Foreclosure filings in September were down to their lowest level in five years, according to the latest U.S. Foreclosure Market Report from RealtyTrac.

Foreclosure filings in the month of September were down 7 percent from August and 16 percent from September 2011, according to the latest U.S. Foreclosure Market Report from RealtyTrac.

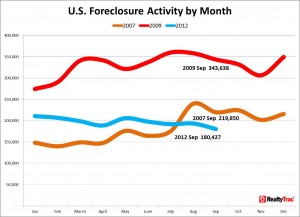

All in all, the 180,427 foreclosure filings reported in the month is the lowest total since July 2007.

Foreclosure Filings Down in Foreclosure Market Report

RealtyTrac also computed the foreclosure filings for the third quarter:

- Filings for that period were the lowest since the fourth quarter of 2007.

- The 531,576 foreclosure filings (or, one in every 248 housing units) were a 5 percent decline from the second quarter and a 13 percent decline from the third quarter of 2011.

- There have now been nine consecutive quarters of annual declines in foreclosure activity, which includes default notices, scheduled auctions and bank repossessions.

For some added perspective on just how improved the foreclosure markets are in 2012, here’s an excellent chart from RealtyTrac that puts things into focus:

Eye Before the Storm?

For months now, RealtyTrac has been predicting foreclosure filings to increase, what with the mortgage settlement a done deal and banks now having more freedom to work through their backlog of delinquent mortgages – except, it hasn’t happened yet, a fact RealtyTrac Vice President Daren Blomquist highlighted in the Foreclosure Market Report.

“We’ve been waiting for the other foreclosure shoe to drop since late 2010, when questionable foreclosure practices slowed activity to a crawl in many areas, but that other shoe is instead being carefully lowered to the floor and therefore making little noise in the housing market — at least at a national level,” he said.

However, Blomquist did note that a number of states have made legislative tweaks that could lead to “roller-coaster” rides of foreclosure activity. Will those predictions materialize? Stay tuned.