Determining how much they could spend on a home was the most frequently named financing concern among a third of all U.S. buyers during the home buying process. A major factor in what a homebuyer can afford is their credit score. According to according to a new Zillow analysis of Annual Percentage Rates (APR),homebuyers with low credit scores are paying thousands in mortgage costs.

A homebuyer with a “fair” score, usually between 640 and 679, could get a 5.10 percent APR compared to the 4.50 percent rate that someone with an “excellent” score, 760 and above, could get.

A borrower with a fair credit score could end up paying about $720 more each year in mortgage payments than if their score were “excellent.” For a homebuyer with a less than excellent score, this could amount to nearly $21,000 over a span of 30 years.

“When you buy a home, your financial history determines your financial future,” said Zillow senior economist Aaron Terrazas. “Homebuyers with weaker credit end up paying substantially higher costs over the lifetime of a home loan. Of course, homeowners do have the option to refinance their loan if their credit improves, but as mortgage rates ride this may be a less attractive option.”

Home prices and mortgage amounts vary widely across the nation. In a pricier market, the consequences of rocky credit scores can be more substantial than in a lower income area. Most homebuyers pursue the option to refinance their loan to more favorable terms as their credit improves and/or interest rates fall.

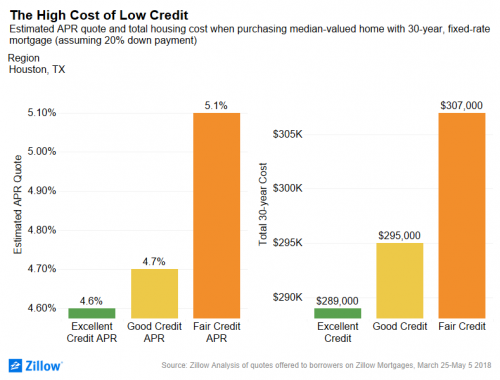

Houston buyers with fair credit scores are paying on average about $18,000 more for a home than someone with an excellent score. A buyer with fair credit in the city could get a 5.10 percent APR while someone with excellent credit could get a 4.60 percent APR.

The effects of poor credit may be more severe than in past years. More homebuyers are holding onto their original purchase loans longer, even as their credit improves. This trend leaves many homeowners stuck with the high cost of low credit for much longer.