Current Market Data

The pace of new-home sales hit an annual rate of 800,000, its highest level since January 2022.

Fannie Mae also reduced its forecasts for home sales in 2025 and 2026.

The average new-home price decreased just slightly to $402,285, down from $402,741 a year prior.

Meanwhile, pending listings declined 6.3%, with 1,889 listings going under contract, and closings decreased 6.8%, with 1,366 home sales.

The decline in sales came as a 17-month run of year-over-year increases in new listings came to a close.

The move was widely anticipated and is expected to be followed by additional cuts this year.

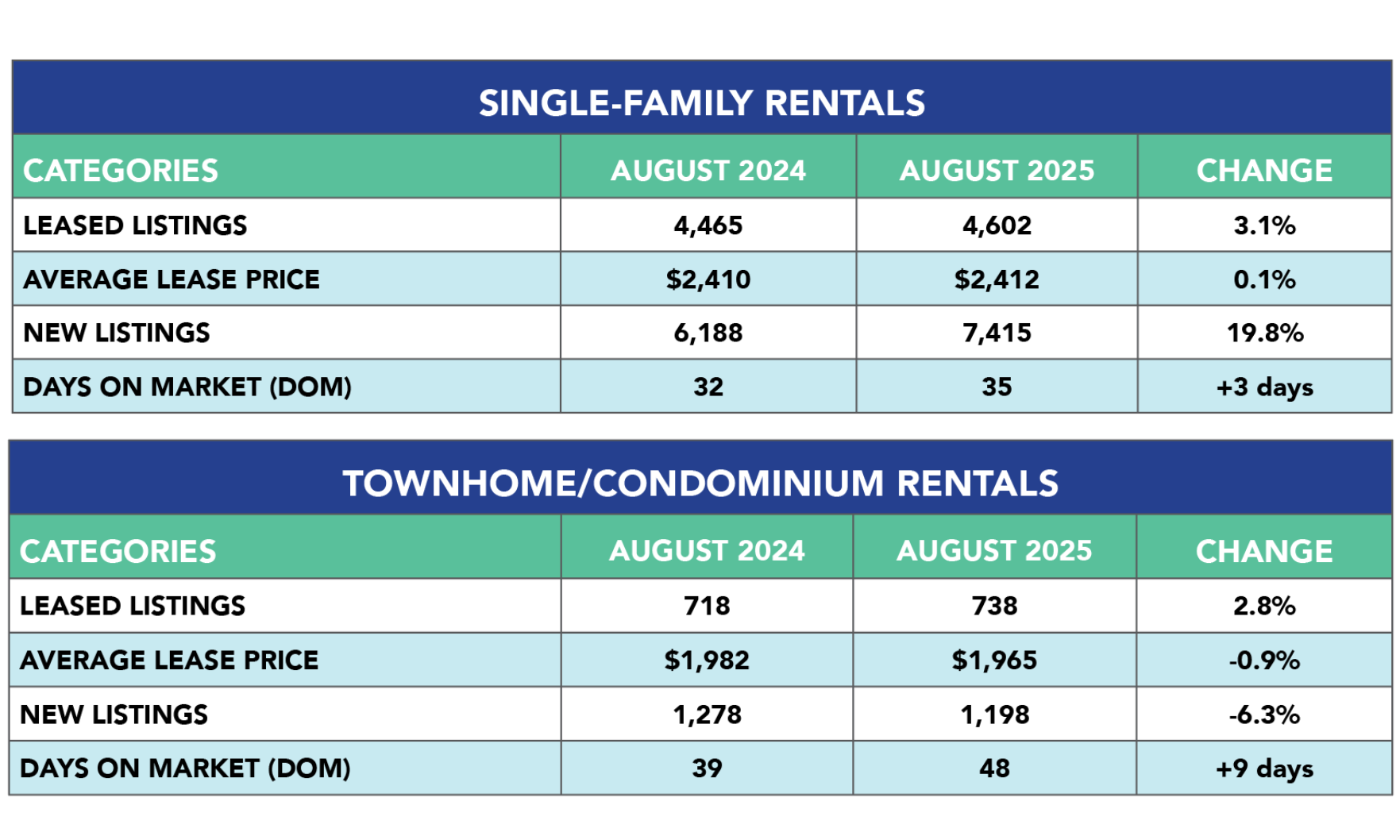

Meanwhile, renters signed 4,602 single-family leases, up 3.1% year over year.

The jump in mortgage activity was driven in large part by refinancings, which surged 58% in the week ended Sept. 12.

At the same time, completions of new single-family homes were on the rise last month, according to federal statistics.

The National Association of Home Builders said its monthly builder-confidence survey indicated rising optimism that lower interest rates could spur new-home buying activity.

Nancy Almodovar, founder and CEO of Nan and Company Properties, worked as both the listing and buying agent for August’s most expensive greater Houston home sale.

Pending sales declined 3.6% year over year, however, with 1,951 listings going under contract, down from 2,023 a year ago.

Buyers closed on 8,138 homes during the month, up from 7,270 in August 2024. Meanwhile, active listings soared 30.4% with 39,374 homes on the market in greater Houston.

The surge comes as the rate on a 30-year fixed-rate mortgage fell to its lowest level since October 2024.

The rate of home-price appreciation slowed to just over half the rate of inflation in July, Cotality noted.

Pending home sales, however, decreased 9.9% year over year with 1,750 listings going under contract.