Multifamily construction has boomed in Houston, but was it too much, too quickly?

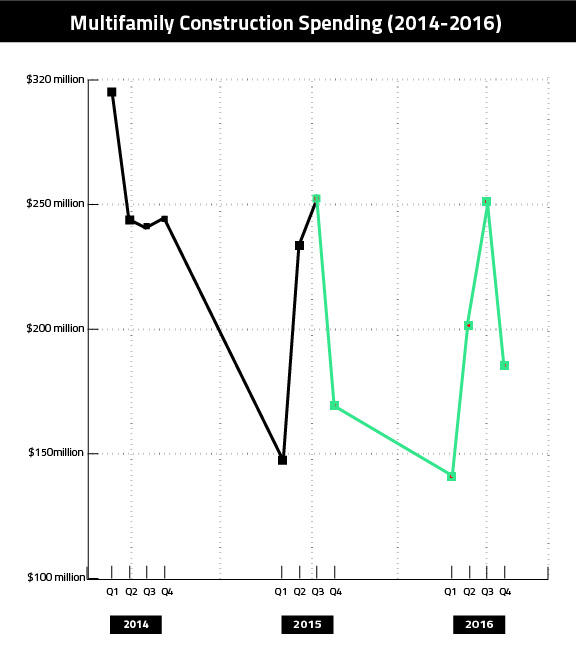

Houston’s multifamily construction hot streak may be coming to an end, as a new report from the CMD Group, an Atlanta-based construction research firm, showed multifamily construction spending fell more than 50 percent from the first-quarter of 2014 to the first-quarter of 2015.

In April, overall residential construction spending in Houston dropped 24 percent year-over-year from more than $1 billion to $791 million. However, while many have speculated on the problem without broaching the subject of multifamily building, CMD’s research suggests the sector very much belongs in the discussion.

In 2014, multifamily construction was strong, amounting to more than $1 billion in construction spending. But coming into 2015 – when spending dropped 53 percent year-over-year from $318 million in 2014’s first-quarter to just under $150 million in 2015’s first-quarter – the number of available units had already begun compiling, and now, the industry faces an overabundance, which is limiting the amount of construction needed.

Throughout 2015, Dallas-based research group Axiometrics – which focuses primarily on multifamily-related data – estimates that as many as 16,670 units will be added to Houston’s market.

Too Many Units?

As it stands, Houston’s overall inventory represents a 2.9-months supply, which is well below the national average (5.3-months supply) and even further below pre-crisis norms, when months of supply were closer to seven. So far, the affects on the city have been varied. While low inventory has helped to drive demand and price growth, it has simultaneously damaged overall affordability.

In March 2015, annual effective rent growth reached upwards of 4.5 percent, according to Axiometrics. Job growth inched up only 2.9 percent.

Still, even with low inventory pushing potential buyers into the rental market, falling occupancy rates and slowing rent growth illustrates how overwhelming the influx of multifamily units has been. Those affects, though, are also varied.

For instance, in Montrose/River Oaks, where multifamily builders have been particularly active, occupancy rates have seen fall-off and rental rates recently dropped 0.9 percent, giving it the slowest growth rate of any Houston neighborhood. On the opposite end of that spectrum, rental rates are up 13 percent in Baytown/San Jacinto River East, and occupancy rates in Spring, Humble and Far Northeast have all surged in 2015 – though, those numbers may be the combined result of low supply and ExxonMobil opening its new headquarters in the area.

Time to Catch Up

To say the rest of Houston’s market only needs to catch up with the multifamily sector is a simplification of a slightly more complicated problem, but suffice it to say the city needs to absorb the additional multifamily units before significant construction in the sector can resume.

CMD projects Houston might reach that level sometime in 2016, though construction numbers are unlikely to parallel the strong activity seen in 2014. According to CMD’s research, proceeding at its current pace, multifamily construction spending in Texas’ largest metro is likely to continue tapering off next year, with first-quarter spending dropping to $144.6 million.

Yearly, CMD projects spending to top out at $817.9 million in 2015, which is a significant drop from the year prior, and in 2016, the group expects spending to further drop to $785.1 million.

But even with drops, construction in the city isn’t coming to a complete stand still. Single-family building, while staying flat during the first three months of 2015, took a sizable, nearly $800 million leap in spending during the year’s second-quarter, and CMD’s projections suggest the margin could expand even more later into the year and beyond.