A shortage in appraisers is accepted as fact by many in the real estate industry, with one appraisal management company executive describing the situation to CNBC as a “massive” shortage. Studies on the number of appraisers indeed show a decline, but a March 2017 survey of industry experts done by the National Association of Realtors shows the current situation is not as dire as some would suggest.

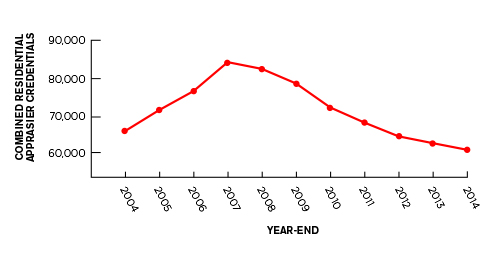

There has been a reduction in licensed appraisers since 2007, when 82,635 appraisers were thought to be working, according to the National Appraisal Congress. The group reported 60,747 appraisers in 2014, an overall reduction of 28 percent. But the industry hit a high point in 2007, at the start of the housing market’s collapse, and the shedding of jobs since then can be chalked up to a combination of market factors and industry barriers. In fact, 2014’s number of licensed appraisers is not far from 2004’s 65,821 working appraisers, according to the National Appraisal Congress.

The decrease in appraisers has led to longer closing times and an increase in the turn-around time expected by clients, with the average home purchase turn-around jumping by 79 percent in recent years, according to the Stratmor Group, a mortgage industry consulting firm. Still, appraisers responding to NAR’s survey said that their work is largely unchanged in recent years, with a majority of survey respondents saying they handled the same workload last year and with 48 percent being satisfied with their workload. But with the relatively advanced age of most appraisers and the lack of trainees, a shortage of appraisers could have dire effects on the industry in the coming years.

Portrait of an appraiser

Of the 2,248 appraisers and former appraisers who responded to NAR’s survey, the average age is 54 years. (More than 60 percent of appraisers are over the age of 50, according to the Appraisal Institute.) They’ve spent an average of 21 years in the industry, and nearly 86 percent of respondents said they intend to stay in the field for at least five more years.

Appraisers are also crunched for time, underpaid, unhappy with industry regulations and largely unwilling to train their future replacements.

Over 46 percent of appraisers are satisfied with their ability to meet deadlines, but 44 percent of those surveyed are unsatisfied with the time they can perform each appraisal. A decrease in the number of appraisers in markets with high homes sale volumes means more work is needed, and it’s needed faster than ever.

Perhaps that’s why 50 percent of surveyed appraisers say they are not satisfied with their compensation, according to NAR. Appraisers are also worried about the increasing prevalence of technology in the field, with 67 percent saying they are unhappy with the use of data-driven valuations and with 64 percent upset about the increased use of appraiser scoring.

Appraisers unwilling to train

To help combat the loss of appraisers, current appraisers are needed to train the next generation. While 51 percent of respondents said they had taken on trainees in the past, 84 percent of respondents said they do not currently train others.

So why are appraisers less willing to train? For one, appraisers are too crunched to take on other responsibilities and are unwilling to do it without adequate compensation. Mostly, though, the reason has to do with regulations.

New federal rules enacted in 2008 after the housing market collapse stipulated that a trainee cannot do full appraisals, requiring the licensed appraiser to be on-site for all home inspections. That has reduced the market for a trainee’s services, and therefore the desire of appraisers to train them. At the same time, trainees need 2,500 hours of experience in two years, something that is much harder to achieve now that they can’t fully appraise homes. Plus, of the work trainees can provide, nearly 40 percent say their clients rarely or never accept a trainee’s work. Those factors also may be inhibiting people from entering the industry as a trainee, according to experts.

Thank you for sharing this article and shining the light on this growing issue.

The FAKE NEWS of a massive appraiser shortage that some appraisal management companies executives are stating is just that FAKE NEWS.

There may be pockets of areas in the nation that have experienced a longer wait time for the appraisal to be completed, but overall this is not the reason AMCs are experiencing a shortage of appraisers.

SOME and I say SOME of the AMCs are experiencing a lack of interest by professional appraisers to do business with them due to not being treated in a professional manner. Some of the AMCs are not being transparent as to the real cost of hiring the professional appraiser to complete the most important part of the process the actual appraisal verses the costs of what the AMC is charging the borrower for only being the firewall between the loan officer and the appraiser. That is what the Dodd/Frank bill and the final rules stated that is the task of the AMC.

There are factual instances where the AMC has charged the bank who in turn has to charge the borrower 43% more than the actual appraisal cost for just being the firewall, but on the closing documents, it was not separated so the borrower thought that the higher cost of the “Appraisal” was for the professional services of the actual appraisal when in fact it was not. This is a lack of transparency to the borrower.

The influx of some of the largest AMCs into the appraisal process with a TERRIBLE business model of taking as much or more than 50% of the fee that the bank paid for the actual appraisal instead of charging whatever their fee would be for the AMC service.

This is a major reason some AMCs do not have appraisers to complete the assignments. Many Lenders who do use an AMC that have this type of business model or do not use an AMC are not having any issues getting appraisals completed in a timely manner and do not have the additional and increasing cost of the AMC service.

Dodd/Frank DID NOT mandate that an AMC is required it just stated that there must be a separation of the appraiser and the loan officer.

This has taken eight years to finally come to the surface, and consumers need to know where the increase costs of getting an appraisal are coming from at this time.

22 of the largest AMCs in the nation control 80% of the appraisal orders nationwide. Many of the 22 have this bad business model of taking a portion of the appraisal fee. However, now that is not enough, so that is where the additional costs are coming from now. Many are increasing the fee and blaming the increased cost on the “appraiser” = FAKE NEWS

When this bad business model is addressed, new professionals will again get into the appraisal profession to complete credible appraisals that protect the banking industry, housing industry, and public trust.

Federal regulations do not prevent trainees from appraising properties, it is AMC and some lenders that do that. Fannie Mae just came out with a clarification that a licensed appraiser can have a trainee do the work.

I agree however that low fees and too tight of deadlines cause a lot of non growth in the profession.

One other thing that should be discussed is that AMC’s tack on a huge amount for their “services”- which lowe s fees to appraisers while increasing costs and inefficiencies to lenders and borrowers.

Not to mention all you are really doing is training your competition because once they are licensed they will do the same job, most likely at a reduced rate because they can join all the same clients and there is no loyalty. Whats the point of training someone, when the day they are licensed the bank thinks they are as qualified as you. Makes No Sense, they are beneficial to you as an appraiser when they get licensed but they just move on anyway

#1 Reason for not training: AMC’s and or their Lender Clients do not allow Trainees working on their Appraisals, then add the time factor, regulations, willingness and not paid for their expertise.

A few more recent article for your perusal. This article largely dismisses the fact that a 3rd party “middleman” called an AMC (Appraisal Management Company) is pocketing most of the “appraisal fee” while also creating most of the delays in getting reports accomplished. See below.

https://www.washingtonpost.com/realestate/paying-a-lot-for-an-appraisal-a-middleman-may-be-getting-a-large-part-of-the-fee/2017/03/20/acd52446-0d9a-11e7-ab07-07d9f521f6b5_story.html?utm_term=.ce84093cc336

https://www.appraisalbuzz.com/ugly-truth-appraisal-fees/

https://appraisersblogs.com/REVAA-opposes-AMC-legislation

Who the hell is the National Appraisal Congress? Not a government organization. A group made up of Appraisal Management Companies. Beware who you quote. There is no shortage of qualified appraisers. There IS a shortage of appraisers who accept less than C&R fees. There IS a shortage of appraisers who are not adequately compensated for their professional work product. There IS s shortage of appraisers who allow Appraisal Management Companies to take a percentage of their fee.