The ability to own your own home is a dream for most Americans, but depending on which part of the country you live in, that may require more working hours than in other locations.

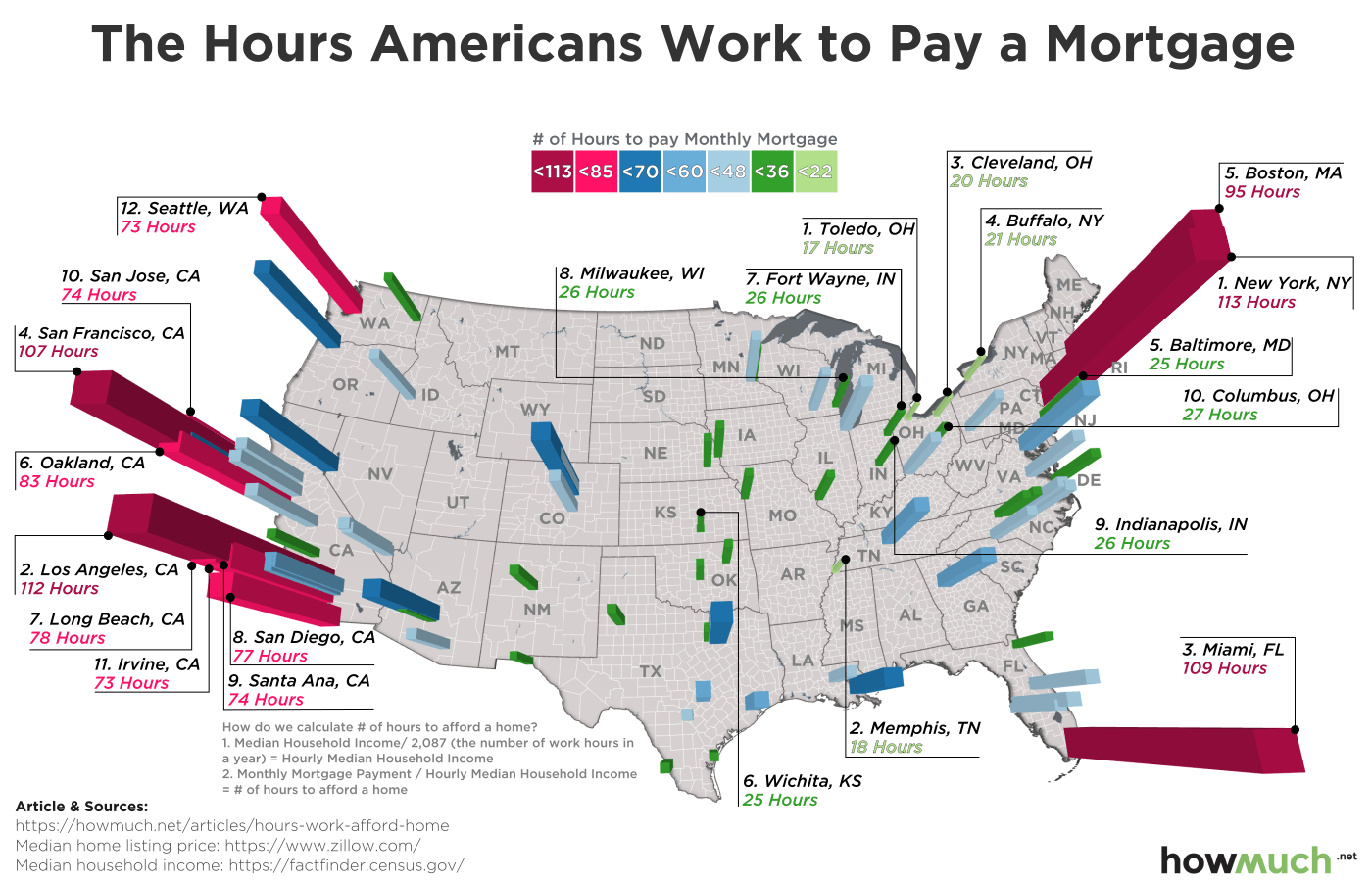

A recent report from How Much combined data from the U.S. Census Bureau that showed the average salary of people living in the largest 98 cities in the United States with Zillow’s median housing price for each city and used the standard 30-year-loan for the mortgage plan.

Houston homeowners may be in it for the long haul with it taking about 51.5 hours per month to meet their monthly mortgage payments. Common budgeting advice is that only about a quarter of your monthly income should go toward renting or monthly mortgage payments. With the median full-time salary in Houston being $3,848 per month, that means over 29.6 percent ($1,140) would go to the monthly mortgage plan.

Not surprisingly, the coasts are home to the areas where it would take the longest to pay off a mortgage, with most requiring almost double the standard 40-hour work week. In fact, eight out of the country’s 10 most expensive cities are located in California.

However, across most of the Midwest, properties are much more affordable. For example, in manufacturing cities of the Midwest, like Toledo, Ohio, it takes only 17 hours per work week to pay off a mortgage, leaving almost 90 percent of homeowners’ remaining salary to pay for other expenses.