News / Features

The median-sales price for an existing home rose 1.3% year over year to $422,800.

Judging by ads for the Alhambra model, the original buyers likely purchased their home for between $1,969 and $2,998.

The lawsuit also claims that with Zillow, sellers don’t have control over how their properties are marketed, a sentiment that’s been a core tenet of anti-clear cooperation rhetoric over the past year.

Homebuilder sentiment recently reached its third-lowest level since 2012.

Houston agents responsible for multiple transaction sides in the top 10 include Mike Mahlstedt and Laura Sweeney of Compass.

The U.S. housing market has exceeded one million active listings for the first time since the winter of 2019, according to Realtor.com’s May Monthly Housing Trends Report.

The two highest-transacting Latino real estate agents in the country both operate in Houston, according to the annual Top 250 Latino Real Estate Agents report from the National Association of Hispanic Real Estate Professionals.

“NAHREP supports the human rights of all people living in the United States,” the association wrote. “These rights are preserved by the U.S. Constitution and include the right to due process.”

The Mortgage Bankers Association said the post-Memorial Day increase came despite economic uncertainty and largely static interest rates.

T3 Sixty said the difference between real estate agents who subscribe to MLSs but are not Realtors and Realtor-subscribers hit 25%, the highest on record.

The amenity features white-sand beaches and a 2.7-acre lagoon where residents can swim, kayak, paddleboard and more.

The National Association of REALTORS® Board of Directors repealed the non-commingling rule, often referred to as “no commingling,” which allowed MLSs to require non-MLS listings to be displayed separately from their own, during last week’s legislative meetings in Washington, D.C.

The National Association of REALTORS® Board of Directors has approved changes to the portions of its Code of Ethics that deal with hate speech and harassment during this week’s legislative meetings in Washington, D.C.

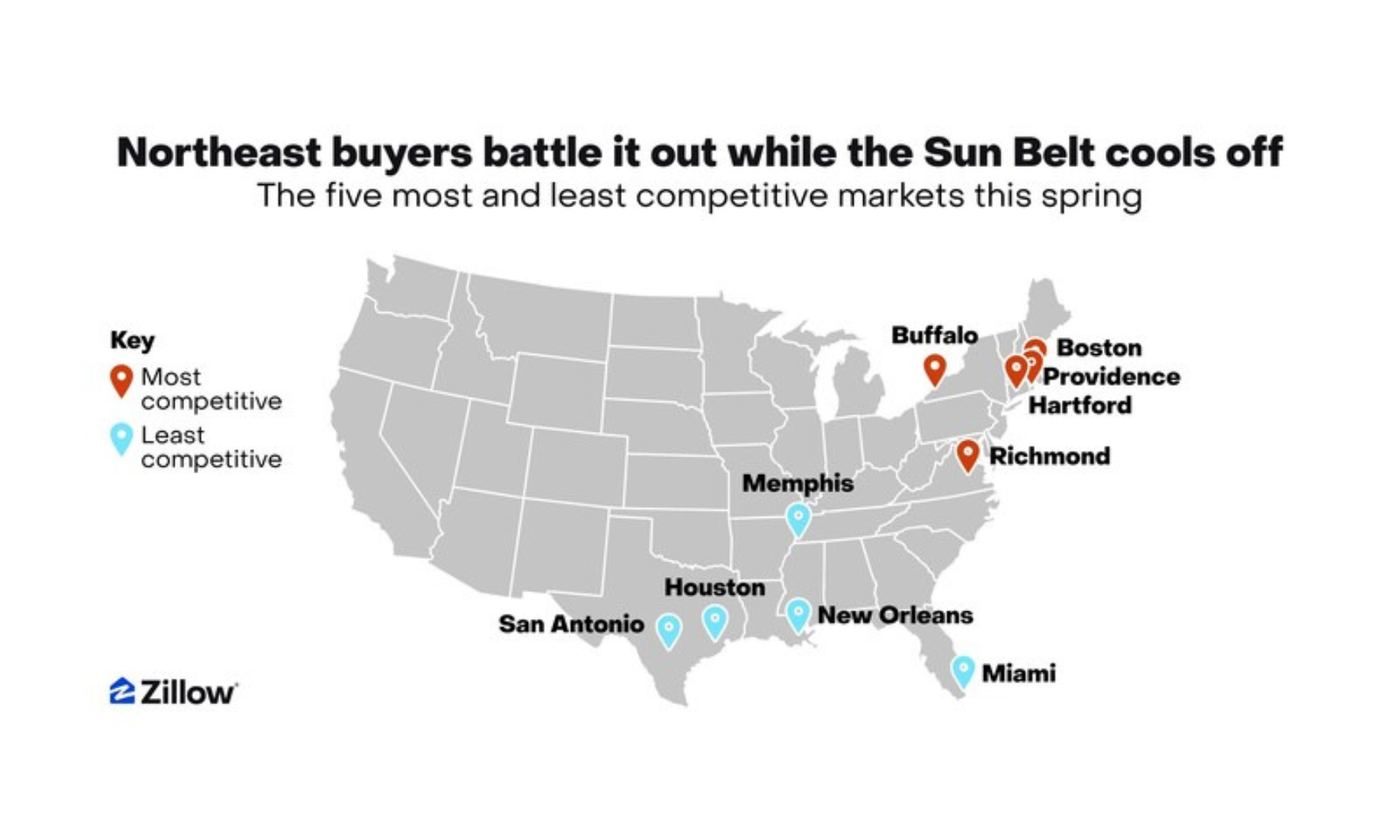

The Northeast and Midwest remained strong, while Florida, which saw a major runup in prices in recent years, continued to cool.

That’s good news for buyers, who have considerably more options than their counterparts in tighter markets on the East Coast.

Rate has been named the “Best Mortgage Lender” of June 2025 by Fortune for its “smooth online mortgage experience,” including its innovative digital tools and array of loan options.