redfin’s measure, any market where sellers outnumber buyers by more than 10% qualifies as a buyer’s market. That threshold has now been exceeded in many metropolitan areas across the country, giving buyers newfound leverage.

Zillow’s August 2025 market report confirms that the tide is shifting. New listings fell 7.3% month over month, while total inventory dipped 1.3%. Even so, inventory remains up 15% from last year, though still almost 20% lower than before the pandemic. The increase has been enough to give buyers more breathing room, while the pullback in new listings signals that sellers are beginning to recognize they can no longer command the same frenzied attention as they once did.

Price growth has also cooled dramatically. Zillow’s Home Value Index is essentially flat compared to a year ago, and the median U.S. home value hovers around $364,000. Homes are sitting longer as well: the median number of days on the market climbed to 27, a full week longer than a year earlier. That shift allows buyers to take their time rather than rush into deals under pressure.

Fixer-uppers as a buyer strategy

Against this backdrop, one of the clearest signals of buyer behavior is a surge in demand for fixer-uppers. According to Realtor.com, searches for “fixer-upper” in July 2025 more than tripled compared with four years ago, while homes marketed with that label drew 52% more page views than comparable older, affordable homes.

The numbers illustrate why. The median listing price for fixer-uppers in the Realtor.com study was $200,000, less than half the $436,250 median price of all single-family homes analyzed. That 54.2% discount offers a way into the market for budget-conscious buyers. The typical fixer-upper identified by the study was built in 1958 and featured three bedrooms and two bathrooms.

Realtor.com reported nearly 80,000 fixer-upper listings in July, up almost 19% from four years earlier. However, the share of such homes on the market is slightly smaller than it was in 2021, suggesting that while demand has grown, supply has not kept pace. For many buyers, though, these listings represent the only feasible path to ownership. By taking on renovations themselves, they can capture equity and customize their homes, even if the process is longer and more challenging.

Signs of a cooling market

The popularity of fixer-uppers aligns with broader evidence of a cooling housing market. Zillow noted that more than a quarter of listings saw price cuts in August, a sign that sellers are adjusting expectations. Builders are also pulling back, with housing starts dropping sharply in August, including a 7% decline in single-family-home construction, according to an August report from the U.S. Census Bureau and the U.S. Department of Housing and Urban Development.

Redfin added another critical piece: buyer activity is near a decade low. The company estimated just 1.44 million buyers were active in August, one of the weakest levels since 2013, compared with nearly 1.94 million sellers. That imbalance is reshaping how transactions unfold. Rather than fighting over scarce listings, buyers increasingly have the upper hand, negotiating price reductions, contingencies and closing credits.

What it means for buyers and sellers

For buyers, the new environment presents opportunity. Instead of stretching budgets in competitive bidding wars, they can take time to negotiate, focus on homes with deferred maintenance and push for concessions that reduce costs. Those willing to consider fixer-uppers stand to benefit the most, provided they have realistic renovation plans and financial buffers to cover unexpected expenses.

For sellers, the playbook is shifting. Cosmetic upgrades designed to create “move-in-ready” appeal may not deliver the same returns they once did. In fact, Realtor.com suggests that marketing a home transparently as a fixer-upper can sometimes generate more interest online than investing in expensive presale improvements. Sellers who resist price adjustments or refuse to negotiate risk watching their homes linger on the market as buyers grow choosier.

What lies ahead in 2025

As 2025 heads into the fall, all reports point to a housing market in transition. Together, the data suggests that the frenzy of the past few years has given way to a more balanced environment — one where buyers have greater leverage, sellers must recalibrate expectations, and the path to homeownership may look different but remains attainable for those willing to adapt.