With home prices rising across the country, many buyers may think that moving out to the suburbs is the solution to finding a home that they can afford. However, suburban areas are now rivaling urban areas in affordability in certain markets.

Nearly half of all buyers purchasing a home are picking one in the suburbs, according to a new Zillow report. But almost half of the largest markets in the country have suburban markets that are just as expensive as urban markets.

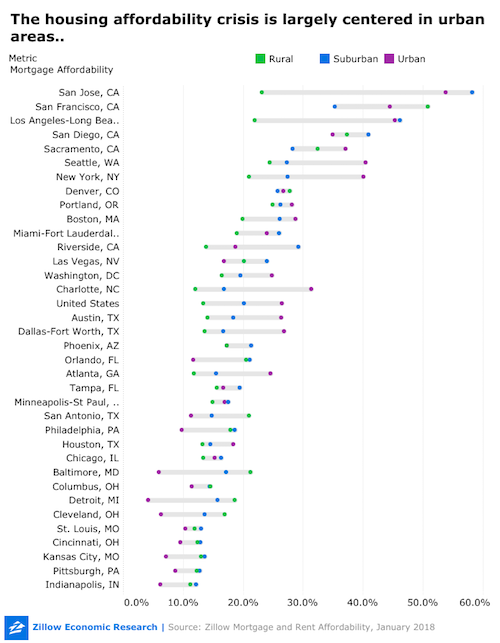

On the whole, urban homeowners are spending around 26.5 percent of their monthly income on mortgage payments, which is higher than suburban and rural homeowners, 20.2 percent and 13.5 percent, respectively.

“Finding a home in your budget can be a stressful process, whether you’re looking to buy or rent,” said Skylar Olsen, Zillow’s director of economic research and outreach. “The difference between an urban core or more distant suburb could make all the difference.”

Some of the major markets where suburban mortgage payments are a higher share of income than those of urban markets include Los Angeles, Chicago, Philadelphia, Phoenix and San Diego.

In Houston, suburbanites are winning as 14.6 percent of the median income is spent on mortgage payments in the suburbs, while only 18.3 percent of income is spent on mortgage payments within the city.

“Choosing where to live depends on many factors other than strictly financial terms. The size and space of the home, and the nearby amenities have to meet your needs, or come as close as possible,” Olsen said. “How close you can come to those ideal options is always limited by what you can afford, and tradeoffs are almost always necessary.”